Hydroxypropyl Cellulose Market

Hydroxypropyl Cellulose Market Analysis, By Application, By Type, and By Region - Market Insights 2025 to 2035

Analysis of the Hydroxypropyl Cellulose Market Covering 30+ Countries Including Analysis of the US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea, and many more

Hydroxypropyl Cellulose Market Outlook (2025 to 2035)

The hydroxypropyl cellulose market will be valued at USD 204.5 million by 2025 end, as per Fact.MR analysis, hydroxypropyl cellulose will grow at a CAGR of 5.6% and reach USD 349.8 million by 2035.

During 2024, the worldwide industry recorded moderate but steady growth, owing to stable demand in food-grade coatings, ophthalmic solutions, and pharmaceutical excipients. A strong increase was from oral drug delivery, where HPC is used for its film-forming as well as mucoadhesive characteristics.

Various generic drug makers, especially from India and Southeast Asia, upped HPC procurement to cope with increasing demand for affordable therapeutics. Also, interest has been resumed in dietary supplements and nutraceuticals, where HPC finds applications in controlled-release products.

On the supply side, there were regional changes. Suppliers based in China, such as Zhicheng Cellulose Co. Ltd., increased production to counter interruptions in European production because of energy price instability. Although price pressure was still a concern, particularly because of logistics costs and raw material volatility, manufacturers were observed entering long-term procurement agreements to counter supply chain uncertainty.

Looking to 2025 and beyond, the industry will be driven by tightening regulatory pressures across pharmaceutical excipients and movement toward multifunctional ingredients across personal care and biomedical applications.

New R&D is centered around enhancing viscosity modulation and bioadhesive functionality and creating new applications in biomedical implants, ocular inserts, and cosmeceuticals. With steady CAGR, the industry is set for robust long-term growth powered by R&D and end-user diversification.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 205.4 million |

| Industry Value (2035F) | USD 349.8 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey on Hydroxypropyl Cellulose Industry

Fact.MR Survey Findings: Trends According to Stakeholder Opinion

(Surveyed Q1 2025, n=520 stakeholder respondents evenly divided between pharmaceutical formulators, chemical producers, regulatory specialists, and raw material producers in the USA, Western Europe, Japan, and South Korea)

Stakeholders' Top Priorities

- Regulatory Compliance & Alignment with Pharmacopoeia: 84% of stakeholders worldwide named compliance with international pharmacopoeias (USP, EP, JP) as a "critical" priority.

- Functionality & Grade Purity: 73% underlined the critical role of high-performance functional grades (low-substitution, low-viscosity HPC) in innovative drug delivery systems.

Regional Variance:

- USA: 71% underlined scalability of HPC in solid oral dosages for generics with high volume.

- Western Europe: 88% highlighted clean-label and bio-based certification (e.g., EcoCert) as major drivers for decision.

- Japan/South Korea: 64% emphasized precision in control of viscosity in ophthalmic and cosmetic formulations.

Adoption of Advanced Applications and Technology Integration

High Variance:

- USA: 59% of formulators used HPC in sustained-release products and rapid-dissolving films.

- Western Europe: 51% researched HPC in food & beverage hybrid hydrocolloid systems.

- Japan: 29% embraced HPC for non-pharmaceutical use as a result of purity needs and conservatism in the industry.

- South Korea: 41% applied HPC to cosmeceuticals (anti-aging serums, eye gels) as a result of K-beauty trends.

ROI Outlook

- 68% of USA-based producers identified innovation-driven uses to provide "high ROI"; by contrast, 36% in Japan were conservative, confining HPC applications to pharma essentials.

Material and Functional Preferences

Global Consensus:

- 66% favored low-viscosity grades for improved solubility and processing ease in wet granulation and ophthalmics.

Regional Variations:

- Western Europe: 53% chose non-animal-derived, biofermentation-based HPC, motivated by vegan, halal, and kosher positioning.

- Japan/South Korea: 47% requested ultra-fine particle grades for higher cosmetic smoothness.

- USA: 75% opted for normal pharmaceutical grades, particularly for high-volume solid dose manufacturing.

Price Sensitivity and Supply Chain Dynamics

Shared Challenges:

- 89% reported price volatility for propylene oxide (a critical raw material) and cellulose ethers as a first priority.

Regional Insights:

- USA/Western Europe: 63% willing to pay a 10-15% premium for assured GMP-compliant and traceable HPC supply.

- Japan/South Korea: 74% wanted sub-USD 40/kg models for non-pharma applications; only 11% tolerated higher-grade premiums.

- South Korea: 42% of SMEs preferred contract manufacturing or leasing HPC processing capacity, compared to 16% in the USA.

Value Chain Pain Points

Manufacturers:

- USA: 56% indicated quality consistency and traceability problems from raw material imports.

- Western Europe: 49% complained of documentation overload to achieve dual pharma/food compliance requirements.

- Japan: 58% indicated limited local production capacity, raising the dependence on imports.

Distributors:

- USA: 69% experienced shipment delays from Asia and irregular lead times.

- Western Europe: 51% experienced downward price pressure from Eastern Europe and Turkey.

- Japan/South Korea: 62% experienced fragmented customer bases and high unit delivery cost.

End-Users (Pharma/Food/Cosmetics):

- USA: 46% experienced "batch variability" challenges.

- Western Europe: 38% identified inflexible regulatory audits as implementation hurdles.

- Japan: 55% mentioned insufficient tech support upon utilization of HPC in new formulations.

Future Investment Priorities

Global Consensus

- 72% of HPC manufacturers target investment in application-specific R&D (e.g., ophthalmics, nutraceuticals).

Divergence:

- USA: 64% investing in HPC-blend compatibility for combination drug delivery platforms.

- Western Europe: 59% focused on green synthesis routes and life-cycle carbon minimization.

- Japan/South Korea: 48% concentrated on miniaturized format development for eye care and high-end skin care.

Regulatory Impact

- USA: 67% of respondents named changing FDA excipient regulations and USP-NF revisions as a "moderate to high" disruption, particularly for reformulated generics.

- Western Europe: 79% felt future EMA tightening on excipient traceability will drive premium HPC demand sooner.

- Japan/South Korea: Only 34% perceived regulatory influence as important, pointing to fewer enforcement actions and steady monograph alignment.

Conclusion: Consensus vs. Regional Nuance

- High Consensus: There is consensus among stakeholders in regions that there should be regulatory convergence, functionality consistency, and price stability.

Key Variances:

- The USA market is driven by oral pharmaceutical applications, supported by economies of scale and automation.

- Western Europe: Regulatory-mandated move towards sustainable, clean-label HPC.

- Japan/South Korea: Niche application in cosmetics and ophthalmology on the back of precision with stricter cost scrutiny.

Strategic Insight:

Success is dependent on synchronizing HPC grade and application-specific innovation with regional regulatory models and cost tolerances.

Government Regulations on Hydroxypropyl Cellulose Industry

| Country | Policy & Regulatory Impact |

|---|---|

| USA | The USA FDA regulates HPC under 21 CFR § 182.1745, approving it as a Generally Recognized as Safe (GRAS) substance for food use and excipient use in pharmaceuticals. Any HPC used in drug formulations must meet USP-NF monograph standards. Recent FDA initiatives to modernize excipient review (under IPEC-FDA collaboration) are pushing companies to enhance traceability and adopt DMF (Drug Master File) submissions. (Source: FDA) |

| Western Europe | HPC must comply with the European Pharmacopoeia (Ph. Eur.), and food-grade use requires E464 approval as per Regulation (EC) No 1333/2008. HPC is subject to REACH registration (for quantities >1 tonne/year), and recent emphasis on excipient transparency under the EU Animal Welfare Strategy and Falsified Medicines Directive is encouraging suppliers to obtain EXCiPACT or GMP certifications. (Source: Europa) |

| Germany | Stricter enforcement of REACH regulations and additional local documentation requirements for excipient traceability are adding complexity. HPC used in combination drug devices (e.g., inhalers, ocular inserts) must also adhere to MDR (Medical Device Regulation) standards. (Source: Europa) |

| France | Under ANSM (French National Agency for Medicines) oversight, pharmaceutical-grade HPC must pass audits for GMP compliance and EU pharmacopoeia standards. There’s growing regulatory pressure on biodegradability and sustainability in cosmetic applications. |

| Italy | The AIFA (Italian Medicines Agency) mandates formal listing and GMP validation for all excipients used in drug formulations. HPC suppliers are required to maintain complete technical data dossiers for pharma customers. HPC used in cosmetics must comply with Regulation (EC) No 1223/2009. |

| Japan | HPC is listed under the Japanese Pharmaceutical Excipients (JPE) and governed by PMDA guidelines. All imported excipients need Japanese DMF (J-DMF) registration. There is increasing scrutiny on HPC used in eye drops and oral dissolvables, with nanomaterial classification emerging as a potential regulatory hurdle for ultrafine particle grades. |

| South Korea | Regulated by MFDS (Ministry of Food and Drug Safety), HPC must comply with the Korean Pharmacopoeia and Functional Cosmetic Ingredient Notification System if used in skincare. Companies often undergo KGMP (Korean Good Manufacturing Practice) audits. Importers must submit stability and safety data for HPC grades used in ingestibles or topicals. |

| China | Although not requested, it is included for completeness. HPC must comply with Chinese Pharmacopoeia for pharmaceutical use and GB standards for food/cosmetics. All excipient imports need CFDA filing and may require product registration certificates. Suppliers are encouraged to align with China GMP standards for broader access. |

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Market Analysis

The industry will continue to expand steadily up to 2035, owing to growing demand for multifunctional pharmaceutical excipients and clean-label food and cosmetic ingredients. Regulatory clearances across established industries and growing take-up in sophisticated drug delivery systems are generating robust tailwinds for compliant manufacturers. GMP-certified, pharma-grade HPC capacity owners will be the winners, while traceability and regional compliance-scarce players will risk losing share.

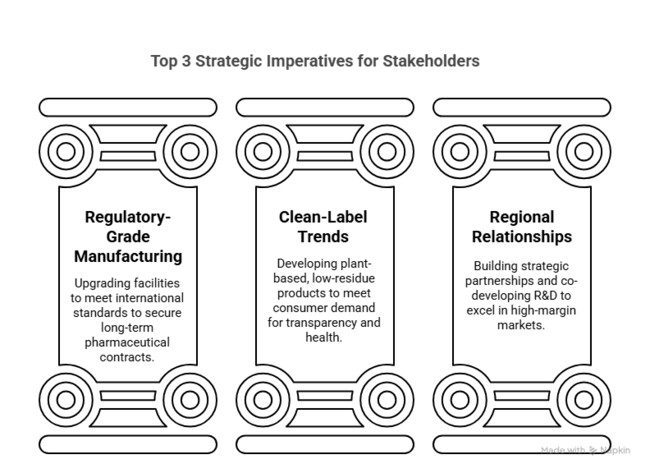

Top 3 Strategic Imperatives for Stakeholders

Invest in Regulatory-Grade Manufacturing

Set up or upgrade manufacturing facilities to the international GMP, USP/Ph. Eur., and EXCiPACT levels to attract long-term agreements with pharmaceutical and nutraceutical businesses, particularly in strongly regulated areas such as the USA, EU, and Japan.

Follow Clean-Label and Multifunctionality Trends

Create and sell clean-label, plant-based, and low-residue HPC products that address increasing demand in oral care, functional foods, and topical applications, positioning your range around excipient flexibility and biocompatibility.

Grow Through Regional Relationships and R&D Co-Development

Develop strategic partnerships with CDMOs, cosmetic OEMs, and regional distributors while co-investing in R&D on high-viscosity and controlled-release HPC to distinguish in high-margin industries such as ophthalmic and transmucosal drug delivery.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

| Increasing Regulatory Scrutiny on Excipient Traceability: Regulatory bodies such as the US FDA, EMA, and Japan’s PMDA are increasingly enforcing full traceability and quality disclosure for excipients used in drug formulations. | High |

| Volatility in Cellulose Ether Raw Material Supply: The industry is heavily reliant on wood pulp derivatives, which are subject to price fluctuations, supply shocks, and logistical disruptions due to environmental policies, natural disasters, or geopolitical issues. | Medium |

| Price Competition from Low-Cost Asian Suppliers with Limited Compliance: Manufacturers in regions with less stringent regulatory oversight (e.g., parts of Southeast Asia) may offer HPC at significantly lower prices, undercutting established players. | High |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Regulatory Readiness for Pharma-Grade HPC | Run internal audit on GMP/DMF readiness and initiate third-party validation for EXCiPACT certification. |

| Portfolio Adaptation to Clean-Label Trends | Initiate OEM feedback loop with nutraceutical and personal care formulators on demand for low-residue, plant-based HPC variants |

| Access in Growth Regions | Launch distributor partnership program and pricing pilot in Southeast Asia and Latin America to capture volume-led growth. |

For the Boardroom

In order to remain at the forefront of the changing Hydroxypropyl Cellulose (HPC) industry, management must make a priority of investment in regulatory-level manufacturing capacity and expedite compliance upgrades for use in pharmaceuticals and nutraceuticals. This insight highlights a fundamental shift: Demand is no longer about volume but about traceability, multifunctionality, and regulatory compliance.

The board needs to approve expansion into controlled-release and clean-label excipient forms, embark on co-development with cosmetic and pharma OEMs, and rebalance regional strategies to encompass low-regulation, high-growth industries. A differentiated strategy that integrates compliance-driven innovation, portfolio hybridization, and regional activation will be the key to harvesting margin-rich growth up to 2035.

Segment-wise Analysis

By Application

The oil field chemical segment is expected to register a 28.0% share in 2025. Oil well chemicals remain at the forefront of the industry because of their widespread use in well stimulation, drilling fluids, hydraulic fracturing, and cementing operations. With the strong demand for global crude oil and the increased use of unconventional drilling methods, HPC increasingly finds application as a rheology modifier, fluid loss additive, and stabilizer.

Its safer environmental profile than synthetic thickeners also increases its uptake. The transition towards environmentally friendly formulation in petroleum activities will tend to drive long-term demand, particularly in mature basins such as the USA, the Middle East, and sections of Asia. The performance of the segment will be driven by both energy industry trends and reformist pressures induced by sustainability.

By Type

The L-hydroxypropyl cellulose segment is expected to register a 63.0% share in 2025. L-HPC leads the industry as a result of its broad usage in pharma, food, and oilfield operations. It is particularly well-suited for medicinal and oral drug products owing to its safety, anti-caking, and solubility characteristics.

L-HPC’s moisture management and compatibility with other excipients make it ideal for its suitability for use by innovator drug and generic drug makers alike. Advances in 3D-printed tablets and printable disintegrants will continue to enhance its applicability. This part will continue to be the anchor of industry demand because of its wide application and regulatory approval.

Country-wise Analysis

| Countries | CAGR |

|---|---|

| USA | 3.5% |

| UK | 4.6% |

| France | 4.2% |

| Germany | 4.4% |

| Italy | 4.0% |

| South Korea | 3.6% |

| Japan | 4.7% |

| China | 8.9% |

USA

The industry in the USA is expected to grow at a CAGR of around 3.5% between 2025 and 2035. This consistent growth is mainly led by the strong pharmaceutical sector, wherein HPC is widely applied as a binder and disintegrant in tablet formulation.

Also, the construction industry's demand for HPC as a thickening agent in cement and mortar is driving the growth. The presence of key HPC players and continued research in new applications also support the industry. Additionally, regulatory hurdles and compliance requirements for strict FDA guidelines can prove to be a limiting factor.

UK

The industry in the UK is also expected to register a CAGR of approximately 4.6% during 2025 to 2035. The growth is driven by the growing pharmaceutical industry and rising usage of HPC in personal care products. Due to the focus on sustainable and green products, the UK favors biodegradable polymers such as HPC.

Moreover, the acceptance of HPC by the food industry as an emulsifier and stabilizer is driving growth. Strategic partnerships between industries and research institutes are driving innovation, resulting in new uses and product innovations. Nevertheless, industry players have to navigate regulations by organizations like the European Medicines Agency (EMA) for compliance and access to the industry.

France

France's sales will grow at a CAGR of about 4.2% between 2025 and 2035. France's well-developed pharmaceutical and cosmetic industries are the main drivers of growth. French cosmetics brands are now using HPC in their formulations because of its film-forming and thickening capabilities.

The food industry also uses HPC as a food additive. Government programs stimulating R&D in biopolymers are stimulating innovation in the industry. Firms, however, have to comply with strict EU legislation on product safety and environmental effects, which can shape production processes and cost structures.

Germany

Germany's sales are predicted to develop at a CAGR of approximately 4.4% between 2025 and 2035. Being Europe's largest economy, Germany's sound pharma and construction industries heavily contribute to HPC demand. The emphasis of the country on high-quality production and technological advancement helps the advancement of sophisticated HPC applications.

Moreover, the increasing trend towards green building materials resulted in the enhanced application of HPC in the building sector. German regulatory authorities ensure strict standards, which make compliance a must for HPC manufacturers. In spite of this difficulty, the industry trend is positive due to ongoing industrial developments and a focus on quality.

Italy

Italy's sales are expected to register a CAGR of approximately 4.0% during the period between 2025 and 2035. The nation's acclaimed pharmaceutical and food sectors are primary users of HPC. Within the food industry, HPC is used as an additive for texture and stability enhancement.

The industry in Italy has a strong research and development tradition, especially in biopolymers, creating opportunities for HPC innovation in applications. Yet, economic shifts and compliance with national and EU regulations could affect dynamics. Moreover, the overall trend suggests moderate growth with the support of varied industrial usage and continuous R&D activities.

South Korea

The HPC industry in South Korea is likely to observe a CAGR of around 3.6% during 2025 to 2035. This growth would be driven by the growing pharmaceutical industry and enhanced demand for HPC in personal care products. The sophisticated technology environment in South Korea and focus on innovation have resulted in the creation of new HPC applications.

Moreover, the food industry's use of HPC as an emulsifier and stabilizer assists in growth. Furthermore, the industry experiences raw material price fluctuations and rivalry from substitute products. In spite of this, South Korea's focus on technological development and quality control is anticipated to continue fueling growth.

Japan

The industry in Japan is estimated to expand at a CAGR of roughly 4.7% over the 2025 to 2035 timeframe. The pharmaceutical industry of the country, well established as it is, is a key driver, and HPC is an essential ingredient in many drug formulations. The cosmetics industry in Japan, highly regarded for innovation and quality, is also making increasing use of HPC due to its functional benefits.

Demand comes from the food industry too, using HPC as a food additive. Japan's high standards of quality and emphasis on research and development provide a favorable atmosphere for growth. Nevertheless, firms have to deal with intricately complex regulatory environments and problems of high-cost production.

China

The industry in China is expected to register strong growth at a projected CAGR of nearly 8.9% over the period between 2025 and 2035. Its fast growth comes on the back of China's thriving construction segment, where HPC finds applications as a thickener and a binder.

Further, China's expanding pharmaceutical and personal care industries also significantly push demand. Government incentives for local production and R&D further support growth and technological developments further support the industry.

Market Share Analysis

Ashland Global Holdings Inc.: (18-20%)

Ashland is globally recognized as the leader in cellulose derivatives, including HPC. Its leadership position in North America and Western Europe, coupled with strong connections in the pharmaceutical, personal care, and food sectors, helps it command a leadership share.

Ashland's diversified product base, regular R&D investments, and strong geographically diverse regulatory compliance provide it with a significant advantage. It is also one of the first to launch pharma-grade innovations, further consolidating its premium positioning.

Shin-Etsu Chemical Co., Ltd.: (14-16%)

Shin-Etsu enjoys a strong share of the global industry, especially in Asia and portions of North America. The high-performance cellulose derivatives and technology focus of the company have allowed it to capture key pharmaceutical and industrial applications. Its vertical integration, strong supply chain, and product consistency result in it being a vendor of choice for long-term contracts, particularly in Japan, Korea, and China.

Nippon Soda Co., Ltd.: (10-12%)

With a strong foundation in Japan and expanding exports to Europe and the USA, Nippon Soda remains a mid-to-upper-rank player. The pharma-grade HPC specialization of the company, coupled with its L-HPC product line, places it in favorable positions in regulated sectors. Its focused but moderate innovation approach and quality image have established it as a consistent player in specialty niches.

Shandong Head Europe BV: (8-10%)

A subsidiary of the larger Shandong Head Group, the firm has quickly gained ground in Europe and developing Asian landscape. It's one of the top low-cost, high-volume manufacturers, with the advantage of vertical integration and scale in China. Although it competes more aggressively on price and bulk availability, Shandong Head has also made progress in attaining GMP and ISO compliance to serve regulated applications.

Sidley Chemical Co., Ltd.: (6-7%)

Sidley Chemical has developed a solid reputation for providing economical, functional HPC grades utilized throughout the pharmaceutical, personal care, and coatings markets. Although its penetration in Europe and the USA is still in the building stages, its low-cost pricing and manufacturing capability provide it with a premium position in high-growth, price-insensitive areas such as Southeast Asia and Latin America. Its growing international distributor base will help fuel further growth.

Hangzhou Showland Technology Co., Ltd.: (4-5%)

Having its eye on specialty HPC products, especially for cosmetic and food use, Hangzhou Showland commands a niche share. It has an expanding footprint in South Korea, Southeast Asia, and sections of Eastern Europe. Its dedication to quality and mid-scale production has enabled it to expand steadily in the face of stiff competition from larger Chinese rivals.

Key Players

- Rayonierer Advanced Materials

- Nouryon Holding B.V.

- Shandong Head Europe BV

- CP Kelco USA Inc.

- DuPont

- Akzo Nobel

- MizudaHope

- SE Tylose USA

- TRC Canada

- Zhicheng Cellulose Co. Ltd.

Segmentation

By Type:

- L-Hydroxypropyl Cellulose

- H-Hydroxypropyl Cellulose

By Application:

- Oil Field Chemicals

- Paints and Adhesives

- Pharmaceuticals

- Personal care & cosmetics

- Food & beverage

- Construction

- Paper and Textile

- Others

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

Table of Content

- Executive Summary

- Market Overview

- Market Risks and Trends Assessment

- Market Background and Foundation Data Points

- Key Success Factors

- Global Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market Value Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Oil Field Chemicals

- Paints and Adhesives

- Pharmaceuticals

- Personal care & cosmetics

- Food & beverage

- Construction

- Paper and Textile

- Others

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- L-Hydroxypropyl Cellulose

- H-Hydroxypropyl Cellulose

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Key Countries Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Structure Analysis

- Competition Analysis

- Rayonierer Advanced Materials

- Nouryon Holding B.V.

- Shandong Head Europe BV

- CP Kelco USA Inc.

- DuPont

- Akzo Nobel

- MizudaHope

- SE Tylose USA

- TRC Canada

- Zhicheng Cellulose Co. Ltd.

- Assumptions and Acronyms Used

- Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

How big is the hydroxypropyl cellulose market?

The market is anticipated to reach USD 205.4 million in 2025.

What is the outlook on hydroxypropyl cellulose sales?

The market is predicted to reach a size of USD 349.8 million by 2035.

Who are the key hydroxypropyl cellulose companies?

Prominent players include Ashland Global Holdings Inc., Sidley Chemical Co. Ltd., Nippon Soda Co., Ltd., Shin-Etsu Chemical Co. Ltd., Rayonierer Advanced Materials, Nouryon Holding B.V., Shandong Head Europe BV, CP Kelco U.S. Inc., DuPont, Akzo Nobel, MizudaHope, SE Tylose USA, TRC Canada, SIDLEY CHEMICAL CO. LTD., and Zhicheng Cellulose Co. Ltd.

Which type of hydroxypropyl cellulose is being widely used?

Oil field chemicals are widely used.

Which country is likely to witness the fastest growth in the hydroxypropyl cellulose market?

China, set to grow at 8.9% CAGR during the forecast period, is poised for the fastest growth.