Cloud Radio Access Network Market

Cloud Radio Access Network Market Analysis, By Component (Solutions & Services), By Deployment (Centralized and Cloud Radio Access Network), By End User (Telecom Operators & Enterprises), By Network Type (5G, 4G, and 3G & 2G), and Region - Market Insights 2025 to 2035

Analysis of Cloud Radio Access Network Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Cloud Radio Access Network Market Outlook (2025 to 2035)

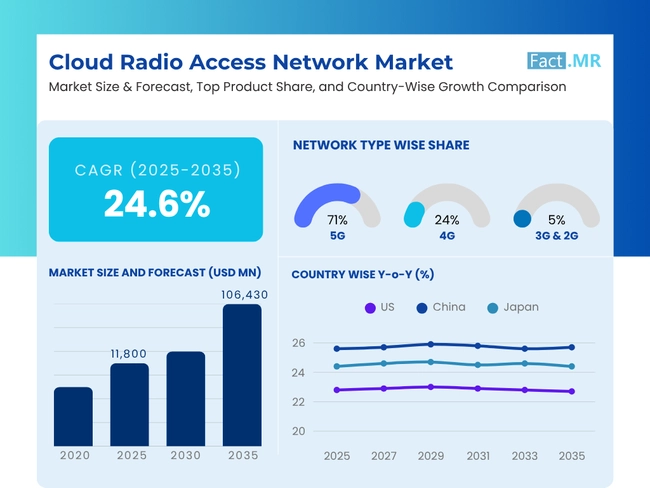

The global cloud radio access network market is expected to reach USD 106,430 million by 2035, up from USD 9,169 million in 2024. During the forecast period (2025 to 2035), the industry is projected to grow at a CAGR of 24.6%. The convergence of 5G deployment requirements, escalating mobile data traffic, and the need to optimize network costs is driving the market.

The combination of these drivers is accelerating the pace at which operators are investing in centralized, virtualized architectures to enhance spectral efficiency, facilitate dynamic resource allocation, and minimize total cost of ownership.

What government initiatives are driving the growth of the Cloud Radio Access Network Market?

The C-RAN market drivers are primarily driven by the increasing mobile data usage, the rapid global rollout of 5G networks, and the rising demand for economical and scalable network solutions. With centralization, telecom operators benefit from lowered operational costs with the pooling of resources and ease of maintenance.

With the advent of network function virtualization and software-defined networking, C-RAN presents the argument for increased network flexibility. The interest in real-time communication for applications such as IoT, augmented reality, and smart cities is on the rise, and subsequently, growing C-RAN adoption. These complementary drivers establish C-RAN as a strategic leap forward in the evolution of modern telecom.

What factors are restraining the growth of the Cloud Radio Access Network Market?

While offering opportunities in the current telecom market, C-RAN faces several challenges. Being expensive to set up initially, all infrastructure included in cloud and high-speed fronthaul networks, small telecom companies may take offense and throw their hands up. Complications arise in deployments of C-RAN due to the presence of heterogeneous environments with legacy systems.

Security concerns arise again due to the high degree of centralization in cloud operations, which warrants strong cybersecurity frameworks. To top these, large-scale deployment is restricted due to the limited availability of fiber infrastructure in remote and underdeveloped areas. Interoperability amongst multi-vendor components continues to be a technical challenge. Through collaborative innovations within the industry, the impediments have to be tackled for the full exploits of C-RAN networks.

Which regions are leading in Cloud Radio Access Network Market adoption and infrastructure investment?

From a regional perspective, the North American region has been ahead in terms of Cloud RAN deployments, courtesy of large-scale investments made by Tier-1 operators such as Verizon, AT&T, and T-Mobile. The region stands to gain from early rollouts of 5G, high consumer data consumption, and government-led initiatives that foster innovation in telecom infrastructure.

Another leading market contributor is East Asia, led by China, Japan, and South Korea. China has created regional momentum via rapid deployment of 5G base stations and proactive investments into centralized network infrastructure by vendors such as Huawei and ZTE. Japan and South Korea are using C-RAN to help with urban densification and low-latency services, such as those pertinent to autonomous mobility and industrial automation.

Western Europe then follows from behind with Germany, France, and the UK on the path to virtualized RAN architectures as their national agenda for digitalization. The European Commission's push towards open RAN and public-private partnerships is fast-tracking innovation and adoption across the continent.

Country-Wise Outlook

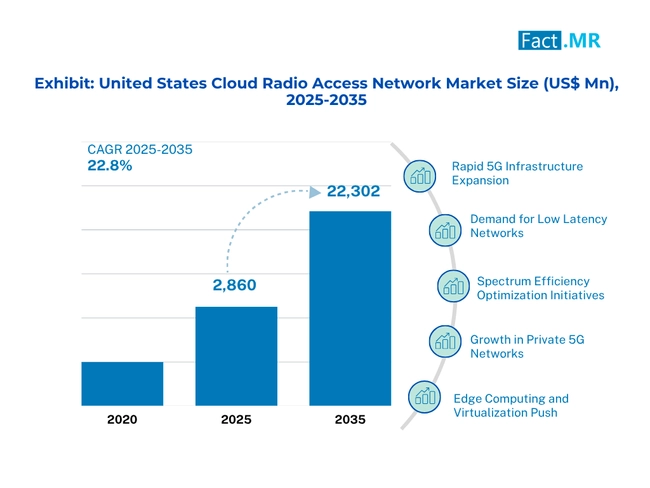

5G Rollouts, Network Virtualization, and Federal Support Accelerate U.S. C-RAN Market Expansion

Expansions of the C-RAN market in the U.S. are driven by massive 5G rollouts, network virtualization, and a continual increase in mobile data volumes. Major telecom operators have heavily financed the development of centrally located RAN infrastructure to reduce latency, increase network performance, and support the growing number of devices.

Government-sponsored programs, such as the Infrastructure Investment and Jobs Act, are funding broadband upgrades, which stimulate growth in C-RAN deployments. The supportive environment of a mature cloud and semiconductor industry in the U.S. facilitates the rapid implementation of AI-based automation and advanced network slicing functions in C-RAN systems. Companies in sectors such as automotive, manufacturing, and healthcare are utilizing private 5G networks with C-RAN architecture to deliver superior operational insights and real-time analytics.

Government Initiatives and Tech Giants Accelerate China’s C-RAN Market Expansion

Government-backed 5G rollouts and the backing of the “New Infrastructure” program are major enablers of China’s fast-growing C-RAN market globally. Government programs focused on smart cities, autonomous vehicle technologies, and industrial IoT are driving significant investments in centralized and virtualized RAN infrastructure.

Taiwanese and Chinese technology leaders are promoting C-RAN development to provide flexible, cost-effective solutions in harmony with regional market needs. Moreover, the positive aspects of C-RANs are quite naturally exploited to encourage improvements in energy efficiency and spectrum optimization in crowded urban environments.

Cooperation between telecommunication providers and the establishment of cloud computing is accelerating the development of edge-cloud integration and network management, supported by artificial intelligence technologies.

5G Readiness and Industrial Resilience Drive Japan’s Cloud RAN Market Expansion

The Cloud Radio Access Network (C-RAN) market in Japan is progressing steadily, with early 5G deployments and an emphasis on ultra-reliable low-latency communications (URLLC) for industry applications. The major telecom operators are deploying C-RAN solutions to maximize spectrum utilization and minimize operational costs in metropolitan regions.

A pursuit to make Japan disaster resilient and businesses continue has led it to explore the realm of decentralized yet centrally coordinated network solutions, such as C-RAN. The synergy between AI, robotics, and IoT used in smart manufacturing and healthcare creates the environment for developing virtualized RAN and edge computing opportunities. The government's efforts to be transparent in regulation and cooperate with industries are spurring advancements in C-RAN technology throughout Japan.

Category-Wise Market Outlook

Implementation Services Surge as Cloud RAN Shifts from Hardware to Software-Defined Networks Amid 5G Rollout Pressures

Implementation Services has been identified as the fastest-growing subsegment under the component category. This momentum, in turn, has been driven by the heightened need for seamless Cloud RAN solutions integration with existing telecom infrastructure. Telecom operators are currently seeking reference implementation assistance to deploy and optimize virtualized RAN components, as networks have begun transitioning from hardware-intensive setups to software-oriented environments.

Implementation services essentially cover end-to-end setup, from network design and planning through deployment and optimization, which has become crucial for service providers seeking to reduce time-to-market with minimal disruption to their business. The complexity in transitioning to cloud-native architecture further supports reliance on expert implementation teams, particularly in regions where 5G rollout and spectrum reallocation are of strategic importance.

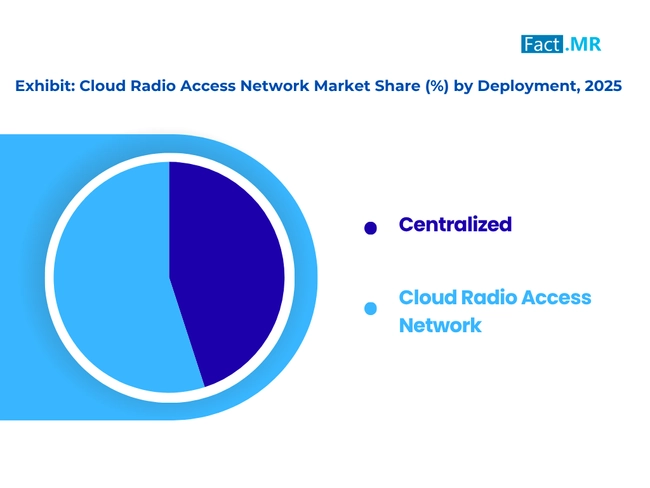

Cloud-Native Flexibility and Urban 5G Demand Position C-RAN as Fastest-Growing Proceeding-Mode Technology

Cloud Radio Access Network (C-RAN) holds the top position with respect to growth among all the preceding-mode categories. This momentum has been driven by the demand for centralized, scalable, and cost-efficient mobile network infrastructure to support next-generation technologies, such as 5G and beyond.

C-RAN can pool baseband processing resources at a central location to minimize hardware costs while maximizing spectral efficiency and allowing for real-time coordination among network nodes. These advantages must have piqued the interest of telecom operators who aim to enhance the quality of service in densely populated urban areas.

Cloud RAN Powers Telecom Network Transformation Amid Surging Data Demand and Infrastructure Modernization

Telecom Operators have constituted the bulk of the rapidly evolving end-user section in the Cloud RAN market. This rapid growth is due to the desire of telecom operators to modernize infrastructure while dealing with huge increases in data demand from mobile applications, IoT, and 5G connectivity.

Cloud RAN provides a modular approach to network extension, allowing telecom companies to separate software from hardware, enabling remote management and dynamic scalability. Operating in a more intense competitive environment now, operators favor solutions that enhance network agility, reduce capital expenditure, and support the future evolution of the networks, precisely the offerings C-RAN brings to the table. Thus, C-RAN stands as a key instrument in the network transformation of major telecoms.

5G Expansion Accelerates Cloud RAN Growth Amid Spectrum Liberalization and Software-Centric Network Demand

5G remains the fastest-growing network type under the Cloud RAN umbrella. The proliferation of 5G networks, which has shaped telecom landscapes over the past few years, is driving the need for more agile, software-centric architectures alongside Cloud RAN. This type of network demands ultra-low latency, immense bandwidth, and the ability to connect vast numbers of devices, all facilities that fit dearly into centralized and virtualized C-RAN.

At an equal pace, governments and industry regulators worldwide are aggressively pushing forward with policy encouragements and spectrum allocations to facilitate rapid 5G deployment. The match-up of 5G requirements and C-RAN capabilities thereby accelerates the unprecedented growth of this segment, putting 5G at the forefront as a market mover.

Competitive Analysis

Competitive Outlook Report: Cloud Radio Access Network Market

Digitalization, automation, and secure data transmission by telecom actors are what is fast-tracking the Cloud Radio Access Network (C-RAN) market. Higher technology adoption is perhaps the only way organizations can improve upon network performance with AI-powered orchestration, cloud-native architecture, and virtualized network elements for information flow and real-time connectivity.

Telecom operators and enterprises are searching for flexible solutions that are scalable and inexpensive with the ever-changing data traffic paradigm and the goals of the 5G deployment itself. Since the industries are focusing more on the intelligent and highly centralized RAN architectures, Cloud RAN is still blossoming as the enabling ground of next-generation mobile network.

In preceding periods, advanced software architecture rendering network virtualization and intelligent automation were the sweet spot of technology majors. On the other hand, the niche vendors have made their crushes in seamless integration, network compliance, and various deployment frameworks.

As low-latency connectivity, operational agility, and data-oriented decision-making established themselves as must-haves, we now are seeing a strong splash of strategic alliances, multi-vendor interoperability, and AI-driven network orchestration coming together. As digital transformation carries on remolding the telecom infrastructures, the competitive landscape is going to be determined by the successful marriage of innovation along with agile ecosystem collaboration in C-RAN architecture.

Key Market Players of Cloud Radio Access Network Market are Nokia Corporation, Ericsson, Huawei Technologies Co. Ltd., ZTE Corporation, Samsung Electronics Co. Ltd., NEC Corporation, Altiostar, Fujitsu Limited, Intel Corporation, Mavenir, Cisco, and other key market players.

Recent Development

- In March 2025, Nokia announced a strategic collaboration with industry partners to advance AI-RAN development. This initiative focuses on enhancing deployment efficiency and real-time optimization of AI-powered Radio Access Networks, aiming to improve network performance, automation, and energy efficiency in 5G and future wireless infrastructure ecosystems.

- In October 2024, Ericsson introduced seven new 5G Advanced software products designed to help Communication Service Providers (CSPs) build high-performing, programmable networks. These solutions enhance spectrum utilization, reduce energy consumption, and support emerging use cases, such as extended reality (XR) and time-critical communications, thereby strengthening Ericsson’s position in next-generation network innovation.

Fact.MR has provided detailed information about the price points of key manufacturers in the cloud radio access network market, positioned across regions, including sales growth, production capacity, and speculative technological expansion, in the recently published report.

Methodology and Industry Tracking Approach

The 2025 global cloud radio access network (C-RAN) market Report by Fact.MR establishes a new standard in strategic telecom intelligence, delivering a precision-crafted, data-rich analysis of how centralized and virtualized RAN architectures are reshaping mobile network ecosystems worldwide. Synthesizing inputs from over 8,000 industry stakeholders across 30 countries, each offering a minimum of 200 qualified responses, the report ensures unmatched analytical depth, stakeholder diversity, and geographic relevance.

The respondent mix was strategically designed, with nearly two-thirds representing telecom operators and enterprise decision-makers, including CTOs, network architecture leads, 5G program heads, and procurement strategists from Tier-1 operators, hyperscalers, and private network providers. The remaining one-third comprised domain experts, including 5G consultants, cloud infrastructure engineers, spectrum planners, and systems integrators, across various sectors such as smart manufacturing, public safety, autonomous mobility, and edge computing.

Spanning a 13-month research period from June 2024 to May 2025, the study captures critical shifts in C-RAN evolution, highlighting trends in virtualized network functions (vNFs), edge-RAN integration, Open RAN adoption, AI-driven orchestration, and multi-access edge computing (MEC) deployment. All data inputs were weighted using advanced stratified modeling to mirror the actual structure of industry roles and regional rollout stages.

Powered by insights from over 250 validated sources, including technical whitepapers, regulatory filings, vendor roadmaps, and deployment data, the report applies advanced analytics such as cluster modeling, time-series forecasting, and scenario simulation to provide robust, high-confidence intelligence.

With market surveillance dating back to 2018, Fact.MR brings unparalleled domain expertise. The 2025 edition serves as an indispensable tool for telecom operators, infrastructure vendors, cloud providers, policy architects, and enterprise 5G strategists aiming to lead in the next phase of low-latency, scalable, and software-defined network transformation.

Segmentation of Cloud Radio Access Network Market Research

-

By Component:

- Solutions

- Services

- Consulting Services

- Implementation Services

- Support Services

-

By Deployment :

- Centralized

- Cloud Radio Access Network

-

By End User :

- Telecom Operators

- Enterprises

-

By Network Type :

- 5G

- 4G

- 3G & 2G

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Trends and Success Factors, including Macro-economic Factors, Market Dynamics, and Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035, including Historical Analysis and Future Projections

- Pricing Analysis

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Component

- Deployment

- End User

- Network Type

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Component

- Solutions

- Services

- Consulting Services

- Implementation Services

- Support Services

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Deployment

- Centralized

- Cloud Radio Access Network

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End User

- Telecom Operators

- Enterprises

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Network Type

- 5G

- 4G

- 3G & 2G

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia Pacific

- Middle East & Africa

- North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia Pacific Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast to 2035 by Component, Deployment, End User, and Network Type for 30 Countries

- Competitive Assessment, Company Share Analysis by Key Players, and Competition Dashboard

- Company Profile

- Nokia Corporation

- Ericsson

- Huawei Technologies Co. Ltd.

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- NEC Corporation

- Altiostar

- Fujitsu Limited

- Intel Corporation

- Mavenir

- FAQs -

What was the Global Cloud Radio Access Network Market Size Reported by Fact.MR for 2024?

The global Cloud Radio Access Network Market was valued at USD 9,169 Million in 2024.

Who are the Major Players Operating in the Cloud Radio Access Network Market?

Prominent players in the market are Nokia Corporation, Ericsson, Huawei Technologies Co. Ltd., ZTE Corporation, Samsung Electronics Co. Ltd., NEC Corporation, Altiostar, Fujitsu Limited, Intel Corporation, Mavenir, Cisco, and other key market players.

What is the Estimated Valuation of the Cloud Radio Access Network Market in 2035?

The market is expected to reach a valuation of USD 106,430 Million in 2035.

What Value CAGR did the Cloud Radio Access Network Market Exhibit Over the Last Five Years?

The historic growth rate of the Cloud Radio Access Network Market was 22.3% from 2020 to 2024.