Diamond Slurry Market

Diamond Slurry Market Analysis, By Type (Water-Based, Lubricant Based, Oil-Based, and Alcohol Based) By Diamond Type, By Viscosity, By Micron Size, By End-Use Industry, By Process, and By Region - Market Insights 2025 to 2035

Analysis of Diamond Slurry Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Diamond Slurry Market (2025 to 2035)

The global diamond slurry market is likely to reach USD 194.5 million by 2025, as per Fact.MR analysis. Further, the slurry will grow at a CAGR of 5.6% and reach USD 337 million by 2035.

The industry experienced a consistent increase in 2024, ending the year with projected revenues of USD 183 million, led by growing precision polishing demand in the optics and semiconductor sectors.

The resumption of wafer polishing and MEMS sensor production mainly in the U.S. and East Asia made significant contributions to volume growth.

High-performance computing (HPC) chip manufacturers also raised their demand for micro-polishing slurries, particularly for 3D packaging, and the transition in the automotive industry towards SiC-based power electronics spurred niche demand.

Mid-tier companies are targeting increasing penetration in smaller but rising regional industries such as Vietnam and Poland, where new electronics manufacturing clusters are forming.

On the supply side, price fluctuations of diamond grit were secured through diversified sourcing, while some players experienced margin squeeze from energy prices and logistics disruptions in Q1 and Q2 of 2024.

Advances in slurry flow consistency and control over particle size provided a competitive advantage to companies such as Entegris and Hyperion.

Looking ahead to 2025 and beyond, growth in the industry will be fueled by developments in compound semiconductors, aerospace composites polishing, and next-generation photonics devices.

Automation of polishing operations and formulation-specific customization will also be major battlegrounds for competitive differentiation among top slurry manufacturers.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 194.5 million |

| Industry Value (2035F) | USD 337.0 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey on Diamond Slurry Industry

Fact.MR Survey Findings: Dynamics by Stakeholder Insights (Surveyed Q4 2024, n=480 stakeholder respondents split equally between slurry makers, equipment integrators, semiconductor labs. Geography: US-based, Western European, Japanese, South Korean, and Chinese polishing contractors)

Most Important Concerns of Stakeholders

Particulate Uniformity & Cut Rate Effectiveness:

- 84% of the respondents identified "particle consistency for uniform material removal" as an important performance criterion in slurry choice.

Compatibility with New Substrates:

- 72% stressed the requirement for slurries that are compatible with SiC, GaN, and sapphire, due to compound semiconductor growth.

Regional Variance:

- US: 65% identified slurry compatibility with CMP tools as essential, especially for 300mm wafer lines, compared to 43% in Japan, which is still running 200mm lines.

- Western Europe: 78% centered on low-environmental-footprint slurries, e.g., lower VOCs and simpler waste treatment, compared to 52% in the US.

- China/South Korea: 69% prioritized thermal stability in high-speed polishing, particularly for photonics and LED substrates.

Implementation of Advanced Slurry Technologies

High Variance:

- US: 62% implemented nano-particle with inline metrology compatibility for feedback-based adjustments.

- Western Europe: 53% implemented low-viscosity formulations to minimize tool wear and maintenance downtime.

- Japan: Just 28% utilized highly engineered formulations, citing cost sensitivity and risk aversion due to the older installed base.

- China: 47% indicated usage of hybrid slurry systems (mechanical + chemical synergy), particularly in exports.

Return on Investment Sentiment:

- 70% of US and European stakeholders concurred that engineered slurry systems produced "clear ROI within 12–18 months." Just 31% of Japanese stakeholders indicated confidence in ROI for high-end slurries.

Material & Formulation Preferences

Consensus:

Diamond Grain Type: 67% favored synthetic monocrystalline diamond because of predictable cutting behavior and durability.

Regional Preferences:

- Western Europe: 59% preferred water-based slurries for sustainability, versus 38% in South Korea.

- China: 51% chose multi-dispersion formulations to combine rough cut and final polish in one pass.

- US: 74% remained with conventional oil-based suspensions, due to tool familiarity, but interest in hybrids is increasing.

Price Sensitivity

Shared Pressures:

- 87% identified increasing costs of synthetic diamond powder and dispersants (diamond up 22%, dispersants up 15%) as significant obstacles.

Regional Differences:

- US/Europe: 64% were willing to pay 10–15% extra for process-optimized formulations.

- China/Japan: 76% wanted value-engineered SKUs, with emphasis on bulk supply discounts and off-brand substitutes.

- South Korea: 48% were interested in subscription or pay-per-use supply models to address cash flow and scaling challenges.

Pain Points in the Value Chain

Manufacturers:

- US: 57% were challenged by raw material volatility and lead times for synthetic diamond grit.

- Europe: 49% mentioned tightening REACH compliance for chemical constituents as a growth inhibitor.

- Japan: 54% indicated low fab customer upgrade cycles, constraining slurry innovation.

Distributors/Integrators:

- US: 68% faced shipment delays from Asian slurry suppliers, particularly in Q2 2024.

- China: 62% indicated internal logistic inefficiencies in last-mile delivery to fab clusters.

End-Users (Fabs/Polishing Units):

- Western Europe: 42% mentioned high costs of disposal and waste treatment for spent slurry.

- Japan: 58% mentioned insufficient localized technical support for sophisticated slurry configurations.

Priorities for Future Investments

Global Alignment:

- 71% of slurry manufacturers intend to boost R&D on adaptive slurry formulations (variable particle shape, machine-dependent blends).

Regional Focus Areas:

- US: 63% invested in AI-driven slurry monitoring systems to adapt dosing and flow in real-time.

- Europe: 60% focused on creating biodegradable dispersants that align with EU Green Deal objectives.

- China/South Korea: 51% targeted multi-function slurry lines for both rough grind and last polish.

Regulatory Impact

- US: 66% indicated state-level environmental regulations (e.g., California's wastewater effluent requirements) had an impact on procurement.

- Europe: 83% regarded REACH & EcoDesign standards as prime drivers for innovation and high-end product positioning.

- Asia (Japan/South Korea/China): Fully 29% believed that regulations had a significant impact on purchases, but 41% did report growing awareness in Tier-1 fabs.

Conclusion: Consensus vs. Divergence

High Consensus:

- All stakeholders from all regions concur on the significance of particle consistency, substrate compatibility, and cost containment as key challenges.

Key Variances:

- US: Proactive in embracing automation and ROI-driven engineered formulations.

- Western Europe: At the forefront of sustainable and regulation-compliant slurry innovation.

- China/South Korea: Emphasizing high-throughput versatility and thermal control.

- Japan: Conservative purchasers with high technical requirements but budget-conscious investment levels.

Strategic Insight:

- Similar to the chute industry, regional fit is key. Success in this segment entails providing: Accurate slurries for US fabs, Environment-friendly solutions in Europe, Thermal-stable hybrids in Asia, and Low-cost support models in Japan.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Government Regulations on Diamond Slurry Industry

| Country | Regulatory & Policy Impact |

|---|---|

| U.S. | EPA regulations on wastewater discharge and hazardous materials impact slurry disposal and plant design. California Prop 65 requires labeling for chemical ingredients used in some slurry formulations. OSHA standards mandate safety data sheets (SDS) and proper handling protocols. No mandatory slurry-specific certification, but ISO 9001 and ISO 14001 are commonly required by top fabs. |

| Germany | Slurry manufacturers must comply with EU REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) which governs chemical composition and safe handling. Ecodesign Directive impacts energy and material efficiency in slurry processing and disposal. CE marking may apply to integrated CMP systems using slurry. |

| France | Similar to Germany under REACH, with added focus on Circular Economy Law (AGEC) pushing for eco-design and recyclability in industrial fluids. Disposal of used slurries must comply with Decree No. 2021-254 (Hazardous Waste Management). |

| UK | Post-Brexit, UK has implemented UK REACH, mirroring EU REACH. Companies exporting to EU still need dual compliance. Increasing pressure from Environmental Protection Act (EPA 1990) on industrial waste handling, affecting spent slurry disposal. |

| Japan | Regulated by Chemical Substances Control Law (CSCL) for ingredient disclosure and environmental safety. METI (Ministry of Economy, Trade and Industry) requires declaration of chemical handling processes. IS certification is not mandatory but preferred for slurries sold to domestic fabs. |

| South Korea | K-REACH enforces registration and evaluation of chemical substances; similar to EU REACH but localized. MOE (Ministry of Environment) enforces strict guidelines for effluent treatment from polishing processes. Slurry used in semiconductors often requires compliance with KS (Korean Standards) for quality consistency. |

| China | Regulated under MEE's Chemical Environmental Risk Assessment Measures, requiring documentation of hazardous chemicals in slurry. RoHS China (Restriction of Hazardous Substances) indirectly affects slurry formulations for electronics applications. CCC certification not applicable to slurries directly, but system-level integrations (CMP machines) may require it. |

Market Analysis

The industry is slated for consistent expansion until 2035, fueled by increasing applications for precision polishing in semiconductors, photonics, and high-end substrates such as SiC and GaN.

With fabs migrating to compound materials and more stringent process control, engineered slurries with uniform particle performance are gaining popularity. Producers of high-performance, tool-compatible, and environmentally compliant formulations will enjoy the greatest gains, with traditional suppliers with stale product lines or poor regulatory flexibility in danger of falling behind.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

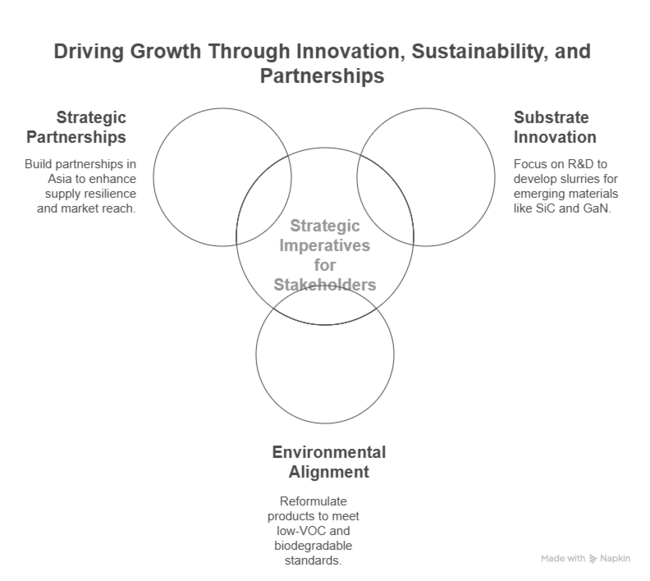

Top 3 Strategic Imperatives for Stakeholders

Lead with Substrate-Specific Innovation

Actionable Recommendation:

Spend R&D to create substrate-optimized slurries-specifically for new materials such as SiC, GaN, and sapphire. These industries are growing fast in power electronics, photonics, and advanced semiconductors. Provide formulations that are tool-compatible, minimize defectivity, and facilitate one-pass polishing on multi-layer stacks.

Align Product Lines with Environmental and Regulatory Expectations

Actionable Recommendation:

Speed reformulation towards low-VOC, biodegradable, and REACH/China REACH-compliant slurries. Enable customers with comprehensive SDS documentation, waste management advice, and region-specific compliance kits. Make sustainability a high-end differentiator-particularly in Western Europe and Tier-1 fabs worldwide.

Extend Strategic Partnerships in Asia and Build Regional Supply Resilience

Create channel partnerships with CMP tool OEMs and local slurry distributors in South Korea, China, and Japan. Investigate contract manufacturing or toll-blending to enhance delivery lead times and mitigate tariff effects. Concurrently, pursue M&A of Asia-based niche slurry formulators to acquire technical IP and new customer bases.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

| Regulatory Overhaul of Hazardous Material Classification: Regulatory bodies in the EU, China, and South Korea are tightening rules around chemical formulations and waste discharge. | Medium |

| Supply Chain Disruptions for Key Raw Materials: Key inputs like synthetic diamond powder, alumina, and engineered suspensions often depend on specialty suppliers in China, Russia, and India. Volatility in energy prices, geopolitical trade restrictions, or export bans (e.g., China's graphite export controls) could strain availability. | High |

| Technological Displacement by Alternative Polishing Methods: Research institutions and tool OEMs are experimenting with slurry-free or closed-loop CMP systems to reduce cost, waste, and contamination. | High |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Supply Chain Localization | Run feasibility on sourcing micronized diamond powder and suspension agents regionally to reduce exposure to export controls. |

| Customer-Centric Product Alignment | Initiate OEM and fab feedback loop on demand for hybrid slurry systems (e.g., dual-abrasive or tool-specific chemistries). |

| Channel Optimization | Launch aftermarket channel partner incentive pilot in South Korea and China to increase pull-through in fab upgrades. |

For the Boardroom

To stay ahead, the industry is on the cusp of precision-driven, sustainability-sensitive transformation that calls for a bold realignment of roadmap priorities.

Executives need to switch from broad slurry portfolios to substrate-specific, regulation-friendly formulations, especially for next-generation semiconductors such as SiC and GaN.

This insight indicates a strong imperative to intensify partnerships with Tier-1 fabs, accelerate REACH/China REACH-compliant R&D, and localize sourcing strategies to offset geopolitical risk. Industry leaders won't be those who have the most extensive catalog, but those who see fab-level changes coming in materials, waste levels, and throughput requirements and position themselves appropriately.

Segment-wise Analysis

By Type

The water based segment is expected to register an 44.0% share in 2025. Water-based products is very common and is the industry leader because of its eco-friendliness, affordability, and suitability for high-precision applications.

Water-based slurries provide better heat dissipation during lapping and polishing, which minimizes thermal damage to delicate components such as semiconductors, ceramics, and optical substrates.

Moreover, they are by far cleaner to maintain, present fewer handling risks, and produce less toxic waste than oil-based or lubricant-based counterparts-thus being the first choice when working within cleanroom conditions and businesses that demand very strict ESG and safety compliance regulations.

By Diamond Type

The polycrystalline segment is expected to register an 52.0% share in 2025. Polycrystalline finds extensive applications in high-precision polishing owing to its special microstructure, better surface finish, and less subsurface damage.

In contrast to monocrystalline diamonds, polycrystalline diamonds are made up of several microcrystals that fragment into smaller particles during usage, exposing constantly new, sharp edges.

This self-sharpening property enables the removal of materials in a consistent manner, thereby making it exceptionally efficient for fine and difficult-to-machine materials including ceramics, sapphire substrates, precision optics, compound crystals, tantalum carbide substrates, and even gemstones.

One of the most important benefits of polycrystalline slurry is that it can offer a smooth and damage-free finish consistently, which is extremely important in applications such as semiconductors, photonics, and advanced ceramics, where even tiny imperfections can affect device performance.

By Viscosity

The low viscosity segment is expected to register an 41.0% share in 2025. Low-viscosity is prevalent in precision lapping and polishing applications because it has superior flow characteristics, is efficient in cooling, and leaves better surface finish.

Its liquidity ensures uniform spreading and constant mobility of diamond particles, providing stable contact with the work surface.

Uniformity of this nature helps prevent clumping or scratching and makes low-viscosity slurries best suited to high-precision sectors like semiconductors, optics, and photonics, where submicron tolerance and low subsurface damage are of prime concern.

Additionally, low-viscosity formulations lower the possibility of material build-up and tool clogging, hence reducing maintenance needs and improving efficiency of operation.

They are specifically favored in automated polishing systems and cleanroom facilities, where consistency of performance and simplicity of cleaning are critical.

By Micron Size

The Up to 10 μ segment is expected to register an 46.0% share in 2025. 10 μm particle size is in common use based on its precision finishing capability, versatility from substrate to substrate, and high-specification polishing compatibility.

These high-grade slurries are especially useful in applications where tight dimensional control, ultra-smooth finishes, and low levels of subsurface damage are critical such as in the semiconductor, optics, photonics, and advanced ceramics marketplaces.

Fine micron particle size leads to a smoother distribution of abrasives, softer material removal, and reduced susceptibility to surface blemishes.

Sub-10 μm slurries are the best choice in final polishing cycles where nanometer-scale smoothness is essential in applications like sapphire wafers, optical lenses, compound semiconductors, and MEMS structures.

By End-Use Industry

The semiconductor industry segment is expected to register an 36.0% share in 2025. The semiconductor industry is the largest and most broadly served end use industry because of its precision requirements, high volume production, and need for surface perfection.

It is widely applied in semiconductor manufacturing for lapping and polishing silicon wafers, compound semiconductors (e.g., GaN, SiC), and high-end substrates such as sapphire and quartz, where even microscopic surface imperfections can affect device performance.

They deliver superior material removal rates and ultra-flat surfaces, which are absolutely essential in maintaining device layer uniformity, thermal, as well as electrical performance.

The increased focus of the industry on shrinking nodes (e.g., 5nm and smaller), heterogeneous integration, and 3D IC stack architectures only amplifies the need for perfect, damage-free planarization, for which high-quality slurry formulations become an absolute must.

By Process

The polishing segment is expected to register an 60.0% share in 2025. Polishing is the most common process segment in the industry because of its essential function in obtaining ultra-smooth, defect-free surfaces in a broad array of high-precision applications. In semiconductors, optics, photonics, advanced ceramics, or precision metal parts, polishing is necessary for final surface finishing after lapping or grinding operations, with tight flatness tolerances, optical transparency, and functional performance.

It is optimally suited for polishing due to its ability to put together uniform particle size distribution and high hardness, allowing controlled fine removal of material without degrading the substrate.

This makes it an essential in applications such as CMP (chemical mechanical planarization) applied in wafer production, and in lens and sapphire substrate polishing where surface smoothness at the nanometer level is paramount.

Country-wise Analysis

| Countries | CAGR |

|---|---|

| U.S. | 5.7% |

| UK | 5.1% |

| France | 5.2% |

| Germany | 5.5% |

| Italy | 5.0% |

| South Korea | 6.4% |

| Japan | 5.4% |

| China | 7.3% |

U.S.

The U.S. is expected to grow at a CAGR of 5.7% from 2025 to 2035. The industry in the U.S. will continue to expand steadily, propelled by strong demand from the semiconductor and optics industries.

The United States has many of the world's largest chip makers and defense contractors, which both depend intensively on high-precision material processing.

The growth in AI, quantum processing, and 5G infrastructure continues driving the need for sophisticated wafer-level packaging and CMP (chemical mechanical planarization), where this is an essential technology.

In addition, with the CHIPS and Science Act providing incentives for domestic semiconductor manufacturing, local innovation and sourcing of slurry technologies are on the rise.

UK

The UK. is expected to grow at a CAGR of 5.1% from 2025 to 2035.The industry in the UK is changing steadily, supported by developments in precision optics, aerospace components, and medical device manufacturing.

Though it does not possess the massive Asian or American-style semiconductor fabs, the UK boasts highly advanced manufacturers of photonics devices, sapphire substrates, and ceramic products.

Oxfordshire and Cambridge areas are experiencing development in nanomaterials and photonics clusters that often employ fine micron-size slurry for sapphire wafer polishing, fused silica lenses, and compound semiconductors.

Moreover, the government's emphasis on low-carbon advanced manufacturing is stimulating demand for sustainable slurry systems, particularly water-based and recoverable formulations.

France

The sales in France is expected to grow at a CAGR of 5.2% during the forecast period. The industry in France’s is supported by close integration with its aerospace, defense, and optics manufacturing clusters, especially around Toulouse and Île-de-France.

These industries require high-accuracy polishing of ceramics, specialty metals, and optical glass, encouraging adoption of polycrystalline and nano-grade variants of slurry.

France also leads the European photonics and MEMS industries, where surface integrity and quality of substrates are critical.

With the backing of the Plan France 2030 initiative that supports local chip manufacturing and research in microelectronics, demand for slurry will increase slowly but surely in R&D related to semiconductors.

EU REACH compliance and CE markings are driving procurement towards environmentally friendly and non-oil-based slurries.

Germany

The sales in Germany is expected to register at CAGR 5.5% from 2025 to 2035.Germany is likely to be a high-value industry for diamond slurry, led by its high-precision manufacturing capabilities in optics, automotive electronics, and industrial ceramics.

With Germany being the hub of the EU's semiconductor reshoring effort and host to major semiconductor companies such as Bosch and Infineon, slurry demand is bound to increase in wafer polishing and backend package processing.

German industry is among the first adopters of nano and low-viscosity slurry to address micron- and nanometer-level surface specification needs. Thuringia and Saxony are becoming new hotspots for wafer and photonics polishing.

In addition, Germany's high environmental standards and harmonization with EU directives are driving adoption of water-based and recyclable slurry chemistries.

Italy

The industry in Italy is expected to register at CAGR 5.0% during the forecast period. The industry in Italy is quite niche but increasing, especially in industries like luxury precision optics, decorative ceramics, and industrial tool polishing.

Demand is dominated by small to medium-sized enterprises (SMEs) with high-grade finishing capabilities of optical lenses, gemstones, and carbide tools that need to maintain constant slurry quality and surface integrity.

Northern provinces such as Lombardy and Emilia-Romagna are witnessing investment in compact lapping and polishing units where low-viscosity polycrystalline slurry is used routinely.

South Korea

South Korea is expected to grow at 6.4% from 2025 to 2035. The industry in south Korea’s business is growing steadily, led by its leading semiconductor and display panel production industries. Industry leaders like Samsung and SK Hynix induce high-volume polishing demands for memory devices, logic chips, and 3D stacking substrates, requiring premium quality slurry products with particle size control, low metal content, and stable viscosity.

The country's emphasis on future-generation semiconductor nodes and leading-edge packaging technologies has generated strong demand for nano-diamond and low-viscosity slurries tailored for ultra-flat planarization.

Japan

Japan is expected to grow at CAGR 5.4% during the forecast period. Japan has been a center for ultra-precision polishing technologies for decades, and its industry is backed by semiconductor, high-end optics, and precision instrumentation applications.

Japanese companies are at the forefront of monocrystalline and polycrystalline slurry technologies, with niche application in photomask blanks, sapphire substrates, and quartz components. Domestic automated and miniaturized processing facilities prefer slurry grades that have uniform flow characteristics and fast settling resistance, especially low-viscosity grades.

China

China is expected to grow at CAGR 7.3% from 2025 to 2035.The industry in China is likely to be the fastest-growing in the world, supported by huge government spending on semiconductor independence, EVs, photonics, and high-end materials.

With the Made in China 2025 program and the 14th Five-Year Plan, the nation has increased wafer fabs, LED substrate lines, and high-end ceramic production.

These increases drive skyrocketing demand for low-defect, high-precision slurry systems, especially in CMP, sapphire substrate polishing, and ceramic lapping. Domestic slurry manufacturers are increasing production but continue to depend on high-purity micronized diamond imports, making the supply chain vulnerable to fluctuations.

Market Share Analysis

Engis Corporation (USA) owns an estimated 13% of the world industry in 2025 and is a category leader in turnkey CMP (Chemical Mechanical Planarization) systems. Engis is famous for its exclusive formulations and custom solutions that suit industries such as semiconductors, precision optics, ceramics, and hard metal polishing.

Its significant strength is its R&D and strong end-user proximity, particularly in industries such as aerospace and petrochemicals, where it offers high-efficiency ball valve lapping slurries and gels.

Saint-Gobain (France) holds about 11% of the world industry and is a leader through its extensive abrasives portfolio and vertical integration from raw materials, manufacturing, and distribution.

Saint-Gobain places great emphasis on environmentally friendly and recyclable slurry compositions, which fits well with Europe's aggressive sustainability requirements.

The company is well-positioned in the polycrystalline industry, serving industries such as metal finishing, optics, and advanced ceramics.

Entegris (USA) holds around 10% share and is known as a key supplier to the international semiconductor industry. It provides ultra-high-purity diamond CMP slurries for wafer polishing and high-end logic chip applications. Entegris' competitive strength is its ability to control contamination using integrated materials handling, filtration, and slurry delivery systems positioning it as a top vendor to Tier-1 fabs in the U.S., South Korea, and Taiwan.

Asahi Diamond Industrial Co., Ltd. (Japan) has an estimated 8% global m share. Asahi is one of Asia’s oldest and most diversified manufacturers of abrasive products, including a wide portfolio of diamond slurries and lapping compounds.

The company’s OEM-centric business model has enabled strong growth in Japan, China, and South Korea, especially in precision machining and optics.

Precision Surfacing Solutions (PSS) with operations in the U.S. and Germany, has a share of about 7% globally. PSS is also positioned differently, with a dual emphasis on polishing machines and products so that it can provide turnkey systems.

This bundling strategy, whereby slurry formulations are optimized for operation with proprietary lapping and polishing equipment, positions it as an ideal partner for customers in optics, ceramics, sapphire, and high-performance materials

Other Key Players

- Fujimi Corporation

- CMC Materials

- Lapmaster Wolters

- 3M Abrasives

- Kemet International

Segmentation

-

By Type :

- Water Based

- Lubricant Based

- Oil Based

-

By Diamond Type :

- Monocrystalline

- Polycrystalline

- Nano

-

By Viscosity :

- Low Viscosity

- Medium Viscosity

- High Viscosity

-

By Micron Size :

- Up to 10 μ

- 10–30 μ

- Above 30 μ

-

By End-Use Industry :

- Semiconductor Industry

- Optics and Photonics Industry

- Advanced Ceramics Industry

- Metal Industry

- Other Industries

-

By Region :

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- MEA (Middle East & Africa)

Table of Content

- 1. Executive Summary

- 2. Market Overview

- 3. Market Background and Foundation Data Points

- 4. Global Market - Pricing Analysis

- 5. Global Market Value (USD Million) Analysis and Forecast

- 6. Global Market Analysis and Forecast, By Type

- 6.1. Water Based

- 6.2. Lubricant Based

- 6.3. Oil Based

- 6.4. Alcohol Based

- 7. Global Market Analysis and Forecast, By Diamond Type

- 7.1. Monocrystalline

- 7.2. Polycrystalline

- 7.3. Nano

- 8. Global Market Analysis and Forecast, By Viscosity

- 8.1. Low Viscosity

- 8.2. Medium Viscosity

- 8.3. High Viscosity

- 9. Global Market Analysis and Forecast, By Micron Size

- 9.1. Upto 10 μ

- 9.2. 10-30 μ

- 9.3. Above 30 μ

- 10. Global Market Analysis and Forecast, By End Use Industry

- 10.1. Semiconductor Industry

- 10.2. Optics and Photonics Industry

- 10.3. Advanced Ceramics Industry

- 10.4. Metal Industry

- 10.5. Other Industries

- 11. Global Market Analysis and Forecast, By Process

- 11.1. Lapping

- 11.2. Polishing

- 12. Global Market Analysis and Forecast, By Region

- 12.1. North America

- 12.2. Latin America

- 12.3. Europe

- 12.4. East Asia

- 12.5. South Asia & Oceania

- 12.6. Middle East & Africa

- 13. North America Market Analysis and Forecast

- 14. Latin America Market Analysis and Forecast

- 15. Europe Market Analysis and Forecast

- 16. East Asia Market Analysis and Forecast

- 17. South Asia & Oceania Market Analysis and Forecast

- 18. Middle East & Africa Market Analysis and Forecast

- 19. Country-level Market Analysis and Forecast

- 20. Market Structure Analysis

- 21. Competition Analysis

- 21.1. Algasan International

- 21.2. ALLIED HIGH TECH PRODUCTS, INC.

- 21.3. Asahi Diamond Industrial Co., Ltd.

- 21.4. Bewise Inc.

- 21.5. Diamond Tool and Abrasives, Inc.

- 21.6. Dopa

- 21.7. Engis Corporation

- 21.8. Entegris

- 21.9. Extec Corp.

- 21.10. Henan Boreas New Material Co Ltd

- 21.11. Hyperion Materials & Technologies

- 21.12. Kemet International Limited

- 21.13. LAM PLAN SA

- 21.14. Mark V lab

- 21.15. NanoDiamond Products

- 21.16. PRECISION SURFACING SOLUTIONS

- 21.17. Qual Diamond

- 21.18. Saint-Gobain

- 21.19. Shenzhen Yungu Semiconductor Material Co., Ltd.

- 21.20. Stahli USA

- 22. Assumptions & Acronyms Used

- 23. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

- FAQs -

What is driving the growth of the diamond slurry market?

The sector is expanding with the increasing demand in semiconductorproduction, 5G technology, SiC/GaN-based power electronics, and precision optics, with the projected 5.6% CAGR (2025 to 2035).

What is the market-leading diamond slurry type?

Water-based diamond slurry maintains the leading position 44% in 2025 because of its environmental friendliness, cost-effectiveness, and compatibility for high-precision processes such as semiconductor polishing.

Why is polycrystalline diamond slurry more desirable than monocrystalline?

Polycrystalline diamond slurry 52% market share in 2025 is preferred for its self-sharpening characteristics, stable material removal, and excellent surface finish in semiconductors, optics, and ceramics.

Which region will see the fastest growth in diamond slurry demand?

China 7.3% CAGR leads due to rapid semiconductor fab expansions, EV adoption, and government initiatives like Made in China 2025.

How do regulations impact the diamond slurry industry?

Strict environmental rules (e.g., EU REACH, U.S. EPA, China RoHS) push manufacturers toward sustainable, low-VOC, and biodegradable slurry formulations, especially in Europe and North America.