Carbon and Graphite Market

Carbon and Graphite Market Analysis, By Product Type, and By Region - Market Insights 2025 to 2035

Analysis of the Carbon and Graphite Market Covering 30+ Countries, Including Analysis of the US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea, and many more

Carbon and Graphite Market Outlook (2025 to 2035)

The carbon and graphite industry will be valued at USD 20.24 billion by 2025 end, as per Fact.MR analysis, carbon, and graphite will grow at a CAGR of 5.9% and reach USD 35.84 billion by 2035.

In 2024, the global industry witnessed a rebound after pandemic-related volatility and early post-pandemic growth in 2023. It was boosted by consistent momentum in the electric vehicle (EV) and energy storage industries, which were powered by increased uptake of lithium-ion batteries, in which graphite is used as a crucial anode material.

The Asia Pacific, particularly China, saw higher graphite exports and resumed local mining following the relaxation of regulations. In contrast, European and North American synthetic graphite manufacturers had higher input costs as a result of energy price volatility and logistics bottlenecks, marginally impacting margins.

Construction activity accelerated in emerging economies such as India and Southeast Asia, driving increased demand for carbon products in concrete additives and steelmaking. At the same time, advanced electronics and photovoltaics industries picked up, supporting graphite's pivotal role in miniaturized thermal management solutions.

Looking to 2025 and beyond, persistent demand for green energy infrastructure, the revival of steel manufacturing, and government-supported EV adoption incentives are likely to cement growth paths. The classification of graphite as a critical mineral in the USA, EU, and Japan also further bolsters supply chain resilience efforts, potentially driving investments in local and alternative graphite sources. Technological innovation in synthetic graphite manufacturing and recycling will also define future trends.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 20.24 billion |

| Industry Value (2035F) | USD 35.84 billion |

| Value-based CAGR (2025 to 2035) | 5.9% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey on the Carbon and Graphite Industry

Fact.MR Survey Findings: Trends (2024 to 2025)

(n = 480 stakeholders; USA, Western Europe, China, Japan, South Korea | Surveyed Q4 2024)

Stakeholders' Top Priorities

Thermal & Electrical Performance: 84% ranked thermal/electrical conductivity as "mission-critical" in electronics, EV batteries, and high-heat industrial applications.

Purity & Customization: 71% required high-purity graphite (≥99.9%) and form-specific customization (powder, flakes, fibers).

Regional Variance:

USA: 67% emphasized local sourcing owing to IRA-related reshoring incentives.

Europe: 81% focused on low-carbon production (graphitization from renewables).

China: 72% focused on capacity scaling and cost-competitiveness.

Japan/South Korea: 64% looked for ultra-fine graphite grades for semiconductor and fuel cell applications.

Technological Adoption & Trends

China: 62% of OEMs are investing in synthetic graphite for high-density EV batteries.

South Korea: 54% are testing nano-graphite in next-generation flexible electronics.

USA: 48% testing recycled carbon materials for cost mitigation.

Japan: Only 29% are utilizing graphene-enhanced composites today because they are expensive per gram.

ROI Insights:

Western Europe: 74% were able to realize cost-effectiveness for graphite-based thermal management systems in data centers in 2 years.

Japan/South Korea: ROI is longer (~4-5 years) in low-volume industries (e.g., medical devices).

Material Preferences & Supply Strategy

Natural Graphite: Preferred by 58% worldwide for anode uses (particularly China).

Synthetic Graphite: 65% preferred in the USA and EU for greater purity and performance.

Graphene: Niche still - just 22% actively using it, but 44% intend adoption by 2027.

Regional Insights:

China: 77% intend vertical integration into upstream graphite mining.

EU: 61% look for non-China sources due to critical raw materials dependency issues.

USA: 53% moving towards secondary graphite recovery (urban mining) programs.

Price Sensitivity & Risk Management

Global Consensus: 88% cited supply chain volatility and raw material inflation as key concerns.

USA/Europe: 69% will pay 10-15% more for ESG-compliant graphite.

China/Japan/Korea: 74% requested price locks or long-term contracts because of extreme cost volatility in Q3 2024.

South Korea: 47% expressed interest in forming joint ventures with miners to mitigate the risk of pricing.

Value Chain Pain Points

Manufacturers:

USA: 61% mentioned labor and energy prices in graphite refining.

Europe: 58% cited REACH and carbon tax burdens.

China: 63% battled export controls on graphite.

OEMs & End-Users:

Japan: 51% grumbled about variable flake size in imports.

Korea: 46% suffered from port congestion delays.

EU: 42% reported certification and traceability issues stalling procurement timelines.

Future Investment Priorities

Global Trend: 72% will invest in graphite recycling or synthetic graphite R&D.

USA: 59% considering domestic processing capacity for anode-grade graphite.

Europe: 64% targetting net-zero carbon material, especially through renewable energy-driven graphitization.

China: 66% targeting micronized graphite scaling for export battery industries.

Japan/Korea: 51% on advanced graphite composites for hydrogen and aerospace technology.

Regulative Influence

USA: 69% indicated that the Inflation Reduction Act (IRA) is a "game-changer" for reshoring battery-grade graphite.

EU: 78% concurred that the Critical Raw Materials Act generated constructive pressure for local graphite procurement.

China: 66% affected by their own export licensing controls during Q3 2024.

Japan/Korea: 38% reported regulatory neutrality, with low pressure but high innovation pull.

Conclusion: Cross-Consensus and Divergence

Consensus:

Strong demand for thermally conductive, high-purity carbon/graphite.

Price volatility and supply risks are urgent challenges.

OEMs in regions are willing to invest in R&D for sustainable or advanced use.

Key Variances:

USA: Spurred by reshoring and recycling.

Europe: Sustainability and traceability drive decision-making.

China: Ahead on scale and cost-effectiveness but hindered by export policy.

Japan/Korea: Concentrating on niche innovation for fuel cells, semiconductors, and ultra-pure grades.

Strategic Insight:

To succeed, suppliers will have to localize supply strategies, deliver form-grade precision, and invest in both material innovation and green processing technology.

Government Regulations on the Carbon and Graphite Industry

| Country | Policies, Regulations, and Certifications |

|---|---|

| USA |

|

| Canada |

|

| Germany |

|

| France |

|

| UK |

|

| Italy |

|

| Japan |

|

| South Korea |

|

| China |

|

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Market Analysis

The industry is set for steady expansion, with demand fueled by skyrocketing demand for EV batteries, steel production, and high-performance electronics. Decarbonization and greener industrial processes are being promoted by regulatory drivers, which are spurring the transition to next-generation graphite materials. Winners are synthetic graphite manufacturers and battery-grade carbon suppliers, with traditional foundry-grade suppliers under pressure to upgrade or merge.

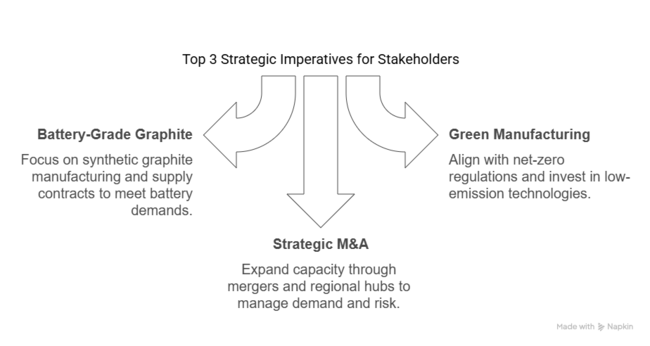

Top 3 Strategic Imperatives for Stakeholders

Expedite Battery-Grade Graphite Integration

Invest heavily in high-purity synthetic graphite manufacturing for lithium-ion battery application, with executives prioritizing this investment. Form joint ventures or offtake agreements with EV and battery OEMs to enter into long-term supply contracts. Expedite technology upgrades (i.e., graphitization furnaces) to achieve battery-grade quality requirements, particularly in North America and the EU, where local sourcing is increasingly a mandate under IRA and CBAM structures.

Align with Green Manufacturing and Emissions Regulations

Companies need to align operations with changing net-zero requirements and local decarbonization regulations. This involves investing in low-emission manufacturing technologies (e.g., arc furnaces powered by renewable energy), obtaining ISO 14001 certification, and implementing circular economy strategies (e.g., recycling graphite for anode material). Strategic compliance makes companies eligible for government subsidies and preferred vendor status in regulated areas such as Western Europe and Japan.

Increase Capacity Through Strategic M&A and Regional Hubs

To address skyrocketing demand and manage risk diversification, firms should seek out M&A in graphite-rich areas (Africa, Australia) and build out modular processing hubs in the vicinity of high-growth end-use clusters (EV in USA/EU, semiconductors in South Korea/Japan). Enhance channel partnerships with Asia-Pacific distributors to obtain midstream and downstream margins and solidify R&D pipelines for next-generation composite and conductive carbon materials.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

|

High |

|

Medium |

|

High |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Secure Non-China Graphite Sources | Run feasibility and risk audit on sourcing from Mozambique, Tanzania, and Canada. |

| Customer-Aligned Product Development | Initiate OEM feedback loop for hybrid graphite-carbon insert demand in EV batteries. |

| Aftermarket Channel Expansion | Launch pilot incentive program for aftermarket distributors in Europe and India. |

| Carbon-Neutral Roadmap Acceleration | Commission third-party audit to identify emission hotspots in synthetic production. |

| Electrode Demand Forecasting | Collaborate with Tier-1 steelmakers to model 18-month electrode consumption shifts. |

For the Boardroom

To stay ahead in the industry, clients must pivot from a volume-centric approach to a resilience-first roadmap. With China’s dominance facing rising geopolitical scrutiny and new ESG mandates tightening across regions, leadership should prioritize diversifying sourcing beyond Asia, fast-track product innovations for EV batteries and UHP electrodes, and form preemptive partnerships in low-emission synthetic graphite.

This intelligence signals a critical inflection point: instead of chasing short-term price arbitrage, firms should invest in future-proofing through supply chain insulation, vertical integration in key applications, and carbon footprint transparency-defining moves that will set apart next-decade leaders from legacy players.

Segment-wise Analysis

By Product Type

The carbon and graphite electrodes segment is expected to register a 42.0% share in 2025.

Carbon and graphite electrodes are in great demand because of their superior electrical conductivity, thermal resistance, and mechanical strength, which make them a vital component in high-temperature industrial processes. They are mostly applied in electric arc furnace (EAF) steelmaking, where they are used as electric conductors to produce the extreme heat needed to melt scrap metal. This process is also gaining worldwide recognition as it produces lower carbon emissions compared to conventional blast furnace technologies.

Additionally, and more importantly, they are critical in the manufacture of essential industrial products like silicon metal, elemental phosphorus, and several ferroalloys. Their strength at high temperatures without degradation also makes them ideal for reuse under harsh operating conditions.

Country-wise Analysis

| Countries | CAGR |

|---|---|

| USA | 4.6% |

| UK | 5.9% |

| France | 4.3% |

| Germany | 5.3% |

| Italy | 4.5% |

| South Korea | 7.7% |

| Japan | 7.1% |

| China | 8.3% |

USA

The industry in the USA is estimated to expand with a 4.6% CAGR between 2025 and 2035. The USA is still among the most developed yet vibrant industries for product materials due to ongoing innovation and a strong industrial base. Clean energy focus, aerospace growth, and EV production are supporting long-term demand for synthetic as well as natural graphite in the nation. Lithium-ion battery manufacturing, driven by demand for EVs and energy storage systems, is a key driver, particularly in states such as Nevada and Michigan.

Graphite's thermal conductivity and low density are also pushing it into use in electronics and defense-grade composites. Strategic investments by the big players, such as GrafTech and new start-ups in next-generation carbon composites and fuel cell technologies, are expanding the envelope of applications. USA government assistance towards cleaner manufacturing and less dependence on Chinese imports of graphite boosts local supply chains.

UK

The industry in the UK is expected to expand at a rate of 5.9% CAGR during 2025 to 2035. The demand for the UK industry is rising strong, supported by high uptake for green technologies and government strategic plans for industrial decarbonization. With a strong aerospace industry and increasing emphasis on electric mobility, materials are increasingly being used for battery systems, lightweight structures, and thermal management. The UK is making investments in cutting-edge material R&D through universities and innovation centers like the High Value Manufacturing Catapult, driving the creation of carbon fibers and graphite composites.

Furthermore, applications are expanding across renewable energy, including wind turbines and hydrogen storage. The UK’s commitment to net-zero emissions by 2050 has driven the need for next-generation energy storage solutions, where graphite plays a pivotal role. Local companies are also tapping into the growing demand for conductive materials in electronics and additive manufacturing.

France

France sales are expected to grow at a CAGR of 4.3% from 2025 to 2035. As France intensifies its efforts toward industrial modernization and green energy transition, demand for product materials is expanding, particularly in aerospace, automotive, and energy applications. Airbus and Safran’s emphasis on lightweight materials for aircraft manufacturing is driving the consumption of carbon fibers and composites.

The commitment to clean mobility and battery innovation by the French government highlighted through initiatives such as the European Battery Alliance sustains graphite demand within the EV battery value chain. The application of graphite in nuclear reactors and fuel cells also ties into France's energy policy, wherein nuclear is an essential source. France's sophisticated metallurgy and electronics sectors also provide stable demand for synthetic graphite electrodes and conductive carbon products.

Germany

The industry in Germany is projected to grow at a CAGR of 5.3% between 2025 and 2035. As Europe’s industrial powerhouse, Germany presents a lucrative environment for the carbon and graphite industry, fueled by its leadership in automotive engineering, electronics, and renewable energy. Germany’s robust automotive sector is increasingly integrating graphite in EV batteries and lightweight composite parts to improve energy efficiency.

In addition, carbon materials are key in new-generation manufacturing fields, including 3D printing, robotics, and semiconducting processing. Energiewende policy has additionally accelerated demand for electrodes based on carbon, fuel cells, and energy storage technologies.

Italy

The industry in Italy is projected to grow at a CAGR of 4.5% between 2025 and 2035. Italy's demand for products is rooted in a broad array of applications across automotive parts, steelmaking, building materials, and electronics. The nation's manufacturing base is increasingly moving toward lightweight and high-strength materials, especially for electric vehicles and rail infrastructure. Increased use of lithium-ion batteries, coupled with EU mandates for reducing emissions, underpins consistent graphite consumption.

Moreover, Italy's historical strengths in steel and metallurgy underpin demand for electric arc furnace (EAF) steelmaking, which requires graphite electrodes.

South Korea

The industry in South Korea is expected to expand at a CAGR of 7.7% during the period 2025 to 2035. South Korea's global dominance in electronics and battery production makes it one of the fastest-growing industries for graphite. Being the home to tech giants LG and Samsung, South Korea is substantially increasing the production of lithium-ion batteries, which is driving demand for high-purity graphite.

Graphite also finds large-scale application in semiconductor heat spreading, conductive polymers, and high-level chip packaging albeit at the forefront of Korea's export-oriented economy. Hydrogen power and the shift towards carbon-free technologies by the country further underscore expanded applications in carbon-based electrodes and fuel cells. In addition, public-private sector investments into material science are facilitating the quicker advancement of carbon composites towards aerospace and military applications.

Japan

Japan's sales are expected to grow at a CAGR of 7.1% from 2025 to 2035. Japan is the epitome of technical development and materials science, with a high demand for products in sophisticated uses such as fuel cells, lithium-ion batteries, and high-frequency semiconductors.

Japan is strategically investing in future battery chemistries in which synthetic graphite is an indispensable material. Japan's automobile titans, Toyota and Honda, are incorporating carbon composites to enhance fuel efficiency and structural strength of vehicles. In addition, the emphasis by the country on hydrogen fuel cell cars and green ammonia enables graphite to find use in electrode materials. Additionally, Japan has a high density of electronics production where graphite's conductivity and heat conduction are vital to performance and miniaturization.

China

The industry in China is projected to develop at a CAGR of 8.3% during the period 2025 to 2035. Being the world's largest producer and consumer of graphite, China is a key driver of the global supply and prices. China dominates more than 60% of the world's natural graphite production and has a monopoly on downstream processing for battery-grade graphite. Its vigorous march toward electrification, with more than 70% of global production of EV batteries, is also hastening synthetic and natural graphite demand.

Chinese players are vertically integrating in order to preserve ownership of the mining, purification, and anode manufacturing businesses. The dual carbon objectives and the government's Five-Year Plans (peak in 2030, neutrality by 2060) are further enhancing the consumption of product for applications in energy storage, hydrogen fuel systems, and renewable power networks.

Market Share Analysis

Tokai Carbon Co., Ltd. (Japan)

Share: ~6.2% of global graphite electrodes and specialty carbon

Tokai Carbon is among the biggest producers of graphite electrodes and fine carbon products in Japan and worldwide. It is increasing its share in Asia and North America. The firm also manufactures carbon blacks and anode materials for lithium-ion batteries, aiming for the EV boom.

Showa Denko Materials Co., Ltd. (Japan)

Share: ~4.0% in synthetic graphite and battery materials

Showa Denko is one of the key suppliers of high-purity graphite, anode materials, and conductive additives. With the focus of the company on lithium-ion battery supply chains, particularly in China and Japan, it is a significant player in the battery-grade graphite industry.

Syrah Resources (Australia)

Share: ~3.3% of world natural graphite supply

Syrah Resources is running the Balama mine in Mozambique and producing graphite in the USA (Vidalia plant). It's becoming a principal non-Chinese source of battery-grade graphite, supplying Tesla and other OEMs, and positioning itself for USA IRA incentives for domestic sourcing.

SGL Carbon SE (Germany)

Share: ~4.7% of global specialty graphite and composites

SGL Carbon supplies automotive, industrial, energy, and semiconductor industries. It is a leading European company with experience in isostatic graphite, carbon fiber-reinforced composites, and thermal management solutions. The firm is taking advantage of EU clean energy and e-mobility targets.

Zhongtai Graphite Co., Ltd. (China)

Share: ~3.0% of global natural flake graphite

Zhongtai is a leading Chinese producer of natural graphite and spherical graphite used in batteries. It supplies mainly domestic and Asian EV industries and is increasing exports to satisfy international demand.

Fangda Carbon New Material Co., Ltd. (China)

Share: ~6.9% of global graphite electrodes

Fangda is a leading graphite electrode producer in China, with dominant power in Asia and increasing exports. It's vertically integrated with needle coke production, providing cost advantage and volume flexibility.

Other Key Players

- Cabot Corporation

- Mitsubishi Chemical Holdings Corporation

- Solvay SA

- GrafTech International Holdings Inc

- Mersen S.A

- HEG Ltd

- Mitsubishi Chemical Carbon Fiber and Composites, Inc

- Hexcel Corporation

- Morgan Advanced Materials Plc

Segmentation

By Product Type:

- Carbon & Graphite Electrodes

- Carbon & Graphite Fibers

- Carbon & Graphite Powders

- Other Product Types

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

Table of Content

- Executive Summary

- Market Overview

- Market Outlook, By Region

- Market Trend Analysis, 2025 to 2035

- Global Market Analysis and Forecast, By Product Type, 2025 to 2035

- Carbon & Graphite Electrodes

- Carbon & Graphite Fibers

- Carbon & Graphite Powders

- Other Product Types

- Global Market Analysis and Forecast, By Region, 2025 to 2035

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

- North America Market Analysis and Forecast, 2025 to 2035

- Europe Market Analysis and Forecast, 2025 to 2035

- Asia Pacific Market Analysis and Forecast, 2025 to 2035

- Latin America Market Analysis and Forecast, 2025 to 2035

- Middle East & Africa Market Analysis and Forecast, 2025 to 2035

- Competition Landscape

- Cabot Corporation

- Mitsubishi Chemical Holdings Corporation

- Solvay SA

- GrafTech International Holdings Inc

- Mersen S.A

- HEG Ltd

- Mitsubishi Chemical Carbon Fiber and Composites, Inc

- Hexcel Corporation

- Morgan Advanced Materials Plc

- Assumptions & Acronyms Used

- Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

How big is the carbon and graphite market?

The industry is anticipated to reach USD 20.24 billion in 2025.

What is the outlook on carbon and graphite sales?

The industry is predicted to reach a size of USD 35.84 billion by 2035.

Who are the key carbon and graphite companies?

Prominent players include Cabot Corporation, Mitsubishi Chemical Holdings Corporation, Solvay SA, GrafTech International Holdings Inc, Mersen S.A, HEG Ltd, Mitsubishi Chemical Carbon Fiber and Composites, Inc, Hexcel Corporation, and Morgan Advanced Materials Plc.

Which types of carbon and graphite are widely used?

Carbon and graphite electrodes are widely used.

Which country is likely to witness the fastest growth in the carbon and graphite market?

China, set to grow at 8.3% CAGR during the forecast period, is poised for the fastest growth.