Rutile Market

Rutile Market Analysis, By Availability (Natural Rutile and Synthetic Rutile) By Application and By Region - Market Insights 2025 to 2035

Analysis of the Rutile Market Covering 30+ Countries Including Analysis of the US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea, and many moreany more

Rutile Market Outlook (2025 to 2035)

The global rutile market is expected to be valued at USD 4.54 billion by 2025, according to Fact.MR analysis, rutile will grow at a CAGR of 5.2% and reach USD 7.43 billion by 2035.

The industry in 2024 continued to ride a wave of steady growth, with worldwide demand increasing incrementally in the face of subtle supply-side adjustments. Major trends were seen in industrial centers. In China, stricter environmental regulations have held back some mining activities, resulting in periodic supply bottlenecks that have driven spot prices for natural products higher.

Substitution with synthetic rutile, particularly by pigment producers, helped to partially counter shortages. In Africa and Australia, the development and exploration of new product deposits gained momentum as part of long-term supply security plans.

End-use applications, such as titanium dioxide pigments and welding electrodes, held strong, with pigment applications supporting the majority of volume demand, particularly in paint, coatings, and plastics within the construction and automotive industries. At the same time, top-quality products feedstock went on to gain increasing popularity in titanium metal fabrication, particularly following the rise of interest in aerospace and defense initiatives in America and Europe.

Looking ahead to 2025 and beyond, the industry is poised to benefit from sustained industrial demand recovery and a steady increase in product prices, driven by tight supplies of high-grade ore. Expenditure on beneficiation and novel processing technologies is likely to increase, thereby upgrading the quality of lower-grade deposits. Strategic alliances and off-take agreements are likely to intensify between major producers and downstream industrial users, creating a more integrated supply chain picture.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 4.54 billion |

| Industry Value (2035F) | USD 7.43 billion |

| Value-based CAGR (2025 to 2035) | 5.2% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey on Rutile Industry

Fact.MR Survey Findings: Trends as per Stakeholder Views

(Surveyed Q4 2024, n=470 stakeholder respondents, balanced representation across raw material providers, pigment makers, titanium metal manufacturers, industrial coating producers, and chemical distributors in the USA, Western Europe, China, and Japan)

Priorities of Stakeholders

- Product Purity & Quality Assurance: 79% recognized persistent high-purity (≥95% TiO₂) products as a "critical performance driver", particularly for titanium metal and pigment manufacture.

- Supply Chain Reliability: 72% pointed to the importance of reliable sourcing in the face of geopolitical risks and export restrictions by major regions (e.g., Africa, Australia).

Regional Variance:

- USA: 64% rated stable feedstock supply as paramount with the tightening of domestic mining policies, versus only 43% in China.

- Western Europe: 87% identified environmental regulations (e.g., REACH) as high-priority, versus only 39% in Japan.

- China/Japan: 68% cited cost competitiveness of synthetic products due to local beneficiation capacity and reduced production costs, versus 27% in the USA

Embracing Advanced Technologies

Adoption Trends:

- USA: 55% of pigment producers implemented AI-based process controls to maximize products' feedstock efficiency.

- Western Europe: 52% cited application of low-carbon chloride route upgrades, stimulated by net-zero targets, with Germany (61%) at the forefront of closed-loop innovation.

- China: 66% adopted energy-efficient kiln technologies, with an emphasis on synthetic product production in provinces with renewable energy incentives.

- Japan: Only 29% used advanced beneficiation technologies, citing limited domestic reserves and high dependency on imports.

ROI Outlook:

- 73% of U.S. stakeholders considered tech investments to have a "high ROI", while 44% in Japan viewed such upgrades as cost-prohibitive unless subsidized.

Material Preferences

Global Consensus:

- Natural products are still favored by 58% of respondents due to their purity, although the high expense is a concern.

Regional Material Choices:

- Western Europe: 49% opted for synthetic rutile, attributing this to regulatory oversight of mining activities and reduced environmental impact.

- China: 63% opted for upgraded ilmenite (as an alternative to rutile) due to its rich reserves and favorable cost profile.

- USA: 71% favored natural rutile, particularly for aerospace-grade titanium, although 38% are considering blends to balance costs.

Price Sensitivity

Shared Challenges:

- 84% mentioned volatility in raw material prices. Natural product prices increased by 27% year-over-year (2024), and synthetic prices by 19%.

Regional Breakdown:

- USA/Western Europe: 66% would pay a 10-15% premium for traceability and sustainable sourcing.

- China/Japan: 74% were concerned with price-per-ton efficiency, particularly for pigment use, with high demand for

- China: 48% favored off-take agreements to hedge price volatility compared to 21% in Western Europe.

Value Chain Pain Points

Raw Material Suppliers:

- USA: 59% reported permitting delays for product mining activities.

- China: 62% mentioned that export restrictions by African suppliers interrupt raw feedstock supply.

Manufacturers:

- Western Europe: 51% indicated regulatory delays for new chloride processing facilities.

- Japan: 58% grappled with energy costs in ilmenite upgrading.

Distributors:

- USA: 45% complained of ocean freight delays and port congestion.

- China/Japan: 60% mentioned inconsistent product quality from certain suppliers of African origin.

Future Investment Priorities

Global Alignment:

- 77% of worldwide producers plan to augment spending on synthetic products R&D and beneficiation capacity.

Regional Areas of Focus:

- USA: 63% plan to invest in vertically integrated mining-to-metal production.

- Western Europe: 58% in green TiO₂ pigment technologies (low-carbon production).

- China/Japan: 53% in low-cost synthetic routes and alternative feedstocks.

Regulatory Impact

- USA: 67% reported state-level environmental regulations (e.g., Florida land rehabilitation requirements) as hindering new exploration.

- Western Europe: 82% of respondents felt that EU carbon border tax and REACH regulations were driving demand for high-purity and sustainable rutile.

- China/Japan: Just 36% indicated that regulations had a "direct impact" on procurement, but reported a growing focus on ESG reporting for exports.

Conclusion: Variance vs. Consensus

High Consensus:

- Purity, cost control, and sourcing reliability are industry-wide concerns.

- Stakeholders worldwide recognize the growing pressure on prices and supply chain vulnerabilities.

Key Variances:

- USA: Emphasis on traceability and purity of feedstock, with the drive for integrated operations.

- Western Europe: Regulatory compliance and sustainability lead the adoption of technology.

- China/Japan: They are Concerned with cost-efficient beneficiation and synthetics.

Strategic Insight:

Region-based strategies will determine the success of the next decade. Natural product for high-purity segments in the USA, synthetic for green Europe, and upgraded ilmenite for price-conscious Asia.

Government Regulations on Rutile Industry

| Country/Region | Policy & Regulatory Impact |

|---|---|

| USA |

|

| Canada |

|

| Germany |

|

| France |

|

| UK |

|

| China |

|

| Japan |

|

| South Korea |

|

| Australia |

|

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Market Analysis

The industry is expected to grow steadily until 2035, driven by increasing demand for high-performance titanium dioxide in solar, plastics, and coatings applications. Environmental policies and critical mineral policies are restructuring supply chains, benefiting areas with synthetic product capabilities and lower-tailing, cleaner beneficiation technologies. The major beneficiaries are vertically integrated producers and ESG-friendly producers, while lower-level miners without processing upgrades face the risk of industry displacement.

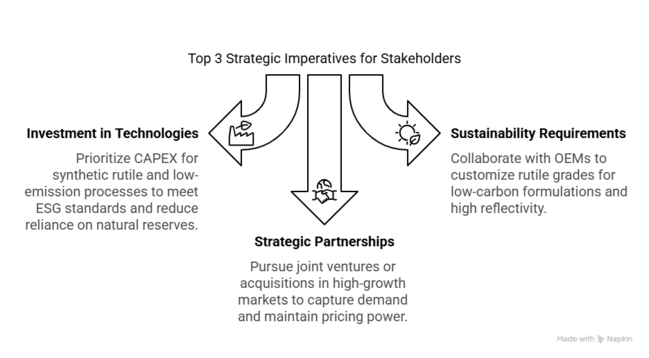

Top 3 Strategic Imperatives for Stakeholders

Make investment in Synthetic and Cleaner Beneficiation Technologies

Executives need to give highest priority to CAPEX allocation for synthetic production and low-emission beneficiation processes (e.g., electric kiln processing) to meet tightening ESG standards and minimize dependence on finite high-grade natural reserves.

Meet End-User Sustainability and Performance Requirements

Deepen partnership with coatings, plastics, and renewable energy OEMs to customize grades optimized for low-carbon formulations, UV stability, and high reflectivity positioning as a strategic input for solar technologies and green construction.

Grow through Strategic Partnerships and Downstream Integration

Seek joint ventures with pigment producers or coating firms and consider acquisitions of downstream processors in high-growth industries (e.g., Asia-Pacific) to capture demand, control the value chain, and maintain pricing power during tight supply cycles.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

| Supply Chain Disruptions in Africa and Australia: Major rutile-producing countries like Sierra Leone and Australia face frequent geopolitical instability and labor-related port closures. | High |

| Regulatory Pressure on Ilmenite Mining and Waste Management Practices: As product is often derived from ilmenite via synthetic upgrading, environmental scrutiny around tailings disposal and acid leaching processes is intensifying, especially in countries like India, Vietnam, and parts of Africa. | Medium |

| Oversupply Risk from Rapid Expansion of Synthetic Facilities in China: China is aggressively scaling synthetic production to reduce import dependency and support domestic TiO₂ demand. | Medium |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Secure Alternative Feedstock Supply Chains | Run feasibility studies on synthetic product sourcing from Southeast Asia and diversify away from politically unstable regions, such as West Africa. |

| Anticipate Regulatory Shifts in Mining and Processing | Initiate internal ESG audit and prepare compliance roadmap aligned with upcoming waste disposal and beneficiation regulations. |

| Strengthen Strategic Positioning with Key End-Users | Launch OEM feedback loop with coatings and solar PV manufacturers to co-develop grades aligned with performance and sustainability metrics. |

For the Boardroom

The industry is entering a period of strategic reset, underpinned by shifting supply fundamentals, growing environmental concerns, and the rise in synthetic capacity, particularly from China. To remain at the forefront, the client will need to shift from a cost-driven procurement strategy to a resilience-based sourcing model that incorporates Southeast Asian partnerships and ESG-friendly operations.

Low-waste benefit technologies and grade development for specific applications, particularly for high-growth industries such as pigments and solar, are what forward-looking investments ought to prioritize. This insight reflects a clear directional change: depart from volume exports to value-added solutions that are aligned with end-user sustainability and the global regulatory framework.

Segment-wise Analysis

By Availability

The natural segment is expected to register a 66.0% share in 2025. Natural rutile is a very desirable feedstock in titanium dioxide pigment and titanium metal production. It finds its use prominent in high-strength aerospace alloys and pigment production for coatings, plastics, and inks. The major benefits are higher quality and a reduced environmental footprint during processing.

Supply issues, however, due to limited deposits and mining prohibitions in some areas, have increased prices. However, nations such as Sierra Leone, South Africa, and Australia still finance world supply via organized mining structures. With increasing regulatory compliance and demand for pure titanium, it will continue to be essential, particularly in aerospace and defense uses.

By Application

The paints and coatings segment is expected to register a 41.0% share in 2025. It is widely used in the coatings and paints industry due to its high potency of titanium dioxide (TiO₂), which gives it exceptional whiteness, brightness, and opacity. TiO₂ possesses a high refractive index, which enables it to scatter light effectively, making the paints appear brighter and more opaque, even with thin layers.

Moreover, pigments are highly UV-resistant and weatherable, which improves the durability of coatings applied to exterior uses. These characteristics are of key importance in automotive coatings, architectural paints, industrial finishes, and marine applications where long-term performance is essential.

Country-wise Analysis

| Countries | CAGR |

|---|---|

| USA | 4.8% |

| UK | 4.1% |

| France | 3.9% |

| Germany | 4.6% |

| Italy | 3.7% |

| South Korea | 4.9% |

| Japan | 3.6% |

| China | 5.4% |

USA

In the United States, the industry is projected to grow at a compound annual growth rate (CAGR) of 4.8% over the forecast period from 2025 to 2035. Demand is primarily driven by titanium dioxide (TiO₂) demand in the paints and coatings industry, which remains supported by infrastructure restoration programs and rising residential construction. Moreover, it is a critical feedstock in titanium metal production, which is in enormous demand from the aerospace and defense sectors.

Regulatory regimes, such as TSCA (Toxic Substances Control Act), are also pushing manufacturers increasingly to adopt cleaner and purer feedstocks, to the detriment of others of greater impurity content. Rising fears of exposure in global supply chains, especially with tensions on the African continent and Australia's traditional sources, also encourage local sourcing.

UK

The UK sales are expected to record a compound annual growth rate (CAGR) of 4.1% during the forecast period. Growth is led by consistent demand for TiO₂ pigments in coatings, paints, and plastic master batches used across automotive, consumer, and construction industries. Urban renewal programs and retrofitting initiatives as part of the UK's Net Zero policy are fueling the usage of high-performance, weather-resistant coatings and composites based on rutile-type formulations.

Post-Brexit regulatory divergence has created a distinct UKCA certification process that imports and domestic manufacturers must now comply with, adding additional complexity and cost to synthetic and downstream pigment stakeholders. Efficient approval pathways for titanium metal for aerospace, though, through organizations like ADS and the UK Space Agency, are driving investments in high-purity feedstocks.

France

The industry is expected to grow at a 3.9% compound annual growth rate (CAGR) in France during the forecast period. The country's cutting-edge coatings, plastics, and aerospace sectors are the primary end-users of rutile, particularly as demand for high-durability architectural coatings and lightweight titanium alloys increases. Titanium dioxide remains a regulated product under EU REACH, and French manufacturers are increasingly utilizing the product due to its higher purity and lower environmental impact compared to other feedstocks.

Stringent ANSES regulations on the heavy metal content in coatings and paints are driving demand towards low-VOC, high-performance rutile-based pigments. Moreover, domestic titanium mill product manufacturers are introducing more synthetic materials to reduce their dependency on ilmenite imports as part of the EU's strategic autonomy agenda.

Germany

In Germany, the industry landscape is projected to reach a CAGR of 4.6% between 2025 and 2035. The country's dominance in automotive coatings, engineered plastics, and advanced alloys positions it as a high-value consumer of rutile, both synthetic and natural.

Germany's automotive and industrial paint manufacturers are investing heavily in low-VOC and high-durability pigment systems, which depend on rutile's opacity and UV stability. Also propelling the use of synthetic with guaranteed quality and low iron content, largely sourced locally through beneficiation of imported ilmenite, is medical-grade and aerospace titanium demand.

Italy

The industry in Italy is expected to register a 3.7% CAGR in the forecast period. It is driven by construction and industrial coating demand, with Northern Italy specifically seeing infrastructure investment and building rehabilitation prioritize long-lasting, weather-resistant coatings based on rutile-grade TiO₂. Masterbatch and plastic manufacturers in Lombardy and Emilia-Romagna are also expanding their pigment consumption to meet EU circularity and performance demands.

Italy's reliance on imported raw materials, particularly ilmenite and synthetic rutile, makes it vulnerable to fluctuations in global prices. To counter this, local converters are investing in upgrading and beneficiation processes to produce synthetic from discarded ilmenite.

South Korea

In South Korea, the industry is projected to grow at a compound annual growth rate (CAGR) of 4.9% from 2025 to 2035. The electronics, semiconductor packaging, and high-end automotive industries in the country are key demand drivers, specifically for ultra-white, thermally stable TiO₂ pigments from rutile. As local manufacturers move towards efficient and environmentally friendly operations, rutile's high TiO₂ content and energy-efficient processing advantages are increasingly preferred over ilmenite-based options.

Hyundai and Kia's electric vehicle supply chains are increasingly using titanium-based parts made from rutile-derived metal due to its high strength-to-weight ratio and corrosion resistance. The government's focus on green materials and zero-emission production is prompting pigment makers to employ lower-carbon raw materials. This trend bodes well for the uptake of synthetically made products in cleaner processes.

Japan

Japan's sales are projected to grow at a compound annual growth rate (CAGR) of 3.6% from 2025 to 2035. Despite being a mature industry, demand is being sustained by high-end applications in coatings, semiconductors, and medical-grade titanium. Japanese firms continue to be dedicated to utilizing high-purity, stable feedstocks, such as natural materials, for specialty coatings and white pigment production, particularly for paints and inks applied in electronics and car interiors.

METI and PMDA government control ensures that only thoroughly tested products of TiO₂ are applied in cosmetic and food products. Local demand is also driven by unique demands for performance, such as pigment particle homogeneity, UV stability, and light heavy metal content specifications that are more easily achieved than ilmenite.

China

China's industry is expected to register a compound annual growth rate (CAGR) of 5.4% between 2025 and 2035, making it one of the fastest-growing national industries globally. The country's expanding use of titanium dioxide in coatings, paint, and plastics, driven mainly by its prosperous building, automotive, and packaging sectors, lags behind the growing demand for natural and synthetic rutile.

With city expansion and infrastructure spending remaining national agendas in the 15th Five-Year Plan, rutile-type TiO₂ pigments are highly sought after for their strength, opaqueness, and UV stability. China is also the world's top producer and exporter of synthetic rutile, with dominant players expanding their capacity in Sichuan, Hebei, and Shandong to meet the needs of both domestic and overseas industries.

Market Share Analysis

Lomon Billions (China): 3.5-4.5%

Lomon Billions, a major global producer of titanium dioxide pigment, is pressing hard for backward integration into producing synthetic rutile. While its rutile-specialized capacity still has to see the light, the company is building in-house feedstock competencies to reduce dependence on imports of ilmenite and external suppliers of synthetics.

Since China's policy gravitates towards indigenous self-sufficiency in essential materials, Lomon Billions' investment in upgrading and beneficiation technologies will contribute to pushing its feedstock ratio to 5% over the next two years primarily through vertical integration with pigment lines.

TiZir Limited (Senegal): 2.5-3.5%

TiZir Limited operates the Grand Côte mineral sands project in Senegal and is a leading producer of product and ilmenite feedstock. Although volumes are smaller than those of Sierra Leone or Australia, TiZir has an established industry base, especially within the EU and Asia-Pacific welding rod and pigment markets. Through frequent exports and long-term offtake arrangements, TiZir accounts for approximately 2.5-3.5% of the world product supply.

Shanghai Jianghu Titanium White Co., Ltd.: 2-3%

A major Chinese pigment producer, Shanghai Jianghu Titanium White, is gradually going upstream towards synthetic production to balance feedstock prices. While now a mid-scale customer in buying, its growing beneficiation capacity and participation in joint ventures with local mining operations positions its estimated share at around 2-3%.

Cristal Global (Now Tronox): Tronox combined 15-17%

Cristal Global was once a dominant TiO₂ pigment and feedstock company with legacy operations. Following its acquisition by Tronox in 2019, Cristal's assets, including its rutile-related operations, have been fully integrated into Tronox's global footprint. Its legacy share (4-6%) now constitutes part of Tronox's consolidated share, which stands at 15-17%. However, no longer an independent player, Cristal's legacy supply chains continue to influence industry concentration, especially in the Middle East and Europe.

Zirco Products Ltd (Sri Lanka): 0.5-1.0%

Zirco Products is a modest-sized company in Sri Lanka, but it is predominantly involved in high-grade natural exports. Its volumes are specialty, niche-based, but address premium pigment and specialty chemical purchasers in Europe and Asia. Its estimated market share is modest-only 0.5-1.0%-but it holds a special niche in the supply of low-volume, high-purity rutile, especially where trace metal levels are carefully controlled.

Other Key Players

- Iluka Resources Limited

- Tronox Holdings PLC

- East Minerals

- IREL (India) Limited

- Rio Tinto

- Kenmare Resources plc

- Base Resources Limited

- Indian Rare Earths Limited (IREL)

- Sierra Rutile Limited

- VV Mineral

Segmentation

By Availability:

- Natural Rutile

- Synthetic Rutile

By Application:

- Plastics & Papers

- Paints & Coatings

- Automotive

- Food

- Others

- Air and Gas Purification

- Others

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

Table of Content

- Executive Summary

- Market Overview

- Market Risks and Trends Assessment

- Market Background and Foundation Data Points

- Key Success Factors

- Global Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market Value Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Availability

- Natural Rutile

- Synthetic Rutile

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Plastics & Papers

- Paints & Coatings

- Automotive

- Food

- Others

- Air and Gas Purification

- Others

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- APAC

- Middle East and Africa (MEA)

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- APAC Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Key Countries Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Structure Analysis

- Competition Analysis

- Iluka Resources Limited

- Tronox Holdings PLC

- East Minerals

- IREL (India) Limited

- Rio Tinto

- Kenmare Resources plc

- Base Resources Limited

- Indian Rare Earths Limited (IREL)

- Sierra Rutile Limited

- VV Mineral

- Assumptions and Acronyms Used

- Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

- FAQs -

How big is the rutile market?

The industry is anticipated to reach USD 4.54 billion in 2025.

What is the outlook on rutile sales?

The industry is predicted to reach a size of USD 7.43 billion by 2035.

Who are the key rutile companies?

Prominent players include Iluka Resources Limited, Tronox Holdings PLC, East Minerals, IREL (India) Limited, Rio Tinto, Kenmare Resources plc, Base Resources Limited, Indian Rare Earths Limited (IREL), Sierra Rutile Limited, and VV Mineral.

What is the major application of rutile?

It is majorly used in paints and coating applications.

Which country is likely to witness the fastest growth in the rutile market?

China, set to grow at 5.4% CAGR during the forecast period, is poised for the fastest growth.