Film Formers Market

Film Formers Market Analysis, By Product Type (Synthetic and Natural) By Compound, By Application, and By Region - Market Insights 2025 to 2035

Analysis of Film Formers Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Film Formers Market (2025 to 2035)

The film formers market will be valued at USD 1.85 billion by 2025 end; as per Fact.MR analysis, film formers will grow at a CAGR of 4.9% and reach USD 2.97 billion by 2035.

In 2024, the industry moved through a tangled environment influenced by regional regulatory changes, bio-based formulation innovation, and evolving consumer needs in major end-use industries such as personal care, paints & coatings, and pharmaceuticals.

North America, especially the U.S., witnessed a steady increase in demand due to advances in skin-friendly and biodegradable products employed in cosmetic emulsions and sunscreens. Simultaneously, in Europe, regulatory oversight of microplastic content resulted in a temporary lag in adoption by traditional players, compelling manufacturers to invest in R&D in compliant formulations.

Asia-Pacific experienced moderate growth, fueled by growing industrial demand and higher disposable incomes, though supply chain pressures and fluctuations in raw material costs marginally slowed momentum in Q2 and Q3 of 2024. M&A activity was quiet, but product launches with multifunctional and hybrid polymer systems generated competitive ripples.

Looking ahead to 2025 and beyond, the industry will stabilize and increase steadily, driven by green chemistry advancements, digital formulation solutions, and increased brand-manufacturer cooperation. Increased demand for water-based, non-toxic, and persistent films particularly in cosmetics and drug delivery systems will be key to growth through 2035.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.85 billion |

| Industry Value (2035F) | USD 2.97 billion |

| Value-based CAGR (2025 to 2035) | 4.9% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey on Film Formers Industry

Fact.MR Survey Results: Dynamics According to Stakeholder Insights (Q4 2024, n=475 stakeholder respondents representing an even split among manufacturers, raw material suppliers, R&D leaders, and end-users operating in the US, Western Europe, Japan, South Korea, and China)

Stakeholders' Most Important Priorities

Consistency of Performance:

- 84% indicated that film integrity (moisture resistance, elasticity, and adhesion) was a "critical priority.".

Regulatory Compliance:

- 77% highlighted the requirements to comply with changing chemical safety and environmental norms (REACH, FDA, etc.).

Regional Variance:

- US: 63% called for quick-dry, durability film technologies in cosmetics and over-the-counter medication.

- Western Europe: 88% mentioned "green chemistry" and eco-endorsements (e.g., COSMOS, EcoCert) as essential.

- Japan/South Korea: 59% called for low-residue and low-volatile films on sensitive skin ranges.

- China: 74% called for low-VOC and high-throughput formulations for industrial coatings.

Technology Adoption and Innovation

Divergence in Sophistication:

- US: 54% of manufacturers integrated smart film technologies (e.g., stimuli-responsive films for pharma).

- Western Europe: 61% investigated biodegradable polymers in personal care segments.

- Japan: Just 29% made use of advanced polymer blending, citing limited-batch production and cost as impediments.

- South Korea: 46% implemented hybrid natural-synthetic film systems in K-beauty brands.

- China: 57% of industrial users concentrated on solvent-free or aqueous dispersions for high-speed manufacturing.

Return on Innovation Investment

- 71% in the US and EU reported R&D expenditure had a "clear ROI within 18–24 months." Just 26% in Japan did so, citing lack of scalability.

Material Preferences

Consensus:

- Acrylic-based film formers: Selected by 67% because of versatility across applications.

Cellulose derivatives:

- Preferred in pharma and personal care by 48%.

Regional Insights:

- Western Europe: 53% favored bio-based products (e.g., PLA, PHA).

- Japan/South Korea: 44% chose synthetic-organic hybrids for moisture balance and sensory appeal.

- US: 66% remained with tried-and-tested acrylates for performance reliability.

- China: 58% chose polyurethane dispersions for industrial durability.

Price Sensitivity and Cost Pressures

Universal Challenge:

- 86% mentioned increasing raw material prices (cellulose ethers up 22%, acrylates up 18%) as the primary pricing issue.

Regional Differences:

- US/Western Europe: 64% were willing to pay a 10–15% premium for eco-certified or multifunctional products.

- Japan/South Korea: 72% opted for cost-effective solutions below USD 12/kg.

- China: 48% preferred in-house development to reduce costs of outside sourcing.

Pain Points in the Value Chain

Manufacturers:

- US: 52% named downtime caused by fluctuating input availability.

- Western Europe: 47% mentioned delay caused by REACH and compliance labeling.

- Japan: 58% stated that demand was "erratic" because personal care cycles were seasonal.

- China: 61% mentioned that lab formulation was a challenge to scale up to commercial production.

Distributors:

- Western Europe: 56% said growing need for sample transparency (MSDS, INCI).

- China: 65% mentioned logistical blockages at port terminals.

- End Users (Cosmetic, Pharma, Industrial Coating companies):

- US: 43% dealt with compatibility within product line (e.g., films reacting to the pH of formulations).

- South Korea: 49% were unable to access high-purity grades locally.

Future Investment Priorities

Global Consensus:

- 73% of producers will invest in low-VOC and biodegradable formulations.

Regional Focus:

- US: 59% in nanofilm R&D for extended drug delivery.

- Western Europe: 62% in green chemistry and low-carbon manufacture.

- Japan/South Korea: 46% in sensorial customization for skincare films.

- China: 53% in automation and continuous film coating systems.

Regulatory Impact

- US: 65% indicated FDA and state-level regulations drove "significant formulation changes" in pharma and personal care.

- Western Europe: 80% viewed new EU Green Deal and REACH updates as drivers of innovation.

- Japan/South Korea: Just 35% viewed regulatory pressure as important, but anticipate more oversight by 2026.

- China: 51% pointed to environmental audits on water-based film former manufacturing.

Conclusion: Variance vs. Consensus

High Consensus:

- Demand for high-performance, regulatory-compliant, and environment-friendly products is global.

Key Variances:

- US: Technology-driven, performance-oriented innovation leads.

- Western Europe: Green chemistry and compliance with regulations are the growth drivers.

- Japan/South Korea: Sensory subtlety, space-efficient formulation, and price sensitivity define demand.

- China: Raw material control and industrial scalability are the focus.

Strategic Insight:

Regional fit is what works for success-acrylics in the US, bio-polymers in Europe, cost-balanced hybrids in Asia. No "global default"; formulation strategy has to respond to local expectations and regulatory pulse.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Government Regulations on Film Formers Industry

| Country | Policy/Regulatory Impact & Mandatory Certifications |

|---|---|

| U.S. | FDA regulations impact products in cosmetics, pharmaceuticals, and food coatings (e.g., GRAS status, 21 CFR compliance). EPA VOC limits regulate solvent use in industrial coatings. California Prop 65 labeling mandates impact ingredients used in film formers. |

| UK | UK REACH post-Brexit closely mirrors EU REACH; compliance needed for chemical safety. DEFRA guidelines for environmental protection influence solvent selection. Cosmetic ingredients must meet UK Cosmetic Product Safety Reports (CPSR). |

| France | Strict EU REACH enforcement; mandatory registration of chemical substances. AFNOR standards for industrial coatings apply in local procurement. COSMOS certification is required for natural products in cosmetics. |

| Germany | Bundesinstitut für Risikobewertung (BfR) standards influence pharma and food-grade film formers. Mandatory CE marking for industrial coating products involving film-forming chemicals. REACH compliance and CLP labeling are rigorously audited. |

| Italy | Adheres to EU REACH and EU Green Deal directives that drive bio-based and low-emission film former development. UNI standards guide technical specifications in industrial applications. |

| South Korea | K-REACH (Korean REACH) mandates registration of new chemical substances. MFDS (Ministry of Food and Drug Safety) regulates cosmetic and pharma film formers. Eco-label incentives offered for biodegradable film technologies. |

| Japan | CSCL (Chemical Substances Control Law) and ISHL (Industrial Safety and Health Law) regulate chemical use and worker safety. PMDA (for pharma) and MHLW (for cosmetics) enforce ingredient safety. Importers must meet JIS standards for coatings. |

| China | MEE’s New Chemical Substance Notification (China REACH) regulates chemical registration. NMPA certification needed for cosmetic film formers. Industrial products must align with GB standards and RoHS-like directives. Environmental audits often mandate VOC caps and water-based formulation use. |

Market Analysis

The global industry is following a consistent growth trajectory, fueled by increasing demand for high-performance and environmentally-friendly formulations in the domains of cosmetics, pharma, and industrial coatings.

Pressure from regulation-specifically from the EU, US FDA, and Asia's REACH-like schemes-is compelling innovation toward biodegradable and low-VOC technology. Firms that bet on green chemistry and region-tailored formulations are poised to gain, while firms dependent on older solvent-based systems risk being left out of regulatory approval and industries.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Top 3 Strategic Imperatives for Stakeholders

Prioritize Eco-Compliant Formulations

Action: Invest in R&D for water-based, low-VOC, and biodegradable products that comply with changing global regulations (EU REACH, US EPA/FDA, China MEE). Obtain certifications such as COSMOS, FDA 21 CFR, and local REACH equivalents to future-proof product portfolios.

Customize by Region, Not Category

Action: Create customized formulations and industry approaches for every major geography-bio-based in Europe, affordable hybrids in Asia, and performance-driven in North America-to match local demand drivers, regulatory differences, and usage patterns.

Grow Strategic Partnerships Throughout the Value Chain

Action: Establish partnerships with ingredient suppliers, contract manufacturers, and local distributors to enhance supply resilience and regulatory compliance. Pursue M&A opportunities in specialty products and green chemistry labs to acquire IP and reduce innovation cycles.

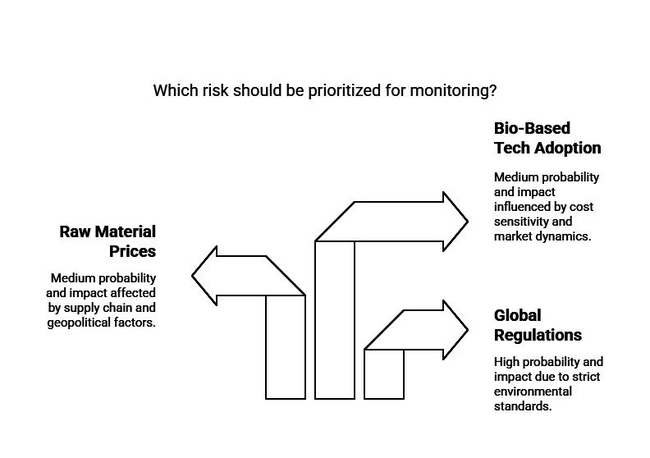

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

| Tightening Global Regulations on Solvent-Based Systems: Regulatory bodies such as the EU (REACH, CLP), US EPA, California Prop 65, and China’s MEE are enforcing stricter VOC limits and environmental standards. | High |

| Volatility in Raw Material Prices (e.g., resins, polymers, bio-based inputs): Supply chain disruptions, geopolitical instability (e.g., conflicts impacting petrochemical flows), and energy costs continue to drive fluctuations in pricing for key inputs like acrylics, cellulose derivatives, and PLA. | Medium |

| Lag in Adoption of Bio-Based Tech Due to Cost and Performance Trade-offs: While demand for sustainable film formers is growing, cost sensitivity, particularly in emerging industries and mass-industry segments, limits adoption. | Medium |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Reformulation Roadmap Acceleration | Conduct feasibility and lab testing for transitioning from solvent-based to water-based or biodegradable film formers. |

| Regulatory Compliance Readiness | Audit global product lines for REACH, FDA, and K-REACH compliance; initiate recertification where needed. |

| Sustainability Partner Mapping | Launch partnerships with suppliers of renewable resins and bio-based polymers to secure early-mover supply access. |

For the Boardroom

To stay ahead clients need to give top priority to shifting away from solvent-products and accelerate the development of compliant, bio-based, and waterborne alternatives, especially for high-growth applications such as cosmetics and pharma coatings.

Regulatory stringency in the US, EU, and Asia is not merely a compliance problem but a driver of product differentiation and premium pricing. This intelligence marks a strategic turning point: success will depend on coordinating R&D with region-specific regulatory paths, establishing upstream sustainability alliances, and securing early advantage through nimble certification and localized product deployment. A global one-size-fits-all strategy will no longer do precision and flexibility must now characterize the roadmap.

Segment-wise Analysis

By Product Type

The synthetic segment is expected to register an 72.0% share in 2025.Synthetic film formers remain the most popular in the world market because of their adaptability, economy, and proven performance record across a broad spectrum of applications.

These materials, commonly from petroleum-based sources such as acrylates, methacrylates, and polyvinylpyrrolidone (PVP), provide stable film-forming properties, better adhesion, water resistance, and long shelf life to emerge as the top choice in paints, coatings, and mass industry personal care products.

Manufacturers also derive advantages from advanced supply chains, scalable manufacturing, and large pools of formulation information, which drive down technical and regulatory hurdles. Natural film formers, for their part, are environmentally friendly and biodegradable but have yet to overcome cost, access, and functionality under some production conditions.

By Compound

The acrylates segment is expected to register an 24.0% share in 2025. Acrylates are universally employed as film formers because of their remarkable combination of flexibility, adhesion, water resistance, and transparency, making them well-suited to a wide range of uses in personal care and industrial formulations.

Their molecular architecture permits the formation of tough yet permeable films, which are particularly prized in cosmetics like hair sprays, sunscreens, and skin care products where a light, non-sticky texture is required.

In coatings and paints, acrylates impart UV resistance, weather ability, and color stability, and therefore have outdoor uses. Acrylates are also readily copolymerized with other materials so that manufacturers can tailor performance characteristics to a particular end use.

By Application

The personal care application segment is expected to register an 48.0% share in 2025. Personal care applications account for the biggest portion of the market for film formers because of the high and increasing world demand for cosmetics, skin care, hair care, and sun care products.

Film formers are important in these products because they provide protective, flexible films on the hair or skin, increasing product life, water resistance, and appearance finish all important drivers in consumer purchasing.

The development of multi-tasking beauty products, for example, long-wear foundation, anti-pollution cosmetics, and humidity-defying sprays for hair, has augmented the demand for high-performance products further.

Country-wise Analysis

| Countries | CAGR% |

|---|---|

| U.S. | 5.4 |

| UK | 4.6 |

| France | 4.8 |

| Germany | 5.0 |

| Italy | 4.7 |

| South Korea | 5.2 |

| Japan | 4.5 |

| China | 5.7 |

U.S.

The sales in the U.S. will grow at a CAGR of 5.4% from 2025 to 2035, above the global average of 4.9%. This above-average growth is influenced by strong demand in the personal care, paints & coatings, and medical formulations segments.

US is a world leader in cosmetic innovation, particularly for multifunctional skin and hair products that demand sophisticated film-forming technology.

High R&D intensity, consumer preference for long-wear and active-lifestyle beauty products, and increased demand for water-resistant and UV-protective coatings for infrastructure are major drivers.

Moreover, the fact that global manufacturers such as Dow, Eastman Chemical, and INOLEX have local presence ensures product diversity, technological innovation, and quick industry responsiveness.

FDA and EPA regulations also direct innovation towards safer and environmentally friendly film formers, driving growth in natural and bio-based segments.

UK

The industry in the UK is set to grow at a CAGR of 4.6% from 2025 to 2035. The UK's reputation as a trendsetter for premium cosmetics and clean beauty trends keeps driving film former demand, particularly in natural and biodegradable segments.

Local formulation companies are increasingly developing "green" personal care products using products derived from glycerine, PVP, and bio-acrylates.

Conformity with post-Brexit environmental and cosmetic regulation standards has provided a scope for low-impact materials innovation.

The UK building industry's new infrastructure drive and demand for green coatings boosted by low-VOC regulations-bolsters constant growth in the industrial coatings segment.

France

The sales in France are projected to expand at a CAGR of 4.8% from 2025 to 2035, slightly lower than the U.S. but higher than the world average.

France remains a world leader in luxury skincare and cosmetics, and French beauty houses are moving more toward natural formulations, driving demand for biodegradable products such as plant-based PVP alternatives.

France's REACH-conformant regulation, complemented by green chemistry support, still drives sourcing and application of bio-based actives. For coatings and paints, demand is driven by preservation work on historic buildings, for which high-performance but low-VOC are in demand.

France also has a number of specialty chemical firms (e.g., Roquette Frères, French subsidiaries of BASF) investing in bio-based solutions. Moreover, the nation's increasing focus on cosmeceuticals and dermo-cosmetics is establishing a premium segment for skin-friendly, multifunctional film formers.

Germany

The sales in Germany will develop steadily at a CAGR of 5.0% from 2025 to 2035, mirroring closely the world average. With its vast industrial base, the largest in Europe, Germany gains from strong demand for high-performance products for both architectural and automotive coatings.

The nation is leading in zero-VOC and carbon-neutral coatings, driving demand for solvent-free and water-based film formers, particularly acrylates and methacrylates. For personal care, Germany's penchant for natural, hypoallergenic, and dermatologically tested products guarantees steady demand for eco-certified film formers.

Italy

The industry in Italy is likely to expand at a CAGR of 4.7% during the forecast period, driven by both exports of personal care and demand for coatings in marine and heritage applications.

Italy's exports of beauty and skincare products, particularly sun care and anti-aging products, are experiencing strong growth calling for flexible products with durability and sensory attractiveness.

The nation also enjoys a robust boutique and artisanal brand presence, providing niches for natural origin, transparency, and low allergenicity film formers. Italy has specialty requirements in coatings for anti-corrosion and decorative products for its historic buildings and coastal areas.

South Korea

The sales in South Korea are projected to grow at a CAGR of 5.2% during the period 2025 to 2035, driven by its ruling K-beauty industry and tech innovation in personal care.

K-beauty companies are breaking the boundaries of formulation science, focusing on light, airy, and long-lasting films in formulations such as cushion compacts, tone-up creams, and sunscreens.

Local consumers are extremely ingredient-aware, and demand for clean-label, bio-based, and functional products is on the rise. South Korea's emphasis on high-tech packaging and delivery systems also depends on products with improved adhesion and time-release characteristics.

Japan

The industry in Japan is expected to advance at a CAGR of 4.5% during the forecast period, marginally lower than the global average as a consequence of a mature industry for personal care and conservative new material technology adoption curve.

Consumers in Japan value safety, skin compatibility, and simple formulations in their products, where well-trusted ingredients such as PVP and glycerine are preferred.

But the demographic challenges of an aging population and growing demand for pharmaceutical-grade formulations particularly in dermal products and wound healing—are opportunities for growth in the pharmaceutical segment.

China

The industry in China is predicted to expand at a rate of 5.7% CAGR from 2025 to 2035, the highest within all the assessed nations.

The boom is fueled by explosive growth in cosmetics, paints, and pharmaceutical uses, supported by urbanization, increasing middle-class consumption, and online retail growth.

China's huge and expanding domestic beauty industry, particularly for low-cost but effective skincare and sun care, fuels bulk demand for synthetic and hybrid film formers.

Market Share Analysis

Eastman Chemical Company should maintain the leading position of the global share with nearly 12-14% market share. The key to the company lies in the extent of its portfolio, including how it commands cellulose derivatives found in both cosmetics and industrial formulas.

It is supported globally through its extensive network of distributors as well as strategic partnerships established across the coatings and cosmetics industries that provide the competitive advantage. Most notably, its presence shines with high growth, particularly within areas such as Asia and North America.

Dow Inc. holds an estimated 10-12% share and continues to be a giant in synthetic products like acrylates and PVP-based polymers.

Dow's strong investment in R&D makes it a leader in innovation, particularly in formulating solutions developed specifically for medical and personal care applications.

Its well-integrated value chain from the feedstocks to the formulated products supports reliability and responsiveness to customer demands.

Covestro AG will be estimated to dominate approximately 8-9% of the industry in 2025. As a pioneer in polyurethane-based and waterborne film formers, Covestro is a forerunner in sustainable product innovation.

Its Baycusan® portfolio features innovative bio-based products for skin and hair care, making the company a sustainability-led innovator in cosmetics as well as premium industrial applications.

Roquette Frères is making inroads as a leader in the bio-based products category with a projected 6-7% share. Its expertise in natural ingredients like starch derivatives and polyols positions it as a go-to supplier for companies looking for environmentally friendly cosmetic products.

Roquette's pull is particularly high in Europe and Asia, where regulatory inclinations and clean beauty trends are driving growth in biodegradable and non-petroleum alternatives.

INOLEX Inc. is expected to own 5-6% of the world share in 2025. The firm has established a niche in the clean beauty segment, providing biodegradable, plant-based products that fit consumer and regulatory trends toward sustainability.

Its creative ingredient design and formulation support have established it as a go-to partner for independent and mid-sized personal care brands worldwide.

BASF SE is expected to account for 4-5% of the industry, capitalizing on its extensive industrial chemistry experience to supply functional film-forming polymers for a host of applications.

From paint solutions to medical coatings, BASF's offerings are supported by intensive R&D and a quality image. Though not as active in niche beauty categories, its supremacy in industrial and medical applications positions it favorably.

Nouryon, with an estimated 3-4% share, focuses on functional additives and performance polymers. The company is particularly active in high-performance coatings where products play a key role for durability and appearance.

Customer co-development and customized performance requirements in challenging end-use conditions drive its product innovation.

Azelis Americas LLC holds 2-3% share but functions as a strategic player in the distribution and formulation assistance arena. Though it might not produce in bulk, Azelis is a master of specialty ingredient sourcing, mixing, and technical consultancy services. Azelis acts as an essential link between world-scale producers and regional industries, mainly in North America and Western Europe, by providing custom-formulation solutions to new-age brands.

Market Segmentation

-

By Form :

- Liquid

- Powder/Solids

-

By Function :

- Primer

- Binder

- Adhesive

-

By Application :

- Paints & Coatings Production

- Inks Production

- Special Purpose Adhesives Production

-

By Region :

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle East & Africa (MEA)

Table of Content

- 1. Executive Summary

- 2. Market Overview

- 3. Market Background and Foundation Data

- 4. Global Demand (Kilo Tons) Analysis and Forecast

- 5. Global - Pricing Analysis

- 6. Global Market Value (USD Million) Analysis and Forecast

- 7. Global Market Analysis and Forecast, By Product Type

- 7.1. Synthetic

- 7.2. Natural

- 8. Global Market Analysis and Forecast, By Compound

- 8.1. PVP

- 8.2. Acrylates

- 8.3. Acrylamides

- 8.4. Glycerine

- 8.5. Methacrylates

- 8.6. Others

- 9. Global Market Analysis and Forecast, By Application

- 9.1. Personal Care Applications

- 9.1.1. Skin Care

- 9.1.2. Hair Care

- 9.1.3. Sun Care

- 9.2. Paint Formulations

- 9.3. Medical Equipment Formulations

- 9.1. Personal Care Applications

- 10. Global Market Analysis and Forecast, By Region

- 10.1. North America

- 10.2. Latin America

- 10.3. Europe

- 10.4. East Asia

- 10.5. South Asia and Oceania

- 10.6. Middle East & Africa

- 11. North America Market Analysis and Forecast

- 12. Latin America Market Analysis and Forecast

- 13. Europe Market Analysis and Forecast

- 14. East Asia Market Analysis and Forecast

- 15. South Asia & Oceania Market Analysis and Forecast

- 16. Middle East & Africa Market Analysis and Forecast

- 17. Country-level Market Analysis and Forecast

- 18. Market Structure Analysis

- 19. Competition Analysis

- 19.1. Azelis North America, LLC.

- 19.2. Eastman Chemical Company

- 19.3. Dow Inc.

- 19.4. Roquette Frères

- 19.5. Nouryon

- 19.6. TC USA Inc.

- 19.7. Ultra Chemical Inc.

- 19.8. K-Tech (India) Pvt. LTD

- 19.9. ChemPoint

- 19.10. Phoenix Chemical Inc.

- 19.11. Covestro AG

- 19.12. INOLEX, Inc.

- 19.13. BASF SE

- 19.14. MIYOSHI EUROPE

- 19.15. Trulux Pty Ltd

- 19.16. Other Players

- 20. Assumptions & Acronyms Used

- 21. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

What is driving the growth of the film formers market?

Increasing demand for eco-friendly, high-performance film formers in cosmetics, pharmaceuticals, and industrial coatings, along with stricter global regulations, is fueling industry growth.

Which region has the highest growth potential for film formers?

China leads with a projected 5.7% CAGR due to booming cosmetics and industrial demand, followed by the U.S. (5.4%) and Germany (5.0%).

Why are synthetic film formers more popular than natural ones?

Synthetic segment 72% share dominates due to their cost-effectiveness, versatility, and proven performance in applications like coatings and personal care.

How are regulations impacting the film formers industry?

Strict environmental laws (EU REACH, U.S. FDA, China MEE) are pushing manufacturers toward bio-based, low-VOC, and water-based film-forming solutions.

Which application segment holds the largest market share?

Personal care accounts for 48% of the industry, driven by demand for long-lasting, water-resistant cosmetics and skincare products.