Pigments and Dyes Market

Pigments and Dyes Market Analysis, By Classification (Disperse Dyes, Reactive Dyes, Sulphur Dyes, Other Classifications) By Application, and Region - Market Insights 2025 to 2035

Analysis of Pigments and Dyes Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Pigments and Dyes Market Outlook (2025 to 2035)

The pigments and dyes market will be valued at USD 34.8 billion by 2025. As per Fact.MR’s analysis, pigments, and dyes will grow at a CAGR of 3.0% and reach USD 51.2 billion by 2035.

During 2024, the world industry for dyes and pigments witnessed subtle evolutions in several regions and sectors. In Europe, the tariff imposition of a maximum of 39.7% on imports from China on titanium dioxide (TiO₂) had a significant effect on paint producers.

The tariffs imposed as provisional in the course of an anti-dumping investigation contributed to higher production costs and fears of impending bankruptcies and factory shutdowns among European producers.

Executives voiced concern about the loss of jobs and that bigger firms could shift production outside the EU to offset the financial burden.

Within the beauty and cosmetics industry, a significant change was seen with the emergence of 'skinification,' focusing on skincare-enriched makeup products. This trend negatively impacted classical makeup sales, pushing brands to revolutionize through the incorporation of skincare benefits within their cosmetic products.

The attention shifted to hybridized formulations that translate into customers' increasing demand for light, dewy finishes over full coverage.

Forward to 2025 and beyond, the dyes and pigments industry is set to continue evolving. The growing multiracial population is likely to redefine the beauty sector, fueling demand for products that address a wide range of skin tones and hair textures. Brands are likely to invest in inclusive practices and innovative formulations to address the individual requirements of this expanding customer base.

Moreover, sustainability concerns are bound to shape dynamics as the demand for greener and natural dyes and pigments increases. Improvements in manufacturing technologies can also result in the creation of products possessing enhanced performance attributes, i.e., better lightfastness and thermal stability.

Businesses that focus on environmental stewardship and innovation are likely to establish themselves as the leaders in the changing scenario.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 34.8 billion |

| Industry Value (2035F) | USD 51.2 billion |

| Value-based CAGR (2025 to 2035) | 3.0% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey on Pigments and Dyes Industry

FACT.MR Survey Outcomes: According to Stakeholder Views

(Q4 2024, n=500 stakeholder respondents proportionally divided by manufacturer, distributor, and end-user in the US, Western Europe, Japan, and South Korea)

Fundamental Priorities of Stakeholders

Worldwide Consensus:

- Compliance with Environmental Laws (Safety & Environment): 85% of the stakeholders cited adherence to environmental laws (e.g., REACH, EPA) as a "critical" priority.

- Color Consistency & Performance: 78% valued high-performance pigments/dyes with UV stability and durability.

Regional Variance:

- US: 65% favored cost-saving bulk production owing to mass industrial demand.

- Western Europe: 82% valued sustainability (bio-based, non-toxic dyes) as a priority, prompted by EU Green Deal policies.

- Japan/South Korea: 59% favored high-purity specialty pigments for electronics and automotive paint, vs. 32% in the US.

Adoption of Advanced Technologies

High Variance in Technological Integration

- US: 56% of producers utilized AI-based color matching systems, particularly in the textile and automotive industries.

- Western Europe: 48% employed bio-synthetic dyes (Germany at 62%).

- Japan: Just 25% invested in nano-pigments due to high R&D expenses.

- South Korea: 40% employed smart dyes (thermochromic/photochromic) for smart packaging and wearables.

ROI Perspectives:

- 68% of US and EU stakeholders viewed sustainable dyes as a long-term investment, while only 29% in Japan concurred due to higher expenses.

Material Preferences (Synthetic vs. Natural)

Consensus:

- Synthetic Pigments: 60% still prevail due to cost-effectiveness and brightness.

Regional Variance:

- Western Europe: 55% moved towards natural/organic dyes (as against 35% worldwide).

- US: 70% favored high-performance synthetic pigments for industrial uses.

- Japan/South Korea: 45% applied hybrid formulations (synthetic + natural) for specialty applications such as cosmetics.

Price Sensitivity & Cost Challenges

Shared Concerns:

- 84% mentioned increasing raw material costs (petrochemical derivatives up 25%, titanium dioxide up 20%).

Regional Differences:

- US/Western Europe: 60% would pay a 10–15% premium for sustainable dyes.

- Japan/South Korea: 72% chose low-cost alternatives because of squeezed profit margins.

- South Korea: 50% preferred subscription models for SME supply, compared with 20% in the US.

Pain Points in the Value Chain

Manufacturers:

- US: 50% experienced supply chain disruption in important raw materials (e.g., cobalt, chromium).

- Western Europe: 45% experienced difficulty with cumbersome ESG reporting requirements.

- Japan: 58% mentioned slow uptake of green substitutes in conventional industries.

Distributors:

- US: 65% mentioned logistical hold-ups from foreign suppliers.

- Western Europe: 50% experienced competition from lower-priced Asian imports.

- Japan/South Korea: 60% mentioned high import tariffs on specialty pigments.

End-Users (Textiles, Paints, Plastics):

- US: 40% complained about inconsistent batch quality.

- Western Europe: 35% had difficulty reformulating products to eco-standards.

- Japan: 52% mentioned insufficient technical support for sophisticated dye applications.

Future Investment Priorities

Global Alignment:

- 72% of producers intend to invest in sustainable pigment R&D.

Regional Divergence:

- US: 58% on high-opacity pigments for automotive/coatings.

- Western Europe: 55% investing in circular economy solutions (dye recycling).

- Japan/South Korea: 47% on functional dyes (conductive/light-sensitive).

Regulatory Impact

- US: 65% reported state-level chemical restrictions (e.g., California Prop 65) raised compliance costs.

- Western Europe: 80% saw the EU's Zero Pollution Action Plan as a growth driver for non-toxic dyes.

- Japan/South Korea: Fewer than 30% indicated that regulations greatly impacted purchasing, because enforcement is weak.

Conclusion: Consensus vs. Variance

-

High Consensus: Compliance with regulations, cost considerations, and performance requirements is worldwide.

Vital Variances:

- US: Bulk synthetic pigments predominate; mechanization is used in manufacturing.

- Western Europe: Bio-based dyes leader with an emphasis on sustainability.

- Japan/South Korea: High-tech and hybrid functional dyes for specialist industries.

Strategic Insight:

- There must be regional tailoring, eco-friendly in Europe, budget-friendly synthetics in the US, and high-tech specialist dyes in Asia.

Government Regulations on Pigments and Dyes Industry

| Country/Region | Regulatory Impact and Mandatory Certifications |

|---|---|

| U.S. | Environmental Protection Agency (EPA) Regulations: Recent rollbacks of emissions, air quality, and water pollution regulations under the previous administration have raised concerns about increased pollution and weakened oversight of textile mills and apparel factories. This poses challenges to the fashion industry's sustainability goals. Toxic Substances Control Act (TSCA): Requires manufacturers to report and test chemicals used in products to ensure they do not pose unreasonable risks to health or the environment. |

| European Union | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Mandates the registration and evaluation of chemicals, including pigments and dyes, to ensure safety. Compliance has increased production costs for synthetic pigments by 12-18% between 2018 and 2022. EC Regulation 1223/2009 on Cosmetics: Sets binding requirements for cosmetic products, including permissible pigments and dyes, to ensure consumer safety. Microplastics Ban: Pending regulations aim to prohibit intentionally added microplastics, affecting certain polymer-based colorants used in cosmetics and textiles, potentially eliminating a USD 320 million industry segment by 2025. |

| India | Azo Dye Restrictions: Prohibits the handling of 112 azo- and benzidine-based dyes due to their hazardous nature. Imported textiles must be accompanied by a pre-shipment certificate from an accredited laboratory certifying the absence of these prohibited substances. |

| China | Environmental Regulations: Stricter environmental laws have led to the shutdown of non-compliant dye manufacturing units, impacting global supply chains and prompting manufacturers to seek sustainable practices. |

| Japan and South Korea | Chemical Control Laws: Implement rigorous chemical management systems requiring manufacturers to notify and obtain approval for the use of certain chemicals in pigments and dyes, ensuring safety and compliance. |

| Brazil | Environmental Licensing: Requires pigment and dye manufacturers to obtain environmental licenses to operate, ensuring adherence to environmental protection standards and sustainable practices. |

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Market Analysis

The pigments and dyes industry is gradually growing, fueled by increasing demand for sustainable and high-performance colorants in textiles, coatings, and cosmetics. Tighter environmental regulations in the EU, China, and India are transforming the competitive landscape, benefiting companies investing in green innovations while putting pressure on conventional manufacturers that depend on synthetic chemicals. Industry leaders adopting regulatory compliance, automation, and bio-based alternatives will benefit, while non-compliant players will lose industry access and profitability.

Top 3 Strategic Imperatives for Stakeholders

Fast-Track Sustainability-Driven Innovation

Invest in bio-based, non-toxic, and biodegradable pigments to meet increasingly stringent environmental regulations and consumer demand for environmentally friendly products. Firms must focus on R&D in waterless dyeing technologies and recyclable colorants to differentiate and future-proof their products.

Enhance Supply Chain Resilience & Compliance

Maximize sourcing practices by locking in substitute suppliers and spreading raw material purchases to hedge against regulatory changes and geopolitical upsets. Executives should ensure adherence to changing regulations (e.g., EU REACH, India's azo dye prohibitions) to preserve access to global industries and escape fines.

Increase High-Growth Penetration

Use strategic collaborations and M&A to build up distribution networks in high-growth industries such as Asia-Pacific and Latin America, where demand is increasing for sustainable and cost-efficient pigments. Firms ought to invest in automation as well as digital color-matching technology to support efficiency and customer responsiveness.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

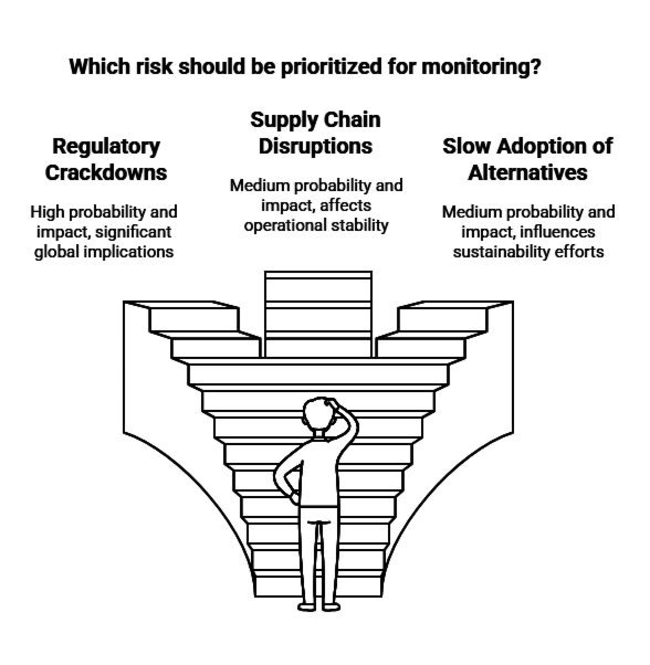

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

| Regulatory Crackdowns on Hazardous Chemicals (e.g., stricter bans on synthetic dyes and micro plastics in the EU, China, and India) | High |

| Supply Chain Disruptions (e.g., geopolitical tensions, raw material shortages, rising freight costs) | Medium |

| Slow Adoption of Sustainable Alternatives (e.g., resistance to bio-based pigments due to cost concerns and performance trade-offs) | Medium |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Regulatory Compliance Readiness | Conduct a full audit of chemical usage and reformulate high-risk products to comply with upcoming EU REACH and India’s azo dye bans. |

| Sustainable Product Innovation | Accelerate R&D investment in bio-based pigments and waterless dyeing technology to meet evolving environmental standards and consumer preferences. |

| Supply Chain Diversification | Identify and onboard alternative suppliers in low-risk regions to mitigate disruptions from geopolitical tensions and raw material shortages. |

For the Boardroom

To stay ahead and remain competitive in the changing industry, companies need to urgently step up investment in sustainable, regulatory-friendly solutions while strengthening supply chain resilience.

As environmental policies are tightening in key industries, reformulation to comply with EU REACH and India's azo dye bans should be a priority.

At the same time, R&D needs to shift towards bio-based pigments and digital color-matching technology to target premium industry segments.

Diversification of supplier networks and securing back-up raw material sources will decouple geopolitical uncertainty and cost volatility.

The following 12 months will decide industry positioning leaders that anticipate and quickly adapt will take share, as laggards experience margin degradation and regulatory hurdles.

Segment-wise Analysis

By Classification

The reactive dyes segment is expected to register 39% share in 2025. Reactive dyes find extensive applications in the dyes and pigments industry as they have much better bonding strength with cellulose fibers, rendering them perfect for dyeing rayon, cotton, and other natural fabrics.

Unlike other forms of dyes, which make use of less effective physical adsorption or coating of the surface, reactive dyes bond through covalent bonding with the molecules of fabrics, resulting in very good wash fastness, wearability, and light resistance.

Their capability to produce brighter, more saturated colors with deep penetration renders them a choice for high-end fashion, home furnishings, and industrial textiles.

By Application

The textiles segment is expected to register a 62% share in 2025. Textiles account for the greatest and most extensive use of pigments and dyes because the world's need for colored fabric exists in apparel, home furnishing, and technical textiles.

The textile sector demands an extensive palette of dyes, such as reactive, disperse, vat, and direct dyes, to ensure color brilliance, wash, light, and chemical fastness.

The dominance of textiles in the industry for dyes and pigments is fueled by the fast growth of fast fashion, growing disposable incomes, and urbanization, particularly in countries such as China, India, Bangladesh, and Vietnam, which are the key textile manufacturing bases.

Country-wise Analysis

U.S.

Sales of pigments and dyes in the U.S. are expected to grow at a CAGR of 4.8% from 2025 to 2035. The textile industry, in turn, has witnessed a comeback in the form of increasing demand from consumers for varied apparel and home furnishing items. The paints and coatings sector also enjoys the spur provided by continuous infrastructure building and reconstruction activities throughout the nation.

The U.S. industry is further marked by high investments in research and development, resulting in the development of innovative and sustainable dyeing solutions. Nevertheless, strict environmental legislation for the use of some chemicals in dyeing might present issues in industry expansion. Nonetheless, the focus on environmentally friendly products and processes will create new opportunities for growth.

UK

The industry in the UK is expected to register a CAGR of 3.5% from 2025 to 2035. The building and construction industry in the UK, especially residential and commercial, is the major driver for demand for superior coating, hence driving the usage of pigments. The fashion industry in the UK also drives demand for dyes, with increasing popularity for ethically and sustainably made fabrics.

Moreover, the industry is challenged by volatile raw material prices and the influence of Brexit on trade relationships. Nevertheless, the emphasis on sustainability and innovation for growth, particularly in the production of bio-based and eco-friendly dyes and pigments, provides opportunities.

France

Sales of pigments and dyes in France are expected to grow at a CAGR of 3.8% from the forecast period. The nation's focus on haute couture and luxury textiles means that specialized dyes must be used to create distinctive and deep colors.

The automotive and aerospace industries in France also provide demand for advanced coatings, which push the pigments industry forward.

The encouragement of sustainable development by the French government has created a surge in research on environmentally friendly dyes and pigments, a move that reflects the international trend towards greener solutions.

Additionally, rigorous environmental standards and the high expense of sustainable manufacturing practices can create impediments to growth. Moreover, quality and sustainability focus put France in a good standing in the European dyes and pigments sector.

Germany

The industry in Germany is expected to register a CAGR of 4.2% from 2025 to 2035. The high-performing auto industry of Germany propels demand for high-performing coatings, hence fueling the consumption of pigments.

Also, Germany's textile business, though smaller in size relative to other European countries, deals with technical textiles and innovative materials, thus requiring expert dyes. The German industry is also marked by high research and development, resulting in breakthroughs in dyeing technologies and the availability of eco-friendly products.

Moreover, the industry has challenges such as strict environmental regulations and expensive production. In spite of these challenges, Germany's dedication to innovation and quality guarantees its ongoing dominance in the European dyes and pigments industry.

Italy

Sales of pigments and dyes in Italy are estimated to grow at a CAGR of 3.6% from the forecast. The nation's fame for high-quality textiles and clothing fuels the demand for high-end dyes that provide rich colors and longevity.

Furthermore, Italy's leather sector, famous for its luxury products, is also driving the demand for specialty dyes and pigments.

The Italian industry is also observing a transition to environmentally friendly and sustainable dyeing processes, as is happening globally, as well as with changing consumer preferences.

In addition, issues like competition from low-cost manufacturing nations and strict environmental laws can affect growth. In spite of all these challenges, Italy's emphasis on quality, craftsmanship, and sustainability puts it in a positive position in the global dyes and pigments industry.

South Korea

The South Korean dyes and pigments industry is expected to grow at a CAGR of 5.0% from 2025 to 2035. The textile industry, renowned for its innovation and quality, requires a broad variety of dyes to serve domestic as well as overseas sectors.

Besides, South Korea's electronics sector, especially consumer electronics, uses pigments to make different parts. Government support for research and development for sustainable technologies has brought about advances in green dyes and pigments.

Moreover, the industry is affected by issues such as environmental regulations and competition from surrounding countries. Despite these challenges, South Korea's commitment to innovation and sustainability ensures its continued growth in the dyes and pigments industry.

Japan

Japan's sales are expected to grow at a CAGR of 4.0% from the forecast. The country's automotive and electronics industries are major consumers of pigments, requiring specialized solutions for coatings and component manufacturing.

Further, the textile industry of Japan, while being smaller in size than that of other Asian countries, focuses on quality and technological advancements, fueling demand for high-quality dyes.

The Japanese industry also sees a trend towards eco-friendly and sustainable products, as part of global tendencies and consumer choices.

Additionally, issues like an aging population and product costs affecting production can influence growth in the industry.

In spite of all these challenges, Japan's dedication to quality and innovation places it in a good position in the international dyes and pigments industry.

China

China continues to be the biggest and most dominant industry, which is expected to grow at a CAGR of 6.5% from 2025 to 2035. The construction and automobile industries also follow closely, with increasing urbanization and infrastructure developments fueling demand for high-performance coatings and pigments.

The stringent environmental policies of the Chinese government have resulted in consolidation in the industry, with small dye makers closing down for non-adherence to pollution curbs.

This has raised industry share for the large, sustainable manufacturers, leading to the use of low-VOC and water-based dyes and pigments. Further, the localization of high-value dyes and specialty chemicals is also gaining momentum to de-emphasize dependence on imports.

Market share Analysis

BASF SE (Germany) - 15-18%

BASF SE is the worldwide industry leader in the pigments business, with an estimated 15-18% industry share. BASF supplies a broad palette of organic, inorganic, and specialty pigments across the automotive, coatings, plastics, and printing industries. Strong R&D resources and strategic purchases (e.g., Clariant's pigments business) have supported its leadership in high-performance and sustainable pigment technology.

Sun Chemical (US) - 12-15%

Sun Chemical, a DIC Corporation subsidiary, is a leading company with a 12-15% industry share, with expertise in high-performance pigments and printing inks. It is a large supplier to the packaging, publication, and industrial coatings industries. Its colorant and advanced ink technology expertise make it an ideal partner for brand owners and printers globally.

Tronox Holdings (US) - 10-12%

Tronox Holdings is a dominant titanium dioxide (TiO₂) producer, with 10-12% of the world's pigment industry. TiO₂ is essential in paints, coatings, plastics, and laminates because of its opacity and brightness. Tronox's vertically integrated supply chain (from mining to production) provides it with a price competitiveness and supply reliability advantage.

Lanxess (Germany) - 8-10%

Lanxess is a leading producer of synthetic iron oxide pigments and organic pigments, with 8-10%. The company's pigments are used extensively in construction (colored concrete), coatings, and plastics. Lanxess has been emphasizing sustainability, launching low-carbon footprint pigments to address regulatory requirements.

Clariant (Switzerland) - 7-9%

Clariant, partly integrated with the BASF pigments business, has a 7-9% share, mainly in special pigments and masterbatches. It is recognized for its effect pigments (e.g., metallic and pearlescent) for automotive and cosmetics. Clariant's innovation in green pigment solutions caters to the increasing need for sustainable colorants.

Key Players

- Atlanta AG

- Asahi Songwon Colors Ltd.

- Atul Ltd.

- BASF SE

- Cathay Industries USA

- Clariant AG

- DIC Corp.

- DyStar Singapore Pte. Ltd.

- Ferro Corp.

- Sun Chemical Corporation

- Synthesia SA

- Sudarshan Chemical Industries Ltd.

- Huntsman Corp.

- LANXESS AG

- Kronos Worldwide Inc.

- Kiri Industries Ltd.

- Tronox Inc.

- Merck KGaA

- Flint Group

Segmentation

By Classification :

With respect to the classification, it is classified into disperse dyes, reactive dyes, sulphur dyes, and other classifications.

By Application :

In terms of application, it is divided into textiles, inks & paints, leather, and paper.

By Region :

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Table of Content

- 1. Executive Summary

- 2. Market Overview

- 3. Key Market Trends

- 4. Key Success Factors

- 5. Market Background

- 6. Global Market Volume (Units) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- 7. Global Market - Pricing Analysis

- 8. Global Market Value Analysis 2020 to 2024 and Forecast, 2025 to 2035

- 9. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Classification

- 9.1. Disperse Dyes

- 9.2. Reactive Dyes

- 9.3. Sulphur Dyes

- 9.4. Other Classifications

- 10. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Application

- 10.1. Textiles

- 10.2. Inks & Paints

- 10.3. Leather

- 10.4. Paper

- 11. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Region

- 11.1. North America

- 11.2. Latin America

- 11.3. Europe

- 11.4. East Asia

- 11.5. South Asia

- 11.6. Oceania

- 11.7. Middle East and Africa (MEA)

- 12. North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 13. Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 14. Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 15. South Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 16. East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 17. Oceania Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 18. Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 19. Key and Emerging Countries Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 20. Market Structure Analysis

- 21. Competition Analysis

- 21.1. Atlanta AG

- 21.2. Asahi Songwon Colors Ltd.

- 21.3. Atul Ltd.

- 21.4. BASF SE

- 21.5. Cathay Industries USA

- 21.6. Clariant AG

- 21.7. DIC Corp.

- 21.8. DyStar Singapore Pte. Ltd.

- 21.9. Ferro Corp.

- 21.10. Sun Chemical Corporation

- 21.11. Synthesia SA

- 21.12. Sudarshan Chemical Industries Ltd.

- 21.13. Huntsman Corp.

- 21.14. LANXESS AG

- 21.15. Kronos Worldwide Inc.

- 21.16. Kiri Industries Ltd.

- 21.17. Tronox Inc.

- 21.18. Merck KGaA

- 21.19. Flint Group

- 22. Assumptions and Acronyms Used

- 23. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

- FAQs -

What is the projected market size for pigments and dyes by 2035?

The pigments and dyes industry is expected to reach USD 51.2 billion by 2035, growing at a CAGR of 3.0%.

Which region is expected to witness the highest growth in the pigments and dyes market?

China leads with a CAGR of 6.5%, driven by rapid urbanization, infrastructure development, and stringent environmental policies.

What are the key factors shaping the future of the pigments and dyes industry?

Sustainability, regulatory compliance, high-performance formulations, and digital color-matching innovations will drive evolution.

Which application segment holds the largest market share?

The textiles segment dominates with a projected 62% share in 2025, fueled by fast fashion and increasing urbanization.

Who are the key pigments and dyes companies?

Prominent players include Atlanta AG, Asahi Songwon Colors Ltd., Atul Ltd., BASF SE, Cathay Industries USA, Clariant AG, DIC Corp., DyStar Singapore Pte. Ltd., Ferro Corp., Sun Chemical Corporation, Synthesia SA, Sudarshan Chemical Industries Ltd., Huntsman Corp., LANXESS AG, Kronos Worldwide Inc., Kiri Industries Ltd., Tronox Inc., and Merck KGaA, which drive innovation, sustainability, and regional market growth through advanced technologies and strategic investments.