Liquid Packaging Carton Market

Liquid Packaging Carton Market Size and Share Forecast Outlook 2025 to 2035

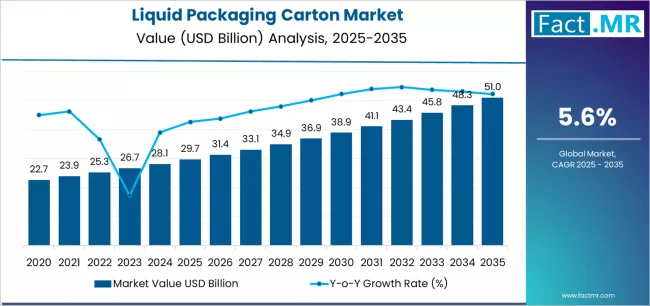

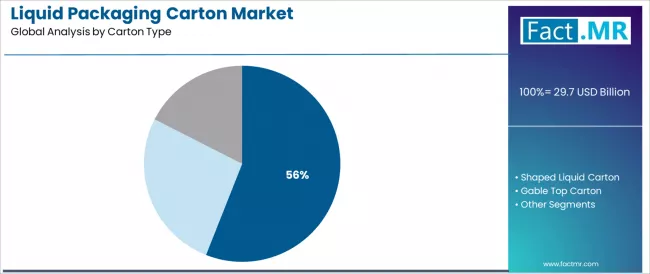

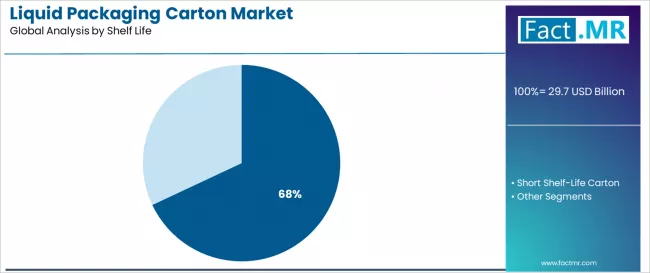

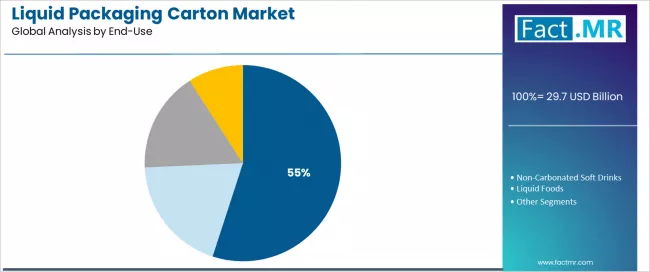

Liquid packaging carton market is projected to grow from USD 29.7 billion in 2025 to USD 51.0 billion by 2035, at a CAGR of 5.6%. Brick Liquid Carton will dominate with a 56.0% market share, while long shelf-life carton will lead the shelf life segment with a 68.0% share.

Liquid Packaging Carton Market Forecast and Outlook 2025 to 2035

The global liquid packaging carton market is projected to reach USD 51.0 billion by 2035, recording an absolute increase of USD 21.3 billion over the forecast period. The market is valued at USD 29.7 billion in 2025 and is set to rise at a CAGR of 5.6% during the assessment period.

The market is expected to grow by approximately 1.7 times during the same period, supported by increasing consumer preference for sustainable packaging solutions across liquid food and beverage applications worldwide, driving demand for recyclable carton materials and rising investments in aseptic packaging technologies with enhanced shelf-life capabilities across dairy, juice, and plant-based beverage categories globally.

Quick Stats for Liquid Packaging Carton Market

- Liquid Packaging Carton Market Value (2025): USD 29.7 billion

- Liquid Packaging Carton Market Forecast Value (2035): USD 51.0 billion

- Liquid Packaging Carton Market Forecast CAGR: 5.6%

- Leading Carton Type in Liquid Packaging Carton Market: Brick Liquid Carton (56.0%)

- Key Growth Regions in Liquid Packaging Carton Market: Asia Pacific, Europe, and North America

- Top Players in Liquid Packaging Carton Market: Tetra Pak, SIG, Elopak, Mondi, Nippon Paper Industries, UFlex Ltd., IPI S.r.l., Greatview Aseptic Packaging, WestRock Company, Heli Packaging Technology, Parksons Packaging Ltd.

Manufacturers face mounting pressure to deliver environmentally responsible packaging while maintaining product safety and freshness throughout extended distribution chains, with modern liquid packaging carton providing documented benefits including reduced carbon footprint, superior barrier properties, and convenient consumer handling compared to conventional plastic and glass packaging alternatives alone.

Rising awareness about plastic pollution and expanding retail distribution networks enabling widespread product availability create substantial opportunities for carton manufacturers and beverage producers. However, regional infrastructure limitations for carton recycling and competition from alternative sustainable packaging formats may pose obstacles to accelerated market penetration.

The brick liquid carton segment dominates market activity, driven by extensive adoption in UHT dairy applications and ambient juice products requiring long shelf-life capabilities across diverse global markets worldwide. Consumers increasingly recognize the convenience benefits of brick carton, with typical product offerings providing excellent barrier protection and space-efficient packaging at competitive price points through established retail distribution networks.

The gable top carton segment demonstrates robust growth potential, supported by premium positioning in fresh dairy categories and consumer preference for easy-pour functionality in refrigerated liquid products. Long shelf-life carton emerge as the dominant shelf life category, reflecting widespread adoption of aseptic processing technologies enabling ambient storage without refrigeration requirements. Liquid dairy products represent the leading end-use application, driven by global milk consumption patterns and growing demand for fortified dairy beverages in emerging markets.

Regional dynamics show Europe maintaining significant market presence, supported by stringent environmental regulations and mature consumption patterns across sustainable packaging categories. Asia Pacific demonstrates the fastest growth trajectory driven by expanding middle-class populations and increasing urbanization accelerating demand for convenient packaged beverages, while North America emphasizes plant-based beverage applications and premium carton designs.

China leads country-level growth through extensive UHT dairy adoption and e-commerce beverage expansion, followed by India supported by ongoing transition from plastic packaging to aseptic carton solutions.

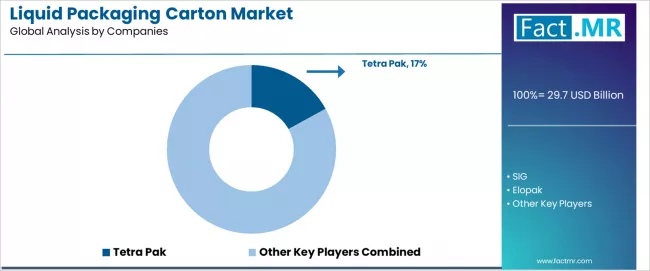

The competitive landscape features moderate concentration with Tetra Pak maintaining market leadership position with a 17.0% market share, while established players including SIG, Elopak, and Mondi compete through advanced barrier technologies and comprehensive packaging system solutions across diverse liquid product applications.

Liquid Packaging Carton Market Year-over-Year Forecast 2025 to 2035

Between 2025 and 2029, the liquid packaging carton market is projected to expand from USD 29.7 billion to USD 36.7 billion, resulting in a value increase of USD 7.0 billion, which represents 32.9% of the total forecast growth for the period. This phase of development will be shaped by rising demand for sustainable packaging alternatives replacing single-use plastics, product innovation in lightweight carton materials with enhanced barrier properties, as well as expanding aseptic processing adoption enabling shelf-stable liquid food distribution. Companies are establishing competitive positions through investment in recycling infrastructure partnerships, advanced coating technologies, and strategic market expansion across emerging economies, online beverage brands, and premium dairy applications.

From 2029 to 2035, the market is forecast to grow from USD 36.7 billion to USD 51.0 billion, adding another USD 14.3 billion, which constitutes 67.1% of the overall expansion. This period is expected to be characterized by the expansion of plant-based beverage packaging applications, including oat milk, almond milk, and functional beverage formulations requiring specialized barrier properties, strategic collaborations between carton manufacturers and beverage brands implementing circular economy initiatives, and an enhanced focus on carbon-neutral production facilities and renewable material sourcing. The growing emphasis on smart packaging technologies integrating QR codes and digital authentication features will drive demand for advanced carton solutions across diverse consumer segments globally.

Liquid Packaging Carton Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 29.7 billion |

| Market Forecast Value (2035) | USD 51.0 billion |

| Forecast CAGR (2025-2035) | 5.6% |

Why is the Liquid Packaging Carton Market Growing?

The liquid packaging carton market grows by enabling beverage and liquid food manufacturers to deliver products with extended shelf life while meeting consumer demands for sustainable packaging alternatives that reduce environmental impact compared to conventional plastic and glass containers.

Manufacturers face mounting pressure to minimize carbon footprints and support circular economy initiatives while maintaining product safety and quality throughout distribution chains, with modern liquid packaging carton typically providing superior recyclability, renewable material content, and lightweight transportation efficiency compared to traditional packaging formats alone, making carton solutions essential for environmentally conscious brand positioning.

The packaging industry's need for cost-effective and consumer-friendly formats creates demand for liquid carton solutions that can provide ambient storage capabilities, reduce refrigeration costs, and deliver convenient pouring mechanisms without compromising product integrity or safety standards.

Government regulations targeting plastic waste reduction and corporate sustainability commitments drive adoption across dairy producers, juice manufacturers, and emerging plant-based beverage brands, where packaging choices have direct impact on consumer purchasing decisions and environmental performance metrics.

The increasing global consumption of packaged beverages, particularly in emerging markets with expanding cold chain infrastructure, creates growing demand for aseptic carton packaging enabling product distribution without continuous refrigeration. Rising consumer awareness about packaging sustainability enables informed purchasing decisions favoring recyclable carton materials over single-use plastic alternatives.

Regional variations in recycling infrastructure and consumer education levels regarding proper carton disposal may limit circularity achievement and optimal environmental benefit realization among diverse geographic markets with different waste management capabilities.

Segmental Analysis

The market is segmented by carton type, shelf life, end-use, and region. By carton type, the market is divided into brick liquid carton, shaped liquid carton, and gable top carton. Based on shelf life, the market is categorized into long shelf-life carton and short shelf-life carton. By end-use, the market includes liquid dairy products, non-carbonated soft drinks, liquid foods, and alcoholic drinks. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

By Carton Type, Which Segment Accounts for the Dominant Market Share?

The brick liquid carton segment represents the dominant force in the liquid packaging carton market, capturing 56.0% of total market share in 2025. This established carton format category encompasses solutions featuring space-efficient rectangular designs and proven aseptic packaging capabilities, including advanced multi-layer barrier constructions combining polyethylene, paperboard, and aluminum foil technologies that enable superior shelf stability and distribution efficiency across ambient temperature beverage and dairy applications worldwide.

The brick liquid carton segment's market leadership stems from its superior cost-effectiveness for high-volume production, with solutions capable of maximizing warehouse storage density and transportation efficiency while maintaining excellent product protection and tamper-evident safety features across diverse liquid product categories.

Within the brick carton segment, aseptic brick carton represent the preferred format for many manufacturers, driven by their ability to provide long shelf-life without refrigeration requirements, enabling global product distribution and reducing cold chain dependencies. This sub-segment benefits from established UHT processing integration and widespread consumer acceptance across dairy and juice categories.

The gable top carton segment maintains a substantial market share in the 28.0% range, serving premium fresh dairy markets and refrigerated beverage applications where consumers value easy-pour functionality and resealable convenience features. These solutions offer distinctive brand differentiation opportunities through customizable printing surfaces while providing sufficient barrier properties for chilled product distribution. The gable top segment demonstrates steady growth potential, driven by premiumization trends in fluid milk categories and expanding organic dairy consumption patterns.

Within the carton type category, shaped liquid carton demonstrate specialized adoption, driven by brand differentiation requirements and distinctive packaging aesthetics for premium juice products and functional beverages. This sub-segment benefits from enhanced shelf visibility and consumer appeal through unique geometric designs.

Key performance advantages driving the brick liquid carton segment include:

- Advanced space optimization enabling maximum pallet efficiency and reduced transportation costs across global distribution networks

- Established aseptic processing compatibility allowing ambient storage and extended product shelf life without preservative requirements

- Enhanced production speed capabilities enabling high-volume manufacturing throughput while maintaining consistent quality standards

- Superior cost-effectiveness providing optimal packaging economics for mainstream dairy and juice applications across price-sensitive consumer markets

By Shelf Life, Which Segment Accounts for the Largest Market Share?

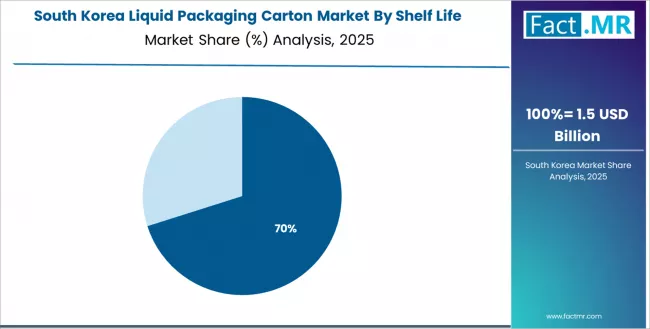

Long shelf-life carton dominate the liquid packaging carton shelf life landscape with a 68.0% market share in 2025, reflecting the critical role of aseptic packaging technologies in supporting ambient product storage and global distribution capabilities across beverage and liquid food categories worldwide.

The long shelf-life carton segment's market leadership is reinforced by manufacturer preferences for reduced cold chain requirements, extended product dating enabling wider geographic reach, and inventory management flexibility that minimizes waste throughout retail operations.

Within this segment, aseptic long-life carton represent the core technology, driven by their ability to sterilize both product and packaging separately before aseptic filling, enabling shelf stability for 6-12 months at ambient temperature. This sub-segment benefits from established UHT dairy applications and expanding adoption in plant-based beverage categories.

The short shelf-life carton segment represents an important category demonstrating stable demand through specialized requirements for fresh dairy products, premium juice applications, and refrigerated beverage formats where consumers prioritize fresh taste profiles over extended storage duration. This segment benefits from premium positioning and consumer perception of superior quality associated with refrigerated products requiring shorter consumption timeframes.

Within shelf life applications, extended-life carton demonstrate growing adoption through innovative barrier technologies enabling intermediate storage durations between traditional fresh and aseptic formats, providing manufacturers with flexibility in distribution strategies.

Key market dynamics supporting shelf life category growth include:

- Aseptic technology advancement enabling ambient storage across expanding product categories beyond traditional dairy applications

- Cold chain infrastructure development in emerging markets creating opportunities for both shelf-stable and refrigerated carton formats

- Integration of advanced barrier materials optimizing oxygen and light protection while maintaining recyclability standards

- Growing emphasis on sustainability considerations balancing extended shelf life benefits with renewable material content and recycling capabilities

By End-Use, Which Segment Accounts for a Significant Market Share?

Liquid dairy products represent the leading end-use segment in the liquid packaging carton market with a 55.0% market share in 2025, reflecting the fundamental role of carton packaging in global milk distribution and the widespread consumer acceptance of carton formats for dairy consumption.

The liquid dairy segment demonstrates consistent demand driven by the need for hygienic packaging protecting nutritional integrity while enabling convenient pouring and storage across diverse consumer households and foodservice applications.

Within liquid dairy applications, white milk represents the core product category, driven by established consumption patterns across developed and emerging markets. The segment benefits from aseptic UHT processing enabling shelf-stable milk distribution in regions with limited refrigeration infrastructure.

The non-carbonated soft drinks segment emerges as an important end-use category with robust growth potential, driven by expanding juice consumption patterns and rising demand for functional beverages including RTD tea, coffee drinks, and fortified water alternatives packaged in environmentally responsible formats. Consumers seeking healthier beverage options increasingly prefer carton packaging for perceived naturalness and sustainability benefits.

Within end-use applications, liquid foods demonstrate specialized adoption through soup, broth, and liquid nutritional supplement categories requiring convenient portion control and extended shelf stability. Alcoholic drinks represent an emerging opportunity with premium wine and cocktail products exploring carton packaging for sustainability positioning and convenience-focused consumption occasions.

Key end-use dynamics include:

- Liquid dairy requirements driving continuous demand for cost-effective carton solutions supporting mainstream milk distribution globally

- Plant-based milk alternatives accelerating carton adoption through sustainability-conscious consumer segments seeking dairy alternatives

- Juice category diversification creating opportunities for premium carton designs and functional barrier properties protecting vitamin content

- Emerging alcoholic beverage applications exploring carton formats for outdoor consumption occasions and sustainability-focused brand positioning

What are the Drivers, Restraints, and Key Trends of the Liquid Packaging Carton Market?

The market is driven by three concrete demand factors tied to sustainability and consumer convenience. First, rising environmental regulations targeting plastic waste reduction create expanding opportunities for recyclable carton packaging across beverage applications, with governmental policies and corporate sustainability commitments representing a critical driver for carton adoption in mainstream liquid product distribution, requiring widespread format conversion. Second, growing consumer preference for sustainable packaging materials drives purchasing decisions and brand loyalty, with surveys demonstrating significant willingness to pay premium prices for environmentally responsible packaging formats that reduce plastic consumption by 2030. Third, increasing urbanization and changing consumption patterns enable more convenient packaged beverage distribution that improves product accessibility while supporting modern retail formats and e-commerce fulfillment operations.

Market restraints include limited recycling infrastructure and consumer confusion regarding proper carton disposal methods that can challenge circularity achievement and environmental benefit realization, particularly in regions where specialized recycling facilities remain unavailable and mixed-material carton construction requires advanced separation technologies. Higher initial capital investment requirements for aseptic filling equipment pose another significant obstacle, as beverage manufacturers must evaluate substantial machinery costs and technical complexity against long-term operational benefits, potentially limiting adoption among smaller producers and regional brands. Competition from alternative sustainable packaging formats including aluminum cans, glass bottles, and emerging bio-plastic solutions creates additional market pressure, demanding continuous innovation in carton performance and cost competitiveness.

Key trends indicate accelerated plant-based beverage adoption in developed markets, particularly North America and Europe, where consumers demonstrate strong preference for oat milk, almond milk, and functional beverage alternatives packaged in sustainable carton formats with premium design aesthetics. Digital printing technology integration trends toward customized packaging graphics and limited-edition designs enable enhanced brand engagement that optimizes consumer connection and supports targeted marketing campaigns. However, the market thesis could face disruption if significant breakthroughs in fully compostable packaging materials or major shifts in beverage consumption patterns toward concentrated formats reduce reliance on traditional liquid carton packaging solutions.

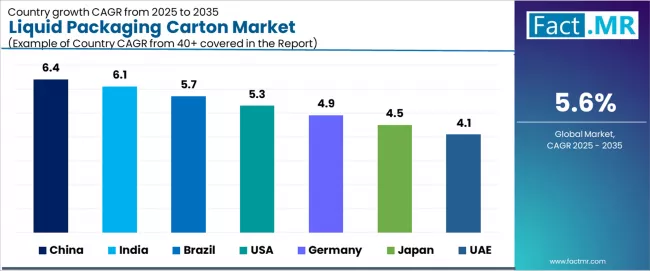

Analysis of the Liquid Packaging Carton Market by Key Countries

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.4% |

| India | 6.1% |

| Brazil | 5.7% |

| USA | 5.3% |

| Germany | 4.9% |

| Japan | 4.5% |

| UAE | 4.1% |

The global liquid packaging carton market is expanding steadily, with China leading at a 6.4% CAGR through 2035, driven by strong UHT dairy demand and rapidly growing e-commerce beverage distribution channels. India follows at 6.1%, supported by ongoing transition from plastic packaging to aseptic carton solutions and expanding organized retail penetration. Brazil records 5.7%, reflecting growth in RTD juice consumption and dairy product diversification.

USA advances at 5.3%, leveraging high plant-based beverage consumption and premium carton design innovation. Germany posts 4.9%, focusing on EU sustainability regulations and circular economy initiatives, while Japan grows steadily at 4.5%, emphasizing fortified beverages for aging population demographics. UAE demonstrates 4.1% growth, anchored by import-dependent dairy markets and aseptic packaging requirements for hot climate conditions.

How is China Leading Global Market Expansion?

China demonstrates the strongest growth potential in the liquid packaging carton market with a CAGR of 6.4% through 2035. The country's leadership position stems from rapidly expanding UHT dairy consumption, growing middle-class populations seeking convenient packaged beverages, and extensive e-commerce platforms enabling direct-to-consumer beverage distribution across vast geographic regions. Growth is concentrated in major urban centers and tier-1 cities, including Shanghai, Beijing, Guangzhou, and Shenzhen, where consumers increasingly prefer ambient-stable dairy products and premium juice offerings packaged in modern carton formats.

Distribution channels through online retail platforms, modern hypermarkets, and convenience store networks expand product accessibility across urban populations and younger consumer segments. The country's growing dairy consumption supporting nutritional improvement initiatives provides strong momentum for milk carton adoption, including comprehensive penetration across income segments seeking affordable yet quality-assured beverage packaging.

Key market factors:

- Urban consumer populations concentrated in coastal regions and economic centers with rising purchasing power levels

- E-commerce expansion through platforms including Alibaba, JD.com, and specialized fresh food delivery services enabling rapid distribution

- Comprehensive cold chain infrastructure development ecosystem supporting both ambient and refrigerated carton distribution models

- Local manufacturing capabilities featuring companies offering competitive pricing and regionally adapted product formats

Why is India Emerging as a High-Growth Market?

In major urban centers including Mumbai, Delhi, Bangalore, and Hyderabad, the adoption of liquid packaging carton solutions is accelerating across dairy and juice categories, driven by increasing awareness about plastic pollution and government initiatives promoting sustainable packaging alternatives.

The market demonstrates strong growth momentum with a CAGR of 6.1% through 2035, linked to comprehensive retail modernization trends and expanding organized dairy sector adoption of aseptic processing technologies. Indian consumers are implementing modern consumption patterns favoring packaged beverages over loose milk purchases to enhance food safety while meeting growing expectations in urban lifestyle environments. The country's expanding middle class creates ongoing demand for convenient single-serve carton formats, while increasing emphasis on nutritional fortification drives adoption of flavored and functional dairy beverages in carton packaging.

Key development areas:

- Urban professional consumers leading carton adoption with emphasis on convenience and food safety assurance

- Distribution expansion through both traditional kirana stores and rapidly growing modern retail chains

- Government initiatives encouraging plastic waste reduction and supporting domestic carton manufacturing capabilities

- Growing preference for UHT milk products addressing refrigeration challenges and enabling rural market penetration

What Drives Brazil’s Market Resilience?

Brazil’s market expansion is driven by diverse beverage preferences, including tropical juice consumption in health-conscious markets and expanding dairy consumption across mainstream segments. The country demonstrates steady growth potential with a CAGR of 5.7% through 2035, supported by continuous innovation in flavor profiles from domestic juice manufacturers and growing adoption of shelf-stable dairy products.

Brazilian consumers face implementation challenges related to regional income disparities and logistics infrastructure limitations, requiring manufacturers to demonstrate clear value propositions and distribute efficiently. However, established juice consumption culture and high awareness of carton packaging benefits create stable baseline demand for liquid carton, particularly among families prioritizing natural beverage options where sustainable packaging drives primary purchasing considerations.

Market characteristics:

- Young population demographics and health-conscious consumer segments showing robust demand with substantial annual juice consumption

- Regional preferences varying between tropical fruit juice emphasis in northeastern markets and dairy focus in southern regions

- Future projections indicate continued premiumization with emphasis on organic juice offerings and functional dairy beverages

- Growing emphasis on local sourcing and domestic manufacturing supporting competitive pricing and rapid market responsiveness

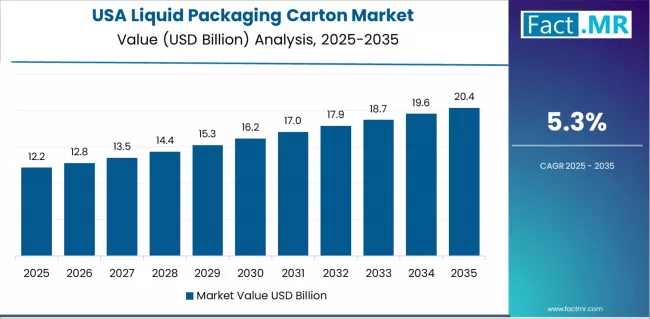

How does USA Demonstrate Innovation Leadership?

The USA’s market leads in plant-based beverage carton adoption based on strong consumer demand for dairy alternatives and premium packaging design aesthetics for enhanced brand differentiation. The country shows strong potential with a CAGR of 5.3% through 2035, driven by established sustainability consciousness and consumer preferences for environmentally responsible packaging across major markets, including California, New York, Texas, and Illinois.

American consumers are adopting liquid carton through specialized natural food retailers and mainstream grocery channels for diverse beverage categories, particularly in health-conscious populations and environmentally aware consumer segments demanding rigorous sustainability credentials. Distribution channels through Whole Foods, Target, Walmart, and direct-to-consumer subscription services expand coverage across urban centers and suburban communities.

Leading market segments:

- Plant-based milk alternatives adoption in coastal metropolitan areas implementing comprehensive sustainability purchasing criteria

- Premium juice brands with organic certifications achieving high consumer loyalty rates

- Strategic collaborations between carton manufacturers and emerging beverage brands expanding format adoption

- Focus on carbon-neutral production commitments and renewable material sourcing addressing environmental impact concerns

What Positions Germany for Regulatory Leadership?

In Munich, Hamburg, Berlin, and other major cities, consumers are implementing liquid carton solutions through established retail channels and environmental consciousness, with documented commitment to recycling participation showing substantial carton recovery rates through dual-system waste collection infrastructure. The market shows steady growth potential with a CAGR of 4.9% through 2035, linked to ongoing EU regulatory framework implementation, extended producer responsibility programs, and emerging circular economy mandates in major regions.

Consumers are adopting certified sustainable carton packaging with transparent sourcing credentials to support environmental goals while maintaining standards demanded by quality-conscious purchasing behaviors. The country's established recycling infrastructure creates ongoing opportunities for closed-loop carton material recovery that differentiates through comprehensive sustainability validation and third-party certification.

Market development factors:

- Environmentally conscious consumers leading adoption of certified sustainable carton products across Germany

- Regulatory compliance requirements providing growth opportunities in circular economy implementation

- Strategic partnerships between carton manufacturers and retail chains expanding sustainable packaging initiatives

- Emphasis on life cycle assessment data and carbon footprint transparency supporting informed consumer choices

How Does Japan Show Quality Excellence Leadership?

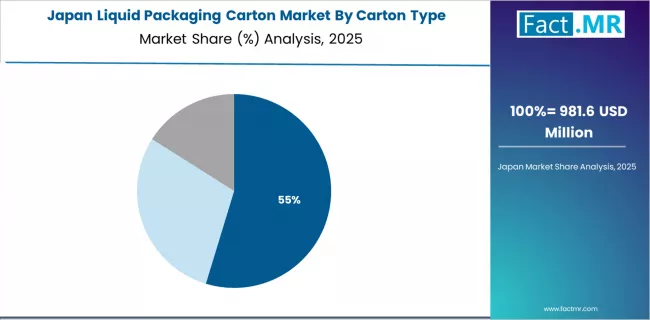

Japan's liquid packaging carton market demonstrates sophisticated consumer preferences focused on product freshness, hygiene assurance, and functional package design optimization, with documented integration of convenient opening mechanisms achieving substantial user satisfaction improvements across dairy and fortified beverage applications.

The country maintains steady growth momentum with a CAGR of 4.5% through 2035, driven by mature market dynamics emphasizing product quality and continuous package functionality improvement methodologies that align with Japanese consumer standards applied to food and beverage products.

Major metropolitan areas, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced adoption of premium carton designs where functional benefits integrate seamlessly with aesthetic presentation and comprehensive food safety assurance programs.

Key market characteristics:

- Quality-conscious aging population driving demand for fortified dairy beverages and functional drink formulations

- Quality partnerships enabling consistent package performance with comprehensive safety testing protocols

- Technology collaboration between Japanese beverage companies and international carton suppliers expanding innovation capabilities

- Emphasis on portion control and single-serve formats addressing smaller household sizes and convenience requirements

What Characterizes UAE's Market Development?

In major urban centers including Dubai, Abu Dhabi, Sharjah, and Ajman, the adoption of liquid packaging carton solutions is expanding across imported dairy products and ambient juice categories, driven by hot climate requirements for shelf-stable packaging and limited domestic dairy production capabilities. The market demonstrates solid growth potential with a CAGR of 4.1% through 2035, linked to comprehensive retail sector development and increasing expatriate populations demanding diverse international beverage brands.

Consumers are implementing modern consumption patterns purchasing imported UHT milk and premium juice products to access variety while meeting growing expectations in multicultural urban environments. The country's dependence on imported dairy creates ongoing demand for long shelf-life carton formats, while increasing emphasis on food safety standards drives adoption of aseptically packaged liquid products.

Key development areas:

- Expatriate consumer populations leading carton adoption with emphasis on familiar international brands

- Distribution expansion through modern hypermarkets and convenience store chains providing comprehensive product availability

- Import logistics optimization supporting ambient-stable carton products reducing cold chain requirements

- Integration of halal certification requirements and comprehensive food safety documentation supporting consumer confidence

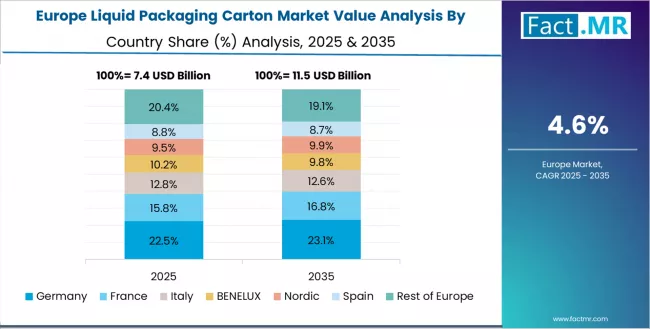

Europe Market Split by Country

The liquid packaging carton market in Europe is projected to grow from USD 7.1 billion in 2025 to USD 12.9 billion by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 29.5% market share in 2025, adjusting to 28.8% by 2035, supported by its extensive sustainability regulations, comprehensive recycling infrastructure, and strict quality standards serving major European markets.

France follows with a 20.5% share in 2025, projected to reach 21.0% by 2035, driven by comprehensive organic dairy production and premium juice manufacturing concentrating in Normandy and Brittany regions implementing sustainable packaging protocols. The United Kingdom holds a 18.0% share in 2025, expected to maintain 18.2% by 2035 through ongoing dairy industry consolidation and plant-based beverage growth.

Italy commands a 16.0% share, while Spain accounts for 12.5% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.5% to 3.5% by 2035, attributed to increasing carton adoption in Nordic countries and emerging Eastern European markets implementing EU packaging directives.

How Does Quality Define Liquid Packaging Carton Adoption in Japan?

The Japanese liquid packaging carton market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of functional design features with hygiene assurance technologies across dairy, fortified beverage applications, and convenience-oriented distribution channels. Japan's emphasis on package performance excellence and comprehensive safety testing drives demand for premium carton solutions that support health-focused consumption initiatives and aging population nutritional requirements in daily beverage consumption routines.

The market benefits from strong partnerships between international carton manufacturers and domestic beverage brands, including established dairy cooperatives and functional drink producers, creating comprehensive supply ecosystems that prioritize consistent quality and consumer education programs. Metropolitan consumer segments showcase advanced carton implementations where resealable closures achieve performance improvements through integrated consumer convenience approaches and comprehensive freshness maintenance programs.

What Drives Premium Positioning in South Korea's Market?

The South Korean liquid packaging carton market is characterized by strong premium product presence, with companies like local dairy manufacturers and international players including specialized beverage brands maintaining significant positions through comprehensive product portfolios and K-beauty-integrated functional drink formulations for health and wellness applications.

The market is demonstrating a growing emphasis on beauty-from-within beverages and specialized functional benefits, as Korean consumers increasingly demand premium carton-packaged products that combine nutritional fortification with aesthetic packaging designs and convenient single-serve formats deployed across urban populations and health-conscious consumer segments.

Local brand innovations and specialty product launches are gaining market share through strategic emphasis on fermented beverages, offering specialized formulations including collagen-enhanced dairy drinks and probiotic-enriched juice solutions for comprehensive wellness support. The competitive landscape shows increasing collaboration between carton manufacturers and café chains, creating hybrid distribution models that combine premium positioning with consumer trend insights and social media influencer marketing capabilities.

Competitive Landscape of the Liquid Packaging Carton Market

The liquid packaging carton market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 30-40% of global market share through established manufacturing infrastructure, comprehensive equipment-packaging system integration, and extensive customer relationships across dairy and beverage industries. Competition centers on technological innovation, sustainability credentials, and total cost of ownership rather than packaging material pricing alone.

Market leaders include Tetra Pak maintaining a 17.0% market share, SIG, and Elopak, which maintain competitive advantages through comprehensive aseptic processing equipment portfolios, global technical service networks, and deep expertise in beverage filling technologies, creating high switching costs among dairy and juice manufacturers utilizing integrated packaging systems.

These companies leverage continuous innovation in barrier materials and strategic sustainability initiatives to defend market positions while expanding into adjacent categories including plant-based beverages and functional drink applications.

Challengers encompass established paper and packaging companies including Mondi, Nippon Paper Industries, and WestRock Company, which compete through vertical integration capabilities and comprehensive packaging portfolio offerings.

Asian manufacturers, including Greatview Aseptic Packaging, UFlex Ltd., and IPI S.r.l., focus on cost-competitive solutions and regional market penetration, offering differentiated capabilities in emerging markets, flexible production arrangements, and responsive customer service approaches.

Emerging specialized players and regional manufacturers create competitive pressure through innovative material technologies and niche application focus, particularly in high-growth markets including China and India, where domestic production capabilities provide advantages in pricing flexibility and rapid market responsiveness.

Market dynamics favor companies that combine technical expertise with sustainability leadership and comprehensive customer support that addresses the complete value chain from filling equipment supply through end-of-life recycling infrastructure development.

Strategic emphasis on renewable material sourcing, carbon-neutral manufacturing facilities, and circular economy partnerships enables differentiation in increasingly sustainability-focused beverage and dairy industries across developed and emerging markets.

Global Liquid Packaging Carton Market - Stakeholder Contribution Framework

Liquid packaging carton represent a critical sustainable packaging solution that enables beverage and liquid food manufacturers to deliver products with extended shelf life while reducing environmental impact compared to conventional plastic and glass alternatives, typically providing superior recyclability, renewable material content, and transportation efficiency compared to traditional formats alone while ensuring product safety and comprehensive distribution capabilities.

With the market projected to grow from USD 29.7 billion in 2025 to USD 51.0 billion by 2035 at a 5.6% CAGR, these solutions offer compelling advantages for dairy applications, aseptic processing integration, and diverse beverage categories seeking environmentally responsible packaging formats. Scaling market penetration and circular economy achievement requires coordinated action across environmental policy, recycling infrastructure development, carton manufacturers, beverage producers, and consumer education initiatives.

How Could Governments Spur Local Development and Adoption?

- Plastic Waste Reduction Programs: Include carton packaging in national circular economy strategies, providing targeted support for recycling infrastructure development in municipal waste systems and supporting material recovery facilities through capital investment grants and operational subsidies.

- Tax Policy & Investment Support: Implement reduced tax rates for recyclable packaging materials, provide tax incentives for companies investing in aseptic filling equipment and sustainable manufacturing practices, and establish favorable import duty structures that encourage renewable paperboard procurement over virgin plastic alternatives.

- Regulatory Framework Development: Create streamlined approval processes for food-contact packaging materials across beverage applications, establish clear recyclability labeling standards and consumer education requirements for proper disposal, and develop international harmonization protocols that facilitate cross-border material specifications.

- Recycling Infrastructure Investment: Fund development of specialized carton recycling facilities, invest in municipal collection system upgrades that support multi-material packaging recovery, and explore extended producer responsibility frameworks for packaging waste management cost allocation.

- Research & Innovation Support: Establish public-private partnerships for packaging sustainability research, support academic-industry collaborations investigating renewable barrier materials and biodegradable coating technologies, and create regulatory environments that encourage innovation in circular packaging solutions.

How Could Industry Bodies Support Market Development?

- Sustainability Standards & Best Practices: Define standardized life cycle assessment methodologies for packaging environmental impact evaluation across production, distribution, and end-of-life stages, establish universal recyclability criteria and material composition transparency protocols, and create sustainability databases that consumers and brands can rely on for informed decision-making.

- Market Education & Consumer Awareness: Lead messaging that demonstrates liquid carton environmental benefits, emphasizing renewable material content, carbon footprint advantages, and proper recycling procedures compared to plastic alternatives through coordinated public awareness campaigns.

- Quality Assurance Standards: Develop guidelines for material sourcing, manufacturing excellence, food safety compliance, and barrier performance specifications, ensuring consumer protection across production and filling operations.

- Professional Development: Run certification programs for filling equipment operators, quality control personnel, and packaging engineers on optimizing carton performance, troubleshooting filling line challenges, and implementing sustainability best practices across diverse manufacturing environments.

How Could Manufacturers and Technology Players Strengthen the Ecosystem?

- Advanced Product Development: Develop next-generation liquid packaging carton with enhanced barrier properties, optimized material structures, and application-specific characteristics that improve product protection while reducing material usage and environmental footprint through lightweighting initiatives.

- Sustainability Innovation Programs: Provide comprehensive renewable material sourcing, carbon-neutral manufacturing commitments, and end-of-life recycling partnerships that support circular economy objectives and transparent environmental impact reporting.

- Customer Technical Support: Offer comprehensive filling equipment integration, process optimization consultation, and troubleshooting assistance that helps beverage manufacturers maximize production efficiency and minimize operational challenges.

- Research & Development Networks: Build comprehensive R&D capabilities, collaborative material science programs, and barrier technology testing systems that ensure liquid carton maintain superior performance standards and continuous innovation across diverse product applications.

How Could Beverage Producers and Brand Owners Navigate the Market?

- Sustainable Packaging Adoption: Incorporate carton packaging into comprehensive brand sustainability strategies, with particular focus on plastic reduction commitments, carbon footprint transparency, and consumer engagement around environmental benefits.

- Consumer Education Excellence: Establish comprehensive packaging information programs addressing environmental benefits, proper disposal instructions, and brand sustainability stories through optimized on-pack communication and digital content.

- Supply Chain Integration: Implement collaborative partnerships with carton suppliers and filling equipment manufacturers that ensure reliable material supply, technical support access, and continuous improvement opportunities throughout production operations.

- Innovation Collaboration: Develop joint development programs with carton manufacturers exploring new product formats, enhanced functionality features, and premium design aesthetics that differentiate brands and enhance consumer appeal.

How Could Investors and Financial Enablers Unlock Value?

- Manufacturing Capacity Financing: Provide growth capital for established companies like Tetra Pak, SIG, and regional manufacturers to expand aseptic filling equipment production and carton converting capabilities supporting market demand growth.

- Innovation Investment: Back startups developing advanced barrier coatings, renewable material alternatives, and smart packaging technologies that enhance carton performance and sustainability credentials.

- Market Expansion Funding: Finance distribution expansion strategies for carton manufacturers establishing operations in high-growth regions including India and China, supporting localization initiatives that address regional preferences while maintaining quality standards.

- Recycling Infrastructure Development: Support companies developing specialized carton recycling technologies, material recovery facilities, and closed-loop fiber recovery systems that enhance circular economy capabilities through technology-enabled solutions.

Key Players in the Liquid Packaging Carton Market

- Tetra Pak

- SIG

- Elopak

- Mondi

- Nippon Paper Industries

- UFlex Ltd.

- IPI S.r.l.

- Greatview Aseptic Packaging

- WestRock Company

- Heli Packaging Technology

- Parksons Packaging Ltd.

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units | USD 29.7 Billion |

| Carton Type | Brick Liquid Carton, Shaped Liquid Carton, Gable Top Carton |

| Shelf Life | Long Shelf-Life Carton, Short Shelf-Life Carton |

| End-Use | Liquid Dairy Products, Non-Carbonated Soft Drinks, Liquid Foods, Alcoholic Drinks |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Brazil, USA, Germany, Japan, UAE, and 40+ countries |

| Key Companies Profiled | Tetra Pak, SIG, Elopak, Mondi, Nippon Paper Industries, UFlex Ltd., IPI S.r.l., Greatview Aseptic Packaging, WestRock Company, Heli Packaging Technology, Parksons Packaging Ltd. |

| Additional Attributes | Dollar sales by carton type and shelf life categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with carton manufacturers and aseptic processing equipment suppliers, product specifications and barrier material requirements, integration with filling equipment technologies and sustainable manufacturing practices, innovations in renewable material sourcing and recycling infrastructure development, and development of specialized applications with food safety compliance and circular economy capabilities. |

Liquid Packaging Carton Market by Segments

-

Carton Type :

- Brick Liquid Carton

- Shaped Liquid Carton

- Gable Top Carton

-

Shelf Life :

- Long Shelf-Life Carton

- Short Shelf-Life Carton

-

End-Use :

- Liquid Dairy Products

- Non-Carbonated Soft Drinks

- Liquid Foods

- Alcoholic Drinks

-

Region :

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia Pacific

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Rest of Europe

- North America

- USA

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Rest of Middle East & Africa

- Asia Pacific

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Carton Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Carton Type, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Carton Type, 2025 to 2035

- Brick Liquid Carton

- Shaped Liquid Carton

- Gable Top Carton

- Y to o to Y Growth Trend Analysis By Carton Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Carton Type, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Shelf Life

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Shelf Life, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Shelf Life, 2025 to 2035

- Long Shelf-Life Carton

- Short Shelf-Life Carton

- Y to o to Y Growth Trend Analysis By Shelf Life, 2020 to 2024

- Absolute $ Opportunity Analysis By Shelf Life, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-Use

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End-Use, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End-Use, 2025 to 2035

- Liquid Dairy Products

- Non-Carbonated Soft Drinks

- Liquid Foods

- Alcoholic Drinks

- Y to o to Y Growth Trend Analysis By End-Use, 2020 to 2024

- Absolute $ Opportunity Analysis By End-Use, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Carton Type

- By Shelf Life

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Carton Type

- By Shelf Life

- By End-Use

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Carton Type

- By Shelf Life

- By End-Use

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Carton Type

- By Shelf Life

- By End-Use

- Competition Analysis

- Competition Deep Dive

- Tetra Pak

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- SIG

- Elopak

- Mondi

- Nippon Paper Industries

- UFlex Ltd.

- IPI S.r.l.

- Greatview Aseptic Packaging

- WestRock Company

- Heli Packaging Technology

- Parksons Packaging Ltd.

- Tetra Pak

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by End-Use, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Carton Type, 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Shelf Life, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by End-Use, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020 to 2035

- Figure 3: Global Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 5: Global Market Attractiveness Analysis by Carton Type

- Figure 6: Global Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 8: Global Market Attractiveness Analysis by Shelf Life

- Figure 9: Global Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 11: Global Market Attractiveness Analysis by End-Use

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025 to 2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 25: North America Market Attractiveness Analysis by Carton Type

- Figure 26: North America Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 28: North America Market Attractiveness Analysis by Shelf Life

- Figure 29: North America Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 31: North America Market Attractiveness Analysis by End-Use

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 35: Latin America Market Attractiveness Analysis by Carton Type

- Figure 36: Latin America Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 38: Latin America Market Attractiveness Analysis by Shelf Life

- Figure 39: Latin America Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 41: Latin America Market Attractiveness Analysis by End-Use

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 45: Western Europe Market Attractiveness Analysis by Carton Type

- Figure 46: Western Europe Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 48: Western Europe Market Attractiveness Analysis by Shelf Life

- Figure 49: Western Europe Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 51: Western Europe Market Attractiveness Analysis by End-Use

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Carton Type

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Shelf Life

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End-Use

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 65: East Asia Market Attractiveness Analysis by Carton Type

- Figure 66: East Asia Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 68: East Asia Market Attractiveness Analysis by Shelf Life

- Figure 69: East Asia Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 71: East Asia Market Attractiveness Analysis by End-Use

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Carton Type

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Shelf Life

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by End-Use

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Carton Type, 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Carton Type, 2025 to 2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Carton Type

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Shelf Life, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Shelf Life, 2025 to 2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Shelf Life

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by End-Use, 2025 to 2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by End-Use

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the liquid packaging carton market in 2025?

The global liquid packaging carton market is estimated to be valued at USD 29.7 billion in 2025.

What will be the size of liquid packaging carton market in 2035?

The market size for the liquid packaging carton market is projected to reach USD 51.0 billion by 2035.

How much will be the liquid packaging carton market growth between 2025 and 2035?

The liquid packaging carton market is expected to grow at a 5.6% CAGR between 2025 and 2035.

What are the key product types in the liquid packaging carton market?

The key product types in liquid packaging carton market are brick liquid carton, shaped liquid carton and gable top carton.

Which shelf life segment to contribute significant share in the liquid packaging carton market in 2025?

In terms of shelf life, long shelf-life carton segment to command 68.0% share in the liquid packaging carton market in 2025.