High Power Connectors Market

High Power Connectors Market Analysis, By Pole (Single Pole Connectors, Multi Pole Connectors), By Mounting Type (Board, Cable, Panel Mount), By Current Rating (Up to 100A, 100-200A, 200-300A, 300-400A, Above 400A), By End-use, By Region - Global Market Insights 2022 to 2032

Analysis of High Power Connectors market covering 30 + countries including analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

High Power Connectors Market Outlook (2022 to 2032)

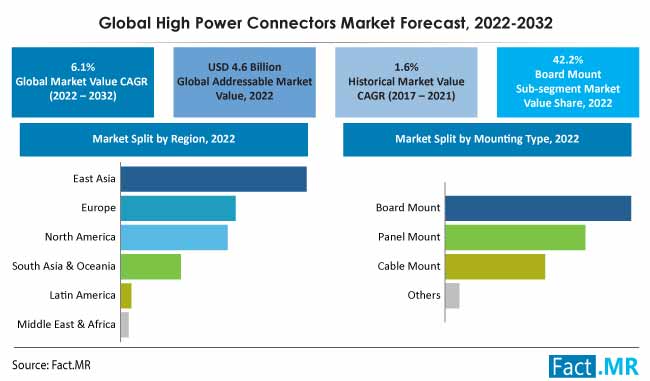

The global high power connectors market is set to surpass a valuation of US$ 4.6 billion in 2022 and expand at a CAGR of 6.1% to reach US$ 8.3 billion by the end of 2032.

Sales of high power connectors accounted for nearly 7% share of the global power connectors market at the end of 2021.

| Report Attributes | Details |

|---|---|

| High Power Connectors Market Size (2021A) | US$ 4.4 Billion |

| Estimated Market Value (2022E) | US$ 4.6 Billion |

| Forecasted Market Value (2032F) | US$ 8.3 Billion |

| Global Market Growth Rate (2022 to 2032) | 6.1% CAGR |

| North America Market Share (2021) | ~22.0% |

| East Asia Market Growth Rate (2022 to 2032) | ~6.3% CAGR |

| United States Market Growth Rate (2022 to 2032) | ~5.5% CAGR |

| Market Share of Top 5 Companies | ~28.3% |

| Key Companies Profiled | ABB; Amphenol; Anderson Power Products; Aptiv; Foxconn; Harting; Harwin; Hirose Electric Co. Ltd; ITT Cannon; Japan Aviation Electronics; Japan Solderless Terminal; Luxshare ICT; Molex; Radiall; Renhotec; Rosenberger; Smiths Interconnect; Souriau Sunbank; TE Connectivity; Valentini; Yazaki |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Sales Analysis of High Power Connectors (2017-2021) Vs. Market Outlook (2022-2032)

High power requirement has been in high demand from vivid end-use industries such as aerospace & defense, industrial manufacturing, and others. Power connections serve as the fundamental link between a device and its power source. The power connectors are utilized in a virtually endless list of applications, including industrial manufacturing, aerospace & defense, electronics & electricals, energy & power, marine & shipbuilding, and so forth.

High power connectors or heavy-duty connectors are typically employed when a significant amount of electricity needs to be transferred through them. Power connectors can be tailored to fulfill application-specific needs in terms of shape, capacity, application, and working environment for several end-use verticals.

- Short Term (2022 Q2 to 2025): Unceasing trend towards heightened system power to positively impact high power connectors market growth.

- Medium Term (2025 to 2028): Abundant growth in end-use application sectors as a result of industry 4.0 revolution and smarter technologies resulting in increased need for power density.

- Long Term (2028 to 2032): As the world would adopt more electric & environment-friendly technologies, sales of high power connectors are expected to reach a new high.

Between 2017 and 2021, the global high power connectors market expanded at a CAGR of 1.6%. According to Fact.MR, a market research and competitive intelligence provider, high power connector sales are predicted to surge at 6.1% CAGR through 2032.

Market share analysis of high power connectors based on application and region is provided in the above image. Under the application segment, the industrial & manufacturing sub-segment currently dominates with 25.1% market share.

Why is Demand for High Power Connectors Rising Rapidly?

“Demand for New Levels of Aerospace & Defense Power Connectivity”

Since power requirements are constantly rising, power management has become vital for different systems in end-use industries. High power connectors are best suited for certain applications where the requirement is seamless power transfer. Aerospace and military application needs compact high power connectors to connect devices with electricity in small space and operate at higher efficiency

Power connectors facilitate a constant supply of high-speed power and help maintain safety, auto emergency braking, and other vital functions for the devices. Thus, the surging need for compact high power in small spaces in aerospace and defense applications is leading to the increased demand for power connectors across the world.

“Greater Power & Portability in Extreme Environments”

Aggressors such as extreme temperatures, vibrations, shocks, abrasion, and wet or muddy conditions are usual in the end-use industries where high power connectors find their application. The ruggedized power connectors are designed and improved to be vibration and shock resistant, extreme temperature resistant, corrosion and chemical resistant as well as radiation-resistant.

Hence to satisfy the requirement of greater power and more portability in harsher environments, demand for high power connectors is expected to increase in the future.

“Rising Blockchain Technology Driving Higher Adoption of High Power Connectors”

Blockchain technology has matured tremendously and it is anticipated to register a massive CAGR of 84% over the decade.

The energy requirement for blockchain technology is very high due to the need for higher computational power. For instance, bitcoin cryptocurrency based on blockchain technology alone consumes estimated electricity of around 150 terawatt-hours annually.

Such high electricity and safety requirements are satisfied by high power connectors hence, generating parallel growth opportunities for the high power connectors market.

“Advanced E-Mobility Engineering to Push Product Sales”

Increase in the use of electric vehicles has led to the growing demand for high power connectors. With advancing high power technology, long charging times are getting a thing of the past.

High power connectors are playing important role in making EV charging stations more efficient. Bigger systems such as boats, lorries, and buses are handing even greater loads. This growth will continue over the coming years as electric powertrains are developed and reach maturity.

“Rising Global Demand for Industrial Automation & Robotics”

- On the global level, global energy consumption is expected to grow by nearly 50% by 2050, according to International Energy Outlook 2021 published by Energy Information Administration (EIA).

To meet the goals of Nationally Determined Contributions, electricity consumption is anticipated to surge 80–90% globally by 2050. The Paris Agreement, which aimed to cut national emissions and prepare for the effects of climate change, established these objectives.

Power connectors are currently the most widely used form of connectors in the electrification of applications, which has prompted the interconnect sector to compete to develop connectors capable of transmitting more power.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

What Constraint Do High Power Connectors Producers Face?

“Challenge of Standardization of Products Slowing Innovation”

The standard range of high power connectors can be developed, but it is still not a practical choice as the sales are limited to fewer markets due to application compatibility.

Firms are often getting in a dilemma to choose high power connectors that don`t offer all the features and wouldn’t be ideal for the application and are forced to compromise.

Manufacturers are facing several challenges such as designing a connector that is both, compact and rugged, as well as reliable with a high current rating. Also, designing a connector with a high-mating cycle is a challenging task for the manufacturers.

Country-wise Insights

Why is the United States an Appealing Market for High Power Connector Manufacturers?

The United States high power connectors market is expected to reach US$ 1.4 billion by 2032.

The electric power industry is the backbone of the American economy. Rising electricity infrastructure in the United States is propelling the demand for interconnects, and thus, for high power connectors.

The United States boasts of one of the world's largest aerospace programs. The aerospace & defense sector is highly likely to generate innovative opportunities for high power connector manufacturers.

- For instance, NASA`s Mars Perseverance Rover was equipped with Smiths interconnects` high-reliability hypertac hyperboloid technology.

The same is offered by the company in a variety of its high power connectors. Such heavy-duty power connectors are addressing NASA`s needs for a high-performance ruggedized connector to meet electrical, mechanical, and environmental performance.

Apart from this, The United States will continue its dominance in data centers on the back of robust IT infrastructure.

As per Fact.MR`s recently published report, global revenue generation from data centers is predicted to expand at an impressive CAGR of 13.8% to surpass a market valuation of US$ 279 billion by 2032.

The United States holds significant potential for high power connector sales over the coming years.

Which European Country Accounts for a Prominent Share in the High Power Connectors Market?

Europe holds 23.6% market share in the global high power connectors market in 2022 and is projected to rise at 5.8% CAGR during the forecast years of 2022-2032.

As a result of the huge expansion of sectors in Europe, such as industrial & manufacturing, electric vehicles, healthcare, etc., sales of high power connectors are expected to increase over the coming years.

Demand is primarily driven by automotive, and industrial manufacturing, followed by IT & telecommunications, in the region.

Germany holds a commanding position accounting for 19.4% of Europe`s high power connectors production in 2021. The Europe market for high power connectors is expected to reach a valuation of US$ 1.1 billion in 2022.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Category-wise Insights

Which Type of High Power Connectors is Most Widely Used?

Mounting types include board, cable, and panel mount high power connectors, and amongst them, board mount higher power connectors are widely used and differ in name based on their specific applications.

Board to board high power connectors are used to connect PCBs while cable to board and board to cable connectors interconnect PCBs by using connectors attached to wires. There are many different connectors available to suit a wide variety of applications.

Thus, the integration of board mount high power connectors has increased steadily in recent years, topping a market size of US$ 1.9 billion in 2021.

Furthermore, with continuous innovations in design and durability, the board mount sub-segment is predicted to expand 1.9X by the end of 2032.

Why is Market Growth Led by Current Ratings of High Power Connectors?

Sales of high power connectors for integration into diverse end-use applications are increasing rapidly. As industries are adopting advanced technologies, energy expenditure is also increasing as a result of enhanced performance and capacity of applications. More power can be transmitted if the output current rating is higher.

As the voltage ratings vary from country to country, major suppliers are focusing on the current ratings of high power connectors for easier application -specific selection. Prominent manufacturers are offering single and multi-way high power connectors with current ratings up to 1,200 amps. Up to 100 amps, power connectors are most widely used across the world due to standardization, availability, and versatile industrial use.

Additionally, with the surging demand from sectors such as aerospace & defense, IT & telecommunications, and logistics & transportation, demand for connectors with current ratings of 100-200A and 200-300A is predicted to expand 1.7X and 1.6X, respectively, by the end of 2032.

Competitive Landscape

Prominent high power connectors manufacturers are ABB, Amphenol, Anderson Power Products, Aptiv, Foxconn, Harting, Harwin Hirose, Electric Co. Ltd., ITT Cannon, Japan Aviation Electronics, Japan Solderless Terminal, Luxshare ICT, Molex, Radiall, Renhotec, Rosenberger, Smiths Interconnect, Souriau Sunbank, TE Connectivity, Valentini, and Yazaki.

Leading manufacturers of high power connectors are offering connectors that are specially designed to meet certain conditions and uses of end-use customers such as high current, ruggedized, vacuum use, longer life, vibration, shock and temperature resilience, corrosion-proof, wrong insertion prevention structure, etc., for the most challenging environments.

For Instance :

- In June 2022, Smiths Interconnect launched the HBB five-pole connector, which is an add-on to the already developed single-pole version for military & defence related applications. The new configuration can be utilized in extremely tight spaces to run several lines, which improves the connector’s flexibility and ability to run superfluous lines as required.

- In Sept 2021, TE Connectivity acquired ERNI Group AG, a leading company in connectivity for factory automation and the automotive industry. With the acquisition of ERNI, TE can now offer a broader range of connectivity solutions, notably in the field of high-speed and fine-pitch connectors for industrial, automotive, medical, and other applications.

- In June 2022, Amphenol and ABB collaborated to develop high-performance electrical solutions to address the changing requirements of clients in the e-mobility, infrastructure, robotics, and transportation industries.

Fact.MR has provided detailed information about the price points of key manufacturers of high power connectors positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

Segmentation of High Power Connectors Industry Research

-

High Power Connectors Market by Pole :

- Single Pole Connector

- Multi Pole Connector

-

High Power Connectors Market by Mounting Type :

- Board Mount

- Cable Mount

- Panel Mount

- Others

-

High Power Connectors Market by Current Rating :

- Up to 100A

- 100-200A

- 200-300A

- 300-400A

- Above 400A

-

High Power Connectors Market by End Use Application :

- Aerospace & Defence

- Automotive

- Construction & Mining

- Electronics & Electricals

- Energy & Power

- Healthcare

- Industrial & Manufacturing

- IT & Telecommunication

- Logistics & Transportation

- Oil & Gas

- Others

-

High Power Connectors Market by Region :

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- MEA

Table of Content

- 1. Market - Executive Summary

- 2. Market Overview

- 3. Market Background and Foundation Data

- 4. Global Demand (Units) Analysis and Forecast

- 5. Global Market - Pricing Analysis

- 6. Global Market Value (US$ million) Analysis and Forecast

- 7. Global Market Analysis and Forecast, By Pole

- 7.1. Single Pole Connector

- 7.2. Multi Pole Connector

- 8. Global Market Analysis and Forecast, By Mounting Type

- 8.1. Board Mount

- 8.2. Cable Mount

- 8.3. Panel Mount

- 8.4. Others

- 9. Global Market Analysis and Forecast, By Current Rating

- 9.1. Up to 100 A

- 9.2. 100-200 A

- 9.3. 200-300 A

- 9.4. 300-400 A

- 9.5. Above 400 A

- 10. Global Market Analysis and Forecast, By End Use Application

- 10.1. Aerospace & Defence

- 10.2. Automotive

- 10.3. Construction & Mining

- 10.4. Electronics & Electricals

- 10.5. Energy & Power

- 10.6. Healthcare

- 10.7. Industrial & Manufacturing

- 10.8. IT & Telecommunication

- 10.9. Logistics & Transportation

- 10.10. Oil & Gas

- 10.11. Others

- 11. Global Market Analysis and Forecast, By Region

- 11.1. North America

- 11.2. Latin America

- 11.3. Europe

- 11.4. East Asia

- 11.5. South Asia & Oceania

- 11.6. Middle East & Africa

- 12. North America Market Analysis and Forecast

- 13. Latin America Market Analysis and Forecast

- 14. Europe Market Analysis and Forecast

- 15. East Asia Market Analysis and Forecast

- 16. South Asia & Oceania Market Analysis and Forecast

- 17. Middle East & Africa Market Analysis and Forecast

- 18. Country-level Market Analysis and Forecast

- 19. Market Structure Analysis

- 20. Competition Analysis

- 20.1. Amphenol

- 20.2. ABB

- 20.3. Anderson Power Products

- 20.4. Aptiv

- 20.5. Foxconn

- 20.6. Harting

- 20.7. Harwin

- 20.8. Hirose Electric Co. Ltd

- 20.9. ITT Cannon

- 20.10. Japan Aviation Electronics

- 20.11. Japan Solderless Terminal

- 20.12. Luxshare ICT

- 20.13. Molex

- 20.14. Radiall

- 20.15. Renhotec

- 20.16. Rosenberger

- 20.17. Smiths Interconnect

- 20.18. Souriau Sunbank

- 20.19. TE Connectivity

- 20.20. Valentini

- 20.21. Yazaki

- 21. Assumptions & Acronyms Used

- 22. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

Table 01. Global Market Value (US$ million) and Forecast by Region, 2017 to 2021

Table 02. Global Market Value (US$ million) and Forecast by Region, 2022 to 2032

Table 03. Global Market Volume (Units) and Forecast by Region, 2017 to 2021

Table 04. Global Market Volume (Units) and Forecast by Region, 2022 to 2032

Table 05. Global Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 06. Global Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 07. Global Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 08. Global Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 09. Global Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 10. Global Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 11. Global Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 12. Global Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 13. Global Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 14. Global Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 15. Global Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 16. Global Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 17. Global Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 18. Global Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 19. Global Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 20. Global Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

Table 21. North America Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 22. North America Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 23. North America Market Volume (Units) and Forecast by Country, 2017 to 2021

Table 24. North America Market Volume (Units) and Forecast by Country, 2022 to 2032

Table 25. North America Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 26. North America Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 27. North America Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 28. North America Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 29. North America Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 30. North America Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 31. North America Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 32. North America Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 33. North America Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 34. North America Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 35. North America Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 36. North America Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 37. North America Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 38. North America Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 39. North America Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 40. North America Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

Table 41. Latin America Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 42. Latin America Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 43. Latin America Market Volume (Units) and Forecast by Country, 2017 to 2021

Table 44. Latin America Market Volume (Units) and Forecast by Country, 2022 to 2032

Table 45. Latin America Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 46. Latin America Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 47. Latin America Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 48. Latin America Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 49. Latin America Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 50. Latin America Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 51. Latin America Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 52. Latin America Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 53. Latin America Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 54. Latin America Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 55. Latin America Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 56. Latin America Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 57. Latin America Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 58. Latin America Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 59. Latin America Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 60. Latin America Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

Table 61. Europe Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 62. Europe Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 63. Europe Market Volume (Units) and Forecast by Country, 2017 to 2021

Table 64. Europe Market Volume (Units) and Forecast by Country, 2022 to 2032

Table 65. Europe Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 66. Europe Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 67. Europe Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 68. Europe Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 69. Europe Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 70. Europe Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 71. Europe Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 72. Europe Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 73. Europe Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 74. Europe Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 75. Europe Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 76. Europe Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 77. Europe Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 78. Europe Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 79. Europe Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 80. Europe Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

Table 81. East Asia Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 82. East Asia Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 83. East Asia Market Volume (Units) and Forecast by Country, 2017 to 2021

Table 84. East Asia Market Volume (Units) and Forecast by Country, 2022 to 2032

Table 85. East Asia Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 86. East Asia Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 87. East Asia Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 88. East Asia Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 89. East Asia Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 90. East Asia Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 91. East Asia Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 92. East Asia Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 93. East Asia Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 94. East Asia Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 95. East Asia Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 96. East Asia Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 97. East Asia Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 98. East Asia Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 99. East Asia Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 100. East Asia Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

Table 101. South Asia & Oceania Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 102. South Asia & Oceania Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 103. South Asia & Oceania Market Volume (Units) and Forecast by Country, 2017 to 2021

Table 104. South Asia & Oceania Market Volume (Units) and Forecast by Country, 2022 to 2032

Table 105. South Asia & Oceania Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 106. South Asia & Oceania Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 107. South Asia & Oceania Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 108. South Asia & Oceania Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 109. South Asia & Oceania Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 110. South Asia & Oceania Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 111. South Asia & Oceania Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 112. South Asia & Oceania Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 113. South Asia & Oceania Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 114. South Asia & Oceania Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 115. South Asia & Oceania Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 116. South Asia & Oceania Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 117. South Asia & Oceania Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 118. South Asia & Oceania Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 119. South Asia & Oceania Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 120. South Asia & Oceania Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

Table 121. MEA Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 122. MEA Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 123. MEA Market Volume (Units) and Forecast by Country, 2017 to 2021

Table 124. MEA Market Volume (Units) and Forecast by Country, 2022 to 2032

Table 125. MEA Market Value (US$ million) and Forecast by Pole, 2017 to 2021

Table 126. MEA Market Value (US$ million) and Forecast by Pole, 2022 to 2032

Table 127. MEA Market Volume (Units) and Forecast by Pole, 2017 to 2021

Table 128. MEA Market Volume (Units) and Forecast by Pole, 2022 to 2032

Table 129. MEA Market Value (US$ million) and Forecast by Mounting Type, 2017 to 2021

Table 130. MEA Market Value (US$ million) and Forecast by Mounting Type, 2022 to 2032

Table 131. MEA Market Volume (Units) and Forecast by Mounting Type, 2017 to 2021

Table 132. MEA Market Volume (Units) and Forecast by Mounting Type, 2022 to 2032

Table 133. MEA Market Value (US$ million) and Forecast by Current Rating, 2017 to 2021

Table 134. MEA Market Value (US$ million) and Forecast by Current Rating, 2022 to 2032

Table 135. MEA Market Volume (Units) and Forecast by Current Rating, 2017 to 2021

Table 136. MEA Market Volume (Units) and Forecast by Current Rating, 2022 to 2032

Table 137. MEA Market Value (US$ million) and Forecast by End Use Application, 2017 to 2021

Table 138. MEA Market Value (US$ million) and Forecast by End Use Application, 2022 to 2032

Table 139. MEA Market Volume (Units) and Forecast by End Use Application, 2017 to 2021

Table 140. MEA Market Volume (Units) and Forecast by End Use Application, 2022 to 2032

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Figure 01. Global Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 02. Global Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 03. Global Market Value (US$ million) and Volume (Units) by Region, 2022 & 2032

Figure 04. Global Market Y-o-Y Growth Rate by Region, 2022 to 2032

Figure 05. Global Market Value (US$ million) and Volume (Units) by Pole, 2022 & 2032

Figure 06. Global Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 07. Global Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 08. Global Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 09. Global Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 10. Global Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 11. Global Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 12. Global Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 13. North America Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 14. North America Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 15. North America Market Value (US$ million) and Volume (Units) by Country, 2022 & 2032

Figure 16. North America Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 17. North America Market Value (US$ million) and Volume (Units) By Pole, 2022 & 2032

Figure 18. North America Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 19. North America Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 20. North America Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 21. North America Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 22. North America Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 23. North America Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 24. North America Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 25. North America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 26. North America Market Attractiveness Analysis by Pole, 2022 to 2032

Figure 27. North America Market Attractiveness Analysis by Mounting Type, 2022 to 2032

Figure 28. North America Market Attractiveness Analysis by Current Rating, 2022 to 2032

Figure 29. North America Market Attractiveness Analysis by End Use Application, 2022 to 2032

Figure 30. Latin America Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 31. Latin America Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 32. Latin America Market Value (US$ million) and Volume (Units) by Country, 2022 & 2032

Figure 33. Latin America Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 34. Latin America Market Value (US$ million) and Volume (Units) By Pole, 2022 & 2032

Figure 35. Latin America Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 36. Latin America Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 37. Latin America Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 38. Latin America Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 39. Latin America Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 40. Latin America Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 41. Latin America Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 42. Latin America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 43. Latin America Market Attractiveness Analysis by Pole, 2022 to 2032

Figure 44. Latin America Market Attractiveness Analysis by Mounting Type, 2022 to 2032

Figure 45. Latin America Market Attractiveness Analysis by Current Rating, 2022 to 2032

Figure 46. Latin America Market Attractiveness Analysis by End Use Application, 2022 to 2032

Figure 47. Europe Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 48. Europe Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 49. Europe Market Value (US$ million) and Volume (Units) by Country, 2022 & 2032

Figure 50. Europe Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 51. Europe Market Value (US$ million) and Volume (Units) By Pole, 2022 & 2032

Figure 52. Europe Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 53. Europe Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 54. Europe Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 55. Europe Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 56. Europe Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 57. Europe Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 58. Europe Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 59. Europe Market Attractiveness Analysis by Country, 2022 to 2032

Figure 60. Europe Market Attractiveness Analysis by Pole, 2022 to 2032

Figure 61. Europe Market Attractiveness Analysis by Mounting Type, 2022 to 2032

Figure 62. Europe Market Attractiveness Analysis by Current Rating, 2022 to 2032

Figure 63. Europe Market Attractiveness Analysis by End Use Application, 2022 to 2032

Figure 64. East Asia Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 65. East Asia Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 66. East Asia Market Value (US$ million) and Volume (Units) by Country, 2022 & 2032

Figure 67. East Asia Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 68. East Asia Market Value (US$ million) and Volume (Units) By Pole, 2022 & 2032

Figure 69. East Asia Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 70. East Asia Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 71. East Asia Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 72. East Asia Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 73. East Asia Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 74. East Asia Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 75. East Asia Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 76. East Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 77. East Asia Market Attractiveness Analysis by Pole, 2022 to 2032

Figure 78. East Asia Market Attractiveness Analysis by Mounting Type, 2022 to 2032

Figure 79. East Asia Market Attractiveness Analysis by Current Rating, 2022 to 2032

Figure 80. East Asia Market Attractiveness Analysis by End Use Application, 2022 to 2032

Figure 81. South Asia & Oceania Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 82. South Asia & Oceania Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 83. South Asia & Oceania Market Value (US$ million) and Volume (Units) by Country, 2022 & 2032

Figure 84. South Asia & Oceania Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 85. South Asia & Oceania Market Value (US$ million) and Volume (Units) By Pole, 2022 & 2032

Figure 86. South Asia & Oceania Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 87. South Asia & Oceania Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 88. South Asia & Oceania Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 89. South Asia & Oceania Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 90. South Asia & Oceania Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 91. South Asia & Oceania Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 92. South Asia & Oceania Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 93. South Asia & Oceania Market Attractiveness Analysis by Country, 2022 to 2032

Figure 94. South Asia & Oceania Market Attractiveness Analysis by Pole, 2022 to 2032

Figure 95. South Asia & Oceania Market Attractiveness Analysis by Mounting Type, 2022 to 2032

Figure 96. South Asia & Oceania Market Attractiveness Analysis by Current Rating, 2022 to 2032

Figure 97. South Asia & Oceania Market Attractiveness Analysis by End Use Application, 2022 to 2032

Figure 98. MEA Market Value (US$ million) and Volume (Units) Forecast, 2022 to 2032

Figure 99. MEA Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 100. MEA Market Value (US$ million) and Volume (Units) by Country, 2022 & 2032

Figure 101. MEA Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 102. MEA Market Value (US$ million) and Volume (Units) By Pole, 2022 & 2032

Figure 103. MEA Market Y-o-Y Growth Rate by Pole, 2022 to 2032

Figure 104. MEA Market Value (US$ million) and Volume (Units) By Mounting Type, 2022 & 2032

Figure 105. MEA Market Y-o-Y Growth Rate by Mounting Type, 2022 to 2032

Figure 106. MEA Market Value (US$ million) and Volume (Units) By Current Rating, 2022 & 2032

Figure 107. MEA Market Y-o-Y Growth Rate by Current Rating, 2022 to 2032

Figure 108. MEA Market Value (US$ million) and Volume (Units) By End Use Application, 2022 & 2032

Figure 109. MEA Market Y-o-Y Growth Rate by End Use Application, 2022 to 2032

Figure 110. MEA Market Attractiveness Analysis by Country, 2022 to 2032

Figure 111. MEA Market Attractiveness Analysis by Pole, 2022 to 2032

Figure 112. MEA Market Attractiveness Analysis by Mounting Type, 2022 to 2032

Figure 113. MEA Market Attractiveness Analysis by Current Rating, 2022 to 2032

Figure 114. MEA Market Attractiveness Analysis by End Use Application, 2022 to 2032

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

What is the size of the global high power connectors market?

The global high power connectors market is valued at US$ 4.6 billion in 2022.

How is the market for high power connectors set to fare going forward?

Global sales of high power connectors are expected to reach US$ 8.3 billion by 2032.

How did the market perform over the historical study period?

From 2017 to 2021, sales of high power connectors increased at 1.6% CAGR.

Which region accounts for a leading market share?

East Asia leads the global high power connectors market accounting for 38.2% market share in 2022.

Which high power connector type is most widely used?

Board-mounted high power connectors are estimated to account for 42.2% market share in 2022.