Phenol Crystals Market

Phenol Crystals Market Analysis by Precursors for Cyclohexanone, Additives for Synthetic Resins, Nonionic Detergents, Pharmaceutical Drugs, Solvents, and Additives in Lubricants from 2023 to 2033

Analysis of Phenol Crystals Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Phenol Crystals Market Outlook (2023 to 2033)

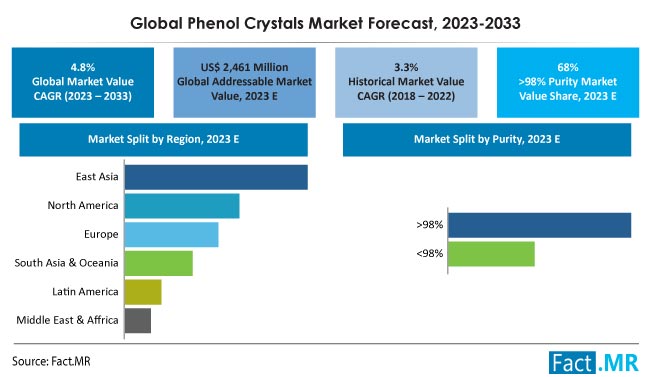

According to this recent industry analysis by Fact.MR, the global phenol crystals market is estimated to be valued at US$ 2.46 billion in 2023 and is predicted to expand at a CAGR of 4.8% to reach US$ 3.94 billion by the end of 2033.

Phenol crystals are a solid white-colored organic compound made up of phenol, also known as carbolic acid. Phenol is an aromatic organic compound with a distant odor that often needs careful handling because of its structure, which can cause chemical burns. It is commonly used as a precursor for other chemicals in various industries, which is leading to the constant demand growth for crystal phenol globally.

- Use of phenol crystals as additives in lubricants is forecasted to increase at a CAGR of 5.9% and reach a market value of US$ 2.53 billion by 2033.

| Report Attributes | Details |

|---|---|

| Phenol Crystals Market Size (2022A) | US$ 2.36 Billion |

| Estimated Market Value (2023E) | US$ 2.46 Billion |

| Forecasted Market Value (2033F) | US$ 3.94 Billion |

| Global Market Growth Rate (2023 to 2033) | 4.8% CAGR |

| China Market Value (2023) | US$ 544.1 Million |

| United States Market Growth Rate (2023 to 2033) | 3.4% CAGR |

| Key Companies Profiled | Sinopec and Mitsui; Chang Chun Group; Kumho PandB; PTT Phenol; Formosa; Taiwan Prosperity; LG Chem; Mitsubishi Chemical; Borealis Polymers; Versalis |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Consumption Analysis of Phenol Crystals (2018 to 2022) vs. Market Projections (2023 to 2033)

Worldwide sales of phenol crystals increased at 3.3% CAGR from 2018 and 2022 and are forecasted to rise at 4.8% CAGR from 2023 to 2033, as per Fact.MR, a market research and competitive intelligence provider.

Phenol crystals act as antiseptics, disinfectants, adhesives, and precursors in industrial and laboratory applications and are used in the synthesis of pharmaceuticals, plastics, textiles, dyes, agrochemicals, phenolic resins, electronics, and other chemical products. Its unique properties of being aromatic, soluble, antiseptic, and precursor to resins contribute to its growing applications across various industries globally.

- Short Term (2023 to 2026): The market is projected to expand with advancements in chemical synthesis and processing, which can lead to increased efficiency and cost-effectiveness in the production methods of phenol crystals, thus driving the demand for phenol crystals.

- Medium Term (2026 to 2029): Phenol crystals are expected to find applications in advanced materials, nanotechnology, and biotechnology for producing superconductors, advanced composites, etc. Also, growing healthcare and pharmaceutical industries are expected to drive the demand for phenol crystals as it is considered the building block in the production of antiseptics, medicines, etc. because of their reactivity property.

- Long Term (2029 to 2033): Due to increasing environmental concerns and growing environmental awareness, the industry is focusing more on sustainable methods of production of phenol, such as using more renewable resources or improving waste management methods. Given the toxicity of phenol, its sustainable production and application become necessary to meet increasing demand in the future.

An overview of the market share analysis of phenol crystals based on application and form is given in the image above. The >98% purity segment is expected to dominate the market and expand at a CAGR of 3.5% over the forecast period.

What are the Factors Influencing the Market for Phenol Crystals?

"Growing Utilization of Phenol Crystals in Pharmaceuticals and Consumer Products”

The expanding world population is contributing to increasing healthcare needs, driving demand for pharmaceutical products. Phenol is used as a raw material in pharmaceutical products like antiseptics, pain relievers, and other medications because of its versatility. The antiseptic and disinfectant properties of phenol prevent and control the spread of various diseases across the world, driving its usage in the pharmaceutical industry.

Global demand for phenol production is being driven by its antimicrobial characteristics, which extend its applications in personal care items, textiles, apparel, electronics, gadgets, and various lifestyle products.

“Chemical and Flame Resistance of Phenol Crystals Driving Their Widespread Adoption”

Technological advancements are playing a crucial role in driving the demand for crystal phenol globally as phenol-based compounds can be tailored to specific applications, expanding their usage across various industries like electronics, healthcare, biotechnology, nanotechnology, etc.

Phenol-based materials offer electronic insulation, thermal stability, and mechanical strength, driving their demand in the production of various technologies. Also, phenol’s biocompatibility, chemical resistance, and flame resistance make it the most suitable raw material to be used in building materials, automotive components, and industries involving harsh chemical environments.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

What are the Challenges Faced by Manufacturers of Phenol Crystals?

“Environmental and Health Concerns Associated with Phenol Crystals”

Phenol is a toxic organic compound and can be hazardous to human health as well as to the environment. Its production and uses release pollutants and harmful by-products, resulting in air, water, and soil pollution. Its toxic nature is the key resistance to its future growth in the global market.

Regulators have implemented stringent standards governing the safe handling, storage, and disposal of phenol. The potential for employing sustainable production methods for phenol can significantly alleviate these concerns and pave the way for the emergence of environment-friendly alternatives in the long term.

Country-wise Insights

Why is Demand for Phenol Crystals Substantial in the United States?

“Wide Use of Phenol Crystals in Synthesis of Intermediates in Pharmaceutical Sector”

The market for crystal phenol in the United States is projected to reach US$ 745 million by the end of 2033. The expansion of the pharmaceutical sector in the country is expected to drive the demand for phenol crystals. These crystals are utilized in the synthesis of intermediates and play a role in coupling reactions in pharmaceutical formulations, thereby enhancing drug solubility and overall performance.

Phenol derivatives are altered to form bioactive compounds with distinct medical properties, such as antibacterial, anti-inflammatory, or anticancer effects. The distinctive reactivity of phenol and its capacity to undergo diverse chemical changes make it a crucial element in pharmaceutical manufacturing processes in the United States.

Why are Sales of Phenol Crystals Rising in China?

“Increasing Use of High-Performance Plastics and Resins in Battery Manufacturing”

Revenue from the sales of phenol crystals in China is estimated to reach US$ 912 million by 2033. China continues to be one of the major players in battery manufacturing, with rising demand for electric vehicles leading to increasing use of lithium-ion batteries and renewable energy storage. Phenol crystals are essential components used in the production of high-performance plastics and resins that are ultimately used in battery manufacturing.

Phenol-based materials such as polycarbonate are used in the manufacturing of protective coatings and frames for solar panels, which is another fastest-growing industry in China. This factor is leading to a growing need for phenol crystals to enhance the efficiency and product performance of phenol-based materials.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Category-wise Insights

Why Do >98% Purity Grade Phenol Crystals Account for Higher Sales?

“Compliance of >98% Purity Grade Phenol Crystals with Stringent Safety Regulations”

Phenol crystals of purity grade >98% are estimated to account for sales of US$ 1.67 billion in 2023. Phenol crystals with purity exceeding 98% guarantee consistent quality and performance and comply with stringent regulatory mandates, particularly in pharmaceutical applications. Lower purity grades can pose heightened risks, particularly in the pharmaceutical sector, where human lives are at stake.

Using high-quality phenol crystals ensures the reliability and reproducibility of chemical reactions, increasing its demand in the chemical industry. With industries shifting towards more advanced and specialized applications in the long run, the demand for high-purity grade phenol crystals is expected to increase simultaneously.

Why Do Additives in Lubricants Dominate This Market?

“Anti-friction Properties of Phenol Crystals Driving Their Extensive Use in Lubricants”

Use of phenol crystals as additives in lubricants is projected to reach a market value of US$ 890 million by 2033-end. Phenol crystals create a protective barrier on metal surfaces with their anti-friction properties. This results in improved lubrication and extends the lifespan of machinery and equipment, because of which it is widely used in various sectors like electronics, automotive, aviation, etc. Their thermal stability contributes to their increasing use in lubricants globally.

Compatibility of phenol with various base oil formulations makes it easier for manufacturers to use this compound as an additive in various lubricants to prevent unwanted interactions. One way it achieves this is by acting as an antioxidant, thereby inhibiting corrosion in various types of equipment.

Competition Analysis

Sinopec and Mitsui, Chang Chun Group, Kumho PandB, PTT Phenol, Formosa, Taiwan Prosperity, LG Chem, Mitsubishi Chemical, Borealis Polymers, and Versalis are leading phenol crystal manufacturers.

In the phenol crystals industry, market players are tapping into various strategies to strengthen their position and remain competitive such as conducting continuous research and development for its new applications and continuous product innovation, enduring partnerships and collaborations, optimizing the supply chain, promoting sustainability, expanding their range of phenol crystals-based products, and ensuring regulatory compliance.

Players are investing in marketing and branding efforts to raise awareness about the applications of phenol crystals and differentiate themselves from competitors to stand out and get recognized among their consumers. By pursuing these growth strategies, market players aim to foster sustainable growth, gain a competitive edge, and meet the evolving demands of the chemical industry.

- Sinopec, in collaboration with Mitsui, a prominent China-based company, has been in the process of establishing a Bisphenol-A plant within the Shanghai Chemical Industry Park. This initiative aims to diversify Bisphenol-A-related products and expand their business internationally by introducing new applications. Furthermore, Sinopec's partnership with MCI enables it to leverage the latter’s technical, financial, and marketing expertise, enhancing its global competitiveness in phenol manufacturing.

Fact.MR has provided detailed information about the price points of key manufacturers of phenol crystals across the world, production capacity, sales growth, and speculative technological expansion in its recently published report.

Segmentation of Phenol Crystals Industry Research

-

By Purity :

- >98%

- <98%

-

By End Use :

- Precursors for Cyclohexanone

- Additives for Synthetic Resins

- Nonionic Detergents

- Pharmaceutical Drugs

- Solvents

- Additives in Lubricants

- Others (Dyes, Synthetic Tanning Agents, Perfumes, etc.)

-

By Region :

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

Table of Content

- 1. Market - Executive Summary

- 2. Market Overview

- 3. Market Background and Foundation Data

- 4. Global Demand (Kilo tons) Analysis and Forecast

- 5. Global Market - Pricing Analysis

- 6. Global Market Analysis and Forecast, By End Use

- 6.1. Precursor for Cyclohexanone

- 6.2. Additive for Synthetic Resins

- 6.3. Nonionic Detergents

- 6.4. Pharmaceutical Drugs

- 6.5. Solvent

- 6.6. Additives in Lubricants

- 6.7. Others (Dyes, Synthetic Tanning Agents, Perfumes, etc.)

- 7. Global Market Analysis and Forecast, By Purity

- 7.1. >98%

- 7.2. <98%

- 8. Global Market Analysis and Forecast, By Region

- 8.1. North America

- 8.2. Latin America

- 8.3. Europe

- 8.4. East Asia

- 8.5. South Asia & Oceania

- 8.6. Middle East & Africa

- 9. North America Market Analysis and Forecast

- 10. Latin America Market Analysis and Forecast

- 11. Europe Market Analysis and Forecast

- 12. East Asia Market Analysis and Forecast

- 13. South Asia & Oceania Market Analysis and Forecast

- 14. Middle East & Africa Market Analysis and Forecast

- 15. Country - level Market Analysis and Forecast

- 16. Market Structure Analysis

- 17. Competition Analysis

- 17.1. James Fisher and Sons PLC

- 17.2. DESCO Corporation

- 17.3. Kirby Morgan Dive Systems, Inc

- 17.4. Sub Sea Systems, Inc.

- 17.5. Aqualung Group

- 17.6. DRASS GALEAZZI U.T. SRL

- 18. Assumptions & Acronyms Used

- 19. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

Table 01. Global Market Value (US$ million) by Region, 2018 to 2022

Table 02. Global Market Value (US$ million) and Forecast by Region, 2023 to 2033

Table 03. Global Market Volume (Kilo tons) by Region, 2018 to 2022

Table 04. Global Market Volume (Kilo tons) and Forecast by Region, 2023 to 2033

Table 05. Global Market Value (US$ million) By End Use, 2018 to 2022

Table 06. Global Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 07. Global Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 08. Global Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 09. Global Market Value (US$ million) By Purity, 2018 to 2022

Table 10. Global Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 11. Global Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 12. Global Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

Table 13. North America Market Value (US$ million) by Country, 2018 to 2022

Table 14. North America Market Value (US$ million) and Forecast by Country, 2023 to 2033

Table 15. North America Market Volume (Kilo tons) by Country, 2018 to 2022

Table 16. North America Market Volume (Kilo tons) and Forecast by Country, 2023 to 2033

Table 17. North America Market Value (US$ million) By End Use, 2018 to 2022

Table 18. North America Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 19. North America Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 20. North America Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 21. North America Market Value (US$ million) By Purity, 2018 to 2022

Table 22. North America Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 23. North America Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 24. North America Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

Table 25. Latin America Market Value (US$ million) by Country, 2018 to 2022

Table 26. Latin America Market Value (US$ million) and Forecast by Country, 2023 to 2033

Table 27. Latin America Market Volume (Kilo tons) by Country, 2018 to 2022

Table 28. Latin America Market Volume (Kilo tons) and Forecast by Country, 2023 to 2033

Table 29. Latin America Market Value (US$ million) By End Use, 2018 to 2022

Table 30. Latin America Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 31. Latin America Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 32. Latin America Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 33. Latin America Market Value (US$ million) By Purity, 2018 to 2022

Table 34. Latin America Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 35. Latin America Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 36. Latin America Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

Table 37. Europe Market Value (US$ million) by Country, 2018 to 2022

Table 38. Europe Market Value (US$ million) and Forecast by Country, 2023 to 2033

Table 39. Europe Market Volume (Kilo tons) by Country, 2018 to 2022

Table 40. Europe Market Volume (Kilo tons) and Forecast by Country, 2023 to 2033

Table 41. Europe Market Value (US$ million) By End Use, 2018 to 2022

Table 42. Europe Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 43. Europe Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 44. Europe Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 45. Europe Market Value (US$ million) By Purity, 2018 to 2022

Table 46. Europe Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 47. Europe Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 48. Europe Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

Table 49. East Asia Market Value (US$ million) by Country, 2018 to 2022

Table 50. East Asia Market Value (US$ million) and Forecast by Country, 2023 to 2033

Table 51. East Asia Market Volume (Kilo tons) by Country, 2018 to 2022

Table 52. East Asia Market Volume (Kilo tons) and Forecast by Country, 2023 to 2033

Table 53. East Asia Market Value (US$ million) By End Use, 2018 to 2022

Table 54. East Asia Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 55. East Asia Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 56. East Asia Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 57. East Asia Market Value (US$ million) By Purity, 2018 to 2022

Table 58. East Asia Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 59. East Asia Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 60. East Asia Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

Table 61. South Asia & Oceania Market Value (US$ million) by Country, 2018 to 2022

Table 62. South Asia & Oceania Market Value (US$ million) and Forecast by Country, 2023 to 2033

Table 63. South Asia & Oceania Market Volume (Kilo tons) by Country, 2018 to 2022

Table 64. South Asia & Oceania Market Volume (Kilo tons) and Forecast by Country, 2023 to 2033

Table 65. South Asia & Oceania Market Value (US$ million) By End Use, 2018 to 2022

Table 66. South Asia & Oceania Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 67. South Asia & Oceania Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 68. South Asia & Oceania Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 69. South Asia & Oceania Market Value (US$ million) By Purity, 2018 to 2022

Table 70. South Asia & Oceania Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 71. South Asia & Oceania Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 72. South Asia & Oceania Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

Table 73. MEA Market Value (US$ million) by Country, 2018 to 2022

Table 74. MEA Market Value (US$ million) and Forecast by Country, 2023 to 2033

Table 75. MEA Market Volume (Kilo tons) by Country, 2018 to 2022

Table 76. MEA Market Volume (Kilo tons) and Forecast by Country, 2023 to 2033

Table 77. MEA Market Value (US$ million) By End Use, 2018 to 2022

Table 78. MEA Market Value (US$ million) and Forecast By End Use, 2023 to 2033

Table 79. MEA Market Volume (Kilo tons) By End Use, 2018 to 2022

Table 80. MEA Market Volume (Kilo tons) and Forecast By End Use, 2023 to 2033

Table 81. MEA Market Value (US$ million) By Purity, 2018 to 2022

Table 82. MEA Market Value (US$ million) and Forecast By Purity, 2023 to 2033

Table 83. MEA Market Volume (Kilo tons) By Purity, 2018 to 2022

Table 84. MEA Market Volume (Kilo tons) and Forecast By Purity, 2023 to 2033

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Figure 01. Global Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 02. Global Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 03. Global Market Value (US$ million) and Volume (Kilo tons) by Region, 2023 & 2033

Figure 04. Global Market Y–o–Y Growth Rate by Region, 2023 to 2033

Figure 05. Global Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 06. Global Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 07. Global Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 08. Global Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 09. North America Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 10. North America Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 11. North America Market Value (US$ million) and Volume (Kilo tons) by Country, 2023 & 2033

Figure 12. North America Market Y–o–Y Growth Rate by Country, 2023 to 2033

Figure 13. North America Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 14. North America Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 15. North America Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 16. North America Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 17. North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 18. North America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 19. North America Market Attractiveness Analysis By Purity, 2023 to 2033

Figure 20. Latin America Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 21. Latin America Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 22. Latin America Market Value (US$ million) and Volume (Kilo tons) by Country, 2023 & 2033

Figure 23. Latin America Market Y–o–Y Growth Rate by Country, 2023 to 2033

Figure 24. Latin America Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 25. Latin America Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 26. Latin America Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 27. Latin America Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 28. Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 29. Latin America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 30. Latin America Market Attractiveness Analysis By Purity, 2023 to 2033

Figure 31. Europe Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 32. Europe Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 33. Europe Market Value (US$ million) and Volume (Kilo tons) by Country, 2023 & 2033

Figure 34. Europe Market Y–o–Y Growth Rate by Country, 2023 to 2033

Figure 35. Europe Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 36. Europe Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 37. Europe Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 38. Europe Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 39. Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40. Europe Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 41. Europe Market Attractiveness Analysis By Purity, 2023 to 2033

Figure 42. East Asia Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 43. East Asia Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 44. East Asia Market Value (US$ million) and Volume (Kilo tons) by Country, 2023 & 2033

Figure 45. East Asia Market Y–o–Y Growth Rate by Country, 2023 to 2033

Figure 46. East Asia Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 47. East Asia Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 48. East Asia Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 49. East Asia Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 50. East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 51. East Asia Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 52. East Asia Market Attractiveness Analysis By Purity, 2023 to 2033

Figure 53. South Asia & Oceania Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 54. South Asia & Oceania Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 55. South Asia & Oceania Market Value (US$ million) and Volume (Kilo tons) by Country, 2023 & 2033

Figure 56. South Asia & Oceania Market Y–o–Y Growth Rate by Country, 2023 to 2033

Figure 57. South Asia & Oceania Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 58. South Asia & Oceania Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 59. South Asia & Oceania Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 60. South Asia & Oceania Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 61. South Asia & Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 62. South Asia & Oceania Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 63. South Asia & Oceania Market Attractiveness Analysis By Purity, 2023 to 2033

Figure 64. MEA Market Value (US$ million) and Volume (Kilo tons) Forecast, 2023 to 2033

Figure 65. MEA Market Absolute $ Opportunity (US$ million), 2023 to 2033

Figure 66. MEA Market Value (US$ million) and Volume (Kilo tons) by Country, 2023 & 2033

Figure 67. MEA Market Y–o–Y Growth Rate by Country, 2023 to 2033

Figure 68. MEA Market Value (US$ million) and Volume (Kilo tons) By End Use, 2023 & 2033

Figure 69. MEA Market Y–o–Y Growth Rate By End Use, 2023 to 2033

Figure 70. MEA Market Value (US$ million) and Volume (Kilo tons) By Purity, 2023 & 2033

Figure 71. MEA Market Y–o–Y Growth Rate By Purity, 2023 to 2033

Figure 72. MEA Market Attractiveness Analysis by Country, 2023 to 2033

Figure 73. MEA Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 74. MEA Market Attractiveness Analysis By Purity, 2023 to 2033

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

What was the size of the phenol crystals market in 2022?

The global phenol crystals market was valued at US$ 2.36 billion in 2022.

At what rate did the demand for phenol crystals increase from 2018 to 2022?

Sales of phenol crystals increased at 3.3% CAGR from 2018 to 2022.

Which regions are included in the market study?

North America, Latin America, MEA, South Asia & Oceania, East Asia, and Europe are the markets detailed in the study.

Who are the leading manufacturers of phenol crystals?

Key market players are Chang Chun Group, Kumho PandB, PTT Phenol, Formosa, and Sinopec and Mitsui.

What is the estimated valuation of the global market for 2033?

The market for phenol crystals is predicted to reach US$ 3.94 billion by 2033.

What is the usage outlook for phenol crystals as additives in lubricants?

Utilization of phenol crystals as additives in lubricants is expected to rise at 5.9% CAGR through 2023.

What is the sales outlook for >98% purity grade phenol crystals?

Sales of >98% purity grade phenol crystals are projected to rise at 5.1% CAGR through 2023.

What are the projections for the sales of phenol crystals in the United States?

The market for phenol crystals in the U.S. is forecasted to reach US$ 745 million by 2033.