Automotive Fuel Cell Systems Market

Automotive Fuel Cell Systems Market Size and Share Forecast Outlook 2025 to 2035

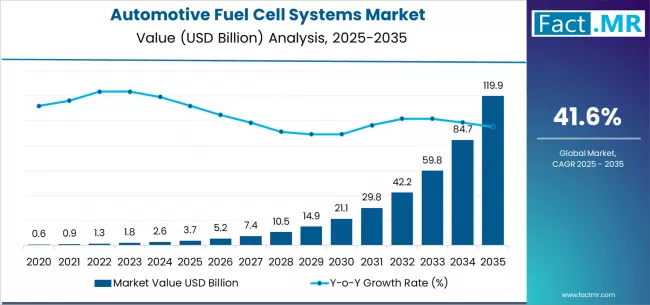

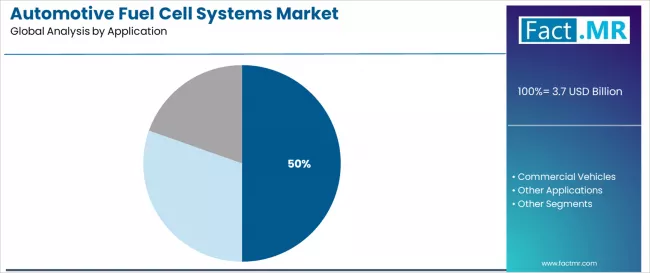

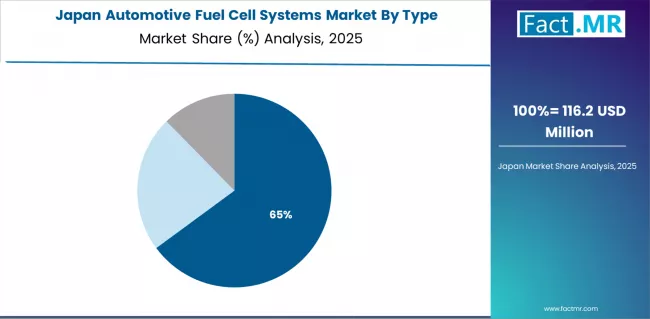

Automotive fuel cell systems market is projected to grow from USD 3.7 billion in 2025 to USD 119.9 billion by 2035, at a CAGR of 41.6%. PEMFC will dominate with a 65.0% market share, while passenger vehicles will lead the application segment with a 50.0% share.

Automotive Fuel Cell Systems Market Forecast and Outlook 2025 to 2035

The automotive fuel cell systems market trajectory from USD 3.7 billion in 2025 to USD 119.9 billion by 2035 represents extraordinary expansion, the market will rise at a CAGR of 41.6% which demonstrating accelerating adoption of hydrogen fuel cell technologies and massive investment in clean mobility infrastructure across automotive manufacturers, commercial fleet operators, and transportation service providers worldwide.

The market operates within a transformative landscape characterized by expanding zero-emission vehicle capabilities, automotive decarbonization initiatives, and growing demand for hydrogen-powered transportation across passenger vehicles, commercial trucks, and specialized mobility applications.

Quick Stats for Automotive Fuel Cell Systems Market

- Automotive Fuel Cell Systems Market Value (2025): USD 3.7 billion

- Automotive Fuel Cell Systems Market Forecast Value (2035): USD 119.9 billion

- Automotive Fuel Cell Systems Market Forecast CAGR: 41.6%

- Leading Type in Automotive Fuel Cell Systems Market: PEMFC Systems

- Key Growth Regions in Automotive Fuel Cell Systems Market: Asia-Pacific, Europe, and North America

- Key Players in Automotive Fuel Cell Systems Market: Toyota, Hyundai, Honda, Ballard Power

- Where revenue comes from - Now Vs Next (Industry-level view)

Market dynamics reflect increasing investment in fuel cell infrastructure, accelerating adoption of advanced hydrogen technologies, and rising demand for versatile propulsion solutions that support diverse range requirements and operational specifications across global automotive networks.

Procurement patterns demonstrate shifting preferences toward PEMFC systems that combine efficiency precision, operational reliability, and vehicle integration capabilities. Automotive manufacturers and commercial fleet operators prioritize system durability, hydrogen efficiency, and operational performance when selecting fuel cell solutions for critical applications including passenger transportation, logistics delivery, commercial trucking, and public transit procedures.

The market benefits from expanding government support activities across automotive, energy, and environmental sectors, driving demand for sophisticated fuel cell equipment that enables complex mobility operations. Growing emphasis on carbon neutrality compliance and emission reduction creates opportunities for manufacturers offering certified fuel cell systems with comprehensive performance and sustainability capabilities.

Technology advancement influences market evolution through integration of advanced stack designs, hydrogen storage capabilities, and enhanced power management features that improve vehicle efficiency and system durability outcomes. Manufacturers focus on developing fuel cell solutions that accommodate varying power ranges, vehicle types, and operational parameters while maintaining precise performance throughout extended service periods.

The automotive fuel cell systems market demonstrates exceptional growth fundamentals driven by expanding clean mobility activities, automotive infrastructure development, and increasing demand for hydrogen-powered vehicle equipment across multiple transportation sectors and geographic regions.

The first half of the decade (2025-2030) will witness market growth from USD 3.7 billion to approximately USD 24.8 billion, adding USD 21.1 billion in value, representing 18% of the total forecast period expansion. This phase will be characterized by rapid adoption of PEMFC systems, driven by automotive electrification programs and increasing demand for zero-emission solutions across passenger vehicle applications.

The latter half (2030-2035) will experience accelerated growth from USD 24.8 billion to USD 119.9 billion, representing an addition of USD 95.1 billion or 82% of the decade expansion. This period will be defined by mass market penetration of commercial fuel cell technologies, integration with vehicle management systems, and seamless connectivity with existing automotive infrastructure.

As the market matures, strategic collaborations between automakers, fuel cell developers, and hydrogen infrastructure providers are expected to intensify, enabling ecosystem-wide standardization and interoperability. Moreover, regional governments are likely to accelerate incentives and regulatory frameworks to promote large-scale hydrogen adoption, thereby strengthening the foundation for a resilient, low-carbon automotive future.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | PEMFC systems (passenger vehicles) | 65% | Standard configurations, early adoption |

| Passenger vehicle applications | 50% | Consumer market, limited models | |

| Asia-Pacific region | 45% | Government support, early deployment | |

| Future (3-5 yrs) | Advanced PEMFC systems | 67-70% | Enhanced efficiency, cost reduction |

| Passenger vehicle applications | 52-55% | Mass market adoption, model expansion | |

| Commercial vehicle applications | 32-35% | Fleet electrification, logistics | |

| SOFC systems | 18-22% | High-temperature applications | |

| MCFC systems | 12-16% | Specialized applications, stationary | |

| Asia-Pacific dominance | 46-49% | Manufacturing hub, policy support | |

| European growth | 33-36% | Regulatory push, hydrogen infrastructure |

Automotive Fuel Cell Systems Market Key Takeaways

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.7 billion |

| Market Forecast (2035) | USD 119.9 billion |

| Growth Rate | 41.6% CAGR |

| Leading Type | PEMFC Systems |

| Primary Application | Passenger Vehicles |

The market demonstrates exceptional growth fundamentals with PEMFC systems capturing dominant share through proven efficiency and automotive application optimization. Passenger vehicle applications drive primary demand, supported by government incentives and automotive manufacturer commitments to hydrogen mobility. Geographic distribution remains concentrated in Asia-Pacific with established hydrogen infrastructure, while European and North American markets show accelerating adoption rates driven by decarbonization programs and rising fuel cell investment.

Imperatives for Stakeholders in Automotive Fuel Cell Systems Market

Design for automotive integration, not just power output

- Offer complete fuel cell systems: hydrogen stacks + power management + control systems + cooling systems + maintenance protocols + technical training programs.

- Preconfigured automotive workflows: power sizing, thermal management, vehicle integration, and fleet management systems for transportation operations.

Vehicle platform readiness

- Real-time performance monitoring, hydrogen efficiency tracking, and smart vehicle integration (fleet management systems, operational monitoring platforms).

Quality-by-design approach

- Advanced stack materials, reliable power systems, automotive environment compatibility, and comprehensive vehicle documentation.

Value-based pricing models

- Clear base system price + transparent service tiers (maintenance services, monitoring systems, performance guarantees); subscriptions for monitoring and optimization services.

Segmental Analysis

The automotive fuel cell systems market is primarily segmented by type into proton exchange membrane fuel cell (PEMFC), solid oxide fuel cell (SOFC), and molten carbonate fuel cell (MCFC) systems. Among these, PEMFC systems account for the largest market share, estimated at around 65%, owing to their superior efficiency, faster start-up time, and adaptability across both passenger and commercial vehicle platforms.

Their compact design, operational flexibility, and compatibility with existing automotive powertrains make them the preferred choice for manufacturers transitioning toward zero-emission propulsion systems. Furthermore, the use of advanced membrane materials and optimized stack configurations enhances energy conversion efficiency, enabling stable power output even under variable driving conditions.

The segment’s dominance is reinforced by continuous R&D investments focused on improving cost competitiveness and operational durability. PEMFC systems also align closely with global emission reduction policies, supporting large-scale adoption under green mobility initiatives.

Their seamless integration into electric vehicle architectures, coupled with lower maintenance requirements and scalability advantages, solidifies their position as the technological backbone of the automotive fuel cell ecosystem. In contrast, SOFC and MCFC systems cater to specialized, high-temperature, or stationary applications, contributing to diversification but with limited deployment in mass-market vehicles.

Regional segmentation highlights Asia-Pacific as the dominant hub for automotive fuel cell system development and deployment. Japan and South Korea lead in vehicle commercialization and hydrogen infrastructure readiness, supported by strong policy frameworks and automaker investments in hydrogen technology. China’s rapidly expanding hydrogen economy, backed by industrial-scale production and local government incentives, further accelerates market growth across the region. These nations are not only early adopters but also key exporters of fuel cell components and integrated vehicle systems.

North America and Europe, meanwhile, exhibit robust growth trajectories driven by carbon-neutral mobility targets and collaborative ventures between automakers, technology providers, and energy companies. The market in the USA benefits from initiatives under the Hydrogen Energy Earthshot program and private investments in refueling infrastructure, while Europe’s Green Deal supports large-scale adoption of fuel cell vehicles across member states. Together, these regions contribute significantly to technological advancement and standardization in fuel cell systems, ensuring a globally competitive and interconnected hydrogen mobility ecosystem by 2035.

Why are SOFC and MCFC Systems Gaining Relevance Despite Their Smaller Market Share?

While PEMFC remains the benchmark for automotive integration, SOFC and MCFC technologies are gaining relevance for niche, high-performance applications. Solid oxide fuel cell (SOFC) systems hold about 20% of the market share and are distinguished by their ability to operate at high temperatures, allowing efficient energy conversion and compatibility with alternative fuels such as biogas and natural gas.

Their long operational life and capacity for combined heat and power (CHP) generation make them particularly attractive for hybrid or auxiliary automotive power systems. This positions SOFCs as strategic complements in vehicle platforms requiring extended range or consistent high-load performance.

MCFC systems, representing approximately 15% of market value, cater to specialized industrial and heavy-duty applications where high-temperature operation supports robust power generation efficiency. Their use is often associated with stationary or auxiliary automotive systems, enabling manufacturers to explore flexible fuel options and integrate hydrogen-based power sources in industrial fleets.

Although both SOFC and MCFC systems face commercialization challenges related to cost and thermal management, ongoing advancements in material science and system integration are expected to expand their automotive viability, particularly in heavy commercial and logistics vehicles over the long term.

Why are Passenger Vehicles Driving Fuel Cell Adoption by Application?

Passenger vehicles currently dominate with around 50% market share, driven by accelerating consumer adoption of zero-emission mobility and the global transition toward hydrogen-powered electric drivetrains.

Automakers such as Toyota, Hyundai, and Honda have actively expanded their hydrogen vehicle lineups, demonstrating strong technical validation of PEMFC technology in personal transportation. Government subsidies, tax incentives, and stringent emission targets have collectively strengthened passenger vehicle deployment, particularly in countries with robust hydrogen refueling networks like Japan, South Korea, and select European nations.

This segment benefits from continuous advancements in stack miniaturization, fuel efficiency, and hydrogen storage technologies that optimize vehicle performance while maintaining driving comfort. Moreover, the consumer shift toward sustainable lifestyles, coupled with regulatory support for low-emission mobility, ensures sustained growth in passenger applications.

Despite challenges related to infrastructure limitations and fuel costs, passenger fuel cell vehicles represent the foundation for future hydrogen mobility ecosystems, influencing broader technological diffusion across the commercial and fleet sectors.

Why is the Commercial Vehicle segment emerging as a Major Opportunity for Fuel Cell Deployment?

Commercial vehicles—encompassing buses, trucks, and logistics fleets—represent a rapidly expanding segment within the automotive fuel cell systems market. The need for high-load, long-range capabilities, and quick refueling advantages makes hydrogen fuel cells an ideal solution for heavy-duty applications where battery-electric alternatives face performance constraints. Fleet operators and logistics companies are increasingly adopting fuel cell trucks and buses to comply with emission norms while maintaining operational efficiency, particularly in long-haul transportation corridors.

The growth of this segment is reinforced by government-led pilot programs and collaborations between fuel cell manufacturers and commercial fleet providers. Hydrogen-powered buses and trucks are being deployed in Europe, China, and North America to meet decarbonization goals, supported by infrastructure investments in refueling networks and hydrogen production hubs.

Over the forecast period, the commercial vehicle segment is expected to record the highest growth rate, driven by total cost-of-ownership benefits, operational scalability, and strategic policy alignment toward sustainable freight and public transport systems.

What are the Drivers, Restraints, and Key Trends of the Automotive Fuel Cell Systems Market?

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Government policies & emission regulations (zero-emission mandates, carbon neutrality targets) | ★★★★★ | Global regulatory push requires advanced fuel cell systems with enhanced efficiency capabilities and environmental compliance proven effective across automotive applications. |

| Driver | Automotive decarbonization & manufacturer commitments (hydrogen strategies, clean mobility) | ★★★★★ | Transforms automotive requirements from "conventional engines" to "zero-emission systems"; manufacturers that offer certified fuel cell systems and infrastructure support gain competitive advantage. |

| Driver | Hydrogen infrastructure development & energy transition (fueling stations, green hydrogen) | ★★★★☆ | Global energy transition needs sophisticated, scalable fuel cell systems; demand for hydrogen-powered and efficient mobility solutions expanding addressable market. |

| Restraint | High system cost & infrastructure requirements (especially for smaller manufacturers) | ★★★★☆ | Smaller automotive players defer fuel cell adoption; increases price sensitivity and slows advanced technology deployment in cost-conscious markets. |

| Restraint | Alternative electric solutions (battery EVs, hybrid systems, charging infrastructure) | ★★★☆☆ | Alternative propulsion methods offer established automotive supply chains and different cost structures, potentially limiting fuel cell adoption in specific vehicle segments. |

| Trend | System integration & vehicle connectivity (smart fuel cells, predictive maintenance) | ★★★★★ | Advanced monitoring properties, vehicle optimization, and data analytics transform automotive operations; technology integration and performance enhancement become core value propositions. |

| Trend | Cost reduction & mass production (economies of scale, manufacturing efficiency) | ★★★★☆ | Manufacturing scale solutions for cost optimization and specific applications; specialized production capabilities drive competition toward affordable systems. |

Analysis of the Automotive Fuel Cell Systems Market by Key Country

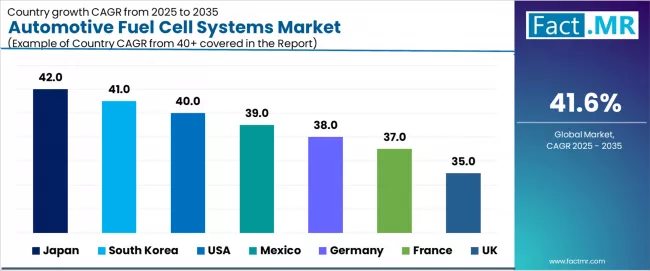

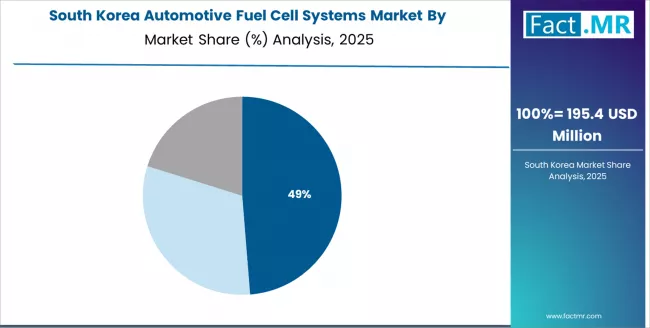

The automotive fuel cell systems market demonstrates varied regional dynamics with Growth Leaders including Japan (42.0% growth rate) and South Korea (41.0% growth rate) driving expansion through automotive manufacturing leadership and hydrogen infrastructure development initiatives.

Strong performers encompass USA (40.0% growth rate), Mexico (39.5% growth rate), and Germany (38.0% growth rate), benefiting from established automotive networks and clean mobility sector growth. Steady Markets feature France (37.0% growth rate) and United Kingdom (35.0% growth rate), where automotive advancement and fuel cell optimization requirements support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through automotive manufacturing excellence and government hydrogen strategies, while North American countries maintain strong expansion supported by environmental regulations and automotive infrastructure investment. European markets show robust growth driven by decarbonization applications and mobility integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| Japan | 42.0% | Focus on automotive integration | Technology competition; cost pressures |

| South Korea | 41.0% | Lead with manufacturing scale | Local competition; infrastructure barriers |

| USA | 40.0% | Push policy-driven adoption | Regulatory changes; alternative technologies |

| Mexico | 39.0% | Offer manufacturing solutions | Currency fluctuations; trade policies |

| Germany | 38.0% | Provide premium systems | Over-regulation; lengthy approvals |

| France | 37.0% | Focus on mobility applications | Compliance costs; market competition |

| UK | 35.0% | Emphasize clean transport | Economic impacts; infrastructure challenges |

Why Does Japan Continue to Drive Global Automotive Fuel Cell Leadership?

Japan’s fuel cell strategy rests on a national vision that treats hydrogen as a core energy vector for transport and industry. Government planning, industry roadmaps, and targeted R&D budgets align OEM priorities with infrastructure deployment, creating predictable demand signals for stack makers, balance-of-plant suppliers, and systems integrators. Supplier qualification cycles remain rigorous, reflecting automotive quality expectations and long product lifecycles; this raises entry barriers while ensuring long-term contract stability for compliant vendors.

Japanese engineering emphasis centers on stack durability, system packaging, and thermal management. Manufacturers prioritize PEMFC configurations optimized for vehicular duty cycles and frequent start-stop profiles. Local research ecosystems refine materials and membrane technologies to extend operational longevity under real-world load patterns, enabling modular stack designs that reduce integration complexity for OEM powertrain teams.

Market structure favors long-term supplier relationships and joint development models. OEMs prefer multi-year development partnerships with tier-1 system integrators that can guarantee traceability and frequent validation testing. Export programs position Japan as a technology provider for Asia-Pacific markets that require high-reliability stacks for buses and heavy trucks.

Strategic Market Indicators:

- National hydrogen roadmap aligning infrastructure roll-out with vehicle procurement targets

- PEMFC stack R&D emphasis on durability and packaging efficiency

- Long procurement lead times favoring suppliers with comprehensive documentation

How Does South Korea Maintain Manufacturing Excellence in Fuel Cell Systems?

South Korea’s fuel cell strategy couples aggressive industrial targets with export orientation. National funding programs mobilize manufacturers, research institutes, and logistics partners to scale stack production and refueling networks. Hyundai and key suppliers drive technical roadmaps that prioritize compact stacks and system modularity for multiple vehicle architectures. Procurement tends toward long-term contracts that stabilize volumes for component producers.

Manufacturing focus lies on automation, process repeatability, and supply-chain resiliency. Smart-factory deployments reduce cycle time and enable tighter tolerances for electrode assembly and membrane handling. Industrial labs and applied research centers validate new coating chemistries and bipolar plate coatings to lower manufacturing cost per kilowatt while preserving performance under duty cycles typical of fleet operations.

Export competitiveness relies on integrated supply chains and logistics engineering. Korean manufacturers secure strategic raw-material agreements and invest in packaging and transport solutions that preserve performance across longer shipment routes. Certification programs emphasize safety and traceability, enabling market access in regions where regulatory alignment is required.

Strategic Market Indicators:

- State R&D and production targets underpinning national stack capacity planning

- Smart-factory adoption improving yield and unit economics

- Export focus driving supply-chain contracting and certification practices

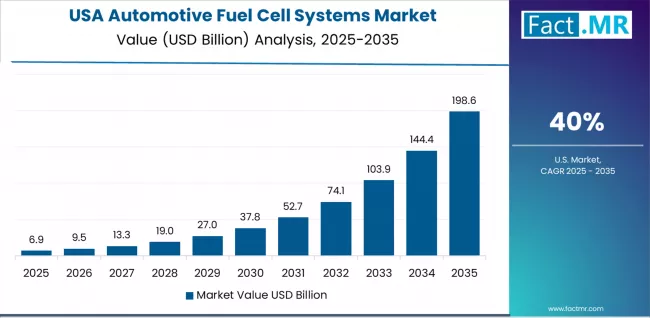

How Is U.S. Market Growth for Automotive Fuel Cells Shaped by Policy and Commercial Demand?

U.S. fuel cell market growth ties closely to state and federal policy frameworks that incentivize zero-emission fleets. California and a subset of coastal states signal near-term procurement targets for buses and medium-duty trucks, generating concentration of demand among fleet operators and public transit agencies. Private fleet pilots and corporate sustainability programs add incremental demand from logistics and last-mile operators seeking longer range than battery platforms can economically provide.

Commercial realities emphasize total cost of ownership. Fleet decision models measure capital cost, fuel cost, refueling cadence, and uptime. Suppliers that can demonstrate predictable service intervals, rapid maintenance turnarounds, and localized technical support obtain preference from large fleet operators. Investment in green hydrogen supply remains uneven, creating localized pockets of higher adoption where renewable hydrogen supply is accessible.

Industrial players deploy interoperability strategies to reduce buyer switching risk. Tier-1 integrators position modular solutions compatible with existing vehicle architectures and fleet management systems. Public-private partnerships fund demonstration corridors and de-risk early commercial rollouts.

Market Intelligence Brief:

- State procurement targets concentrating initial fleet demand

- TCO metrics driving supplier selection and service models

- Public-private corridors accelerating regional hydrogen availability

Why Is Mexico Emerging as a Manufacturing Hub for Automotive Fuel Cell Systems?

Mexico’s appeal arises from nearshoring trends and manufacturing scale advantages. Automotive assembly growth in northern states creates demand for local system integration, retrofitting and OEM supplier diversification. Competitive labor costs and proximity to North American OEMs enable Mexican suppliers to compete on unit economics for medium-scale stack production and component assembly.

Industrial policy supports supplier upgrading and export readiness. Local governments offer production incentives and infrastructure assistance to attract tier-1 investments. Mexican manufacturers pursue partnerships with European and Asian stack developers to obtain technology transfer and quality management capability, enabling faster qualification for regional fleets and industrial users.

Operational focus prioritizes cost-to-serve improvements and supply-chain harmonization. Producers emphasize modular manufacturing lines that integrate quality checkpoints and in-process analytics to satisfy OEM acceptance criteria. Export platforms target U.S. fleets as initial customers, leveraging logistical advantages.

Strategic Market Considerations:

- Nearshoring and proximity to North American fleet demand shaping production location choices

- Technology partnerships enabling rapid supplier upskilling

- Modular manufacturing models lowering qualification time for OEM contracts

How Does Germany Sustain Engineering Leadership in Fuel Cell Deployment?

Germany’s approach centers on engineering depth, systems integration, and regulatory harmonization. Strong industrial research networks supply incremental improvements in stack materials, bipolar plates, and system controls. OEMs and suppliers prioritize validation against stringent European safety and operational standards, making Germany a benchmark market for premium system performance. Manufacturing investments emphasize precision assembly and rigorous lifecycle testing.

Corporate strategies often couple local production capability with export-oriented R&D. German firms leverage joint projects with research institutes to commercialize novel MEA formulations and thermal management solutions. This delivers stack designs optimized for heavy-duty mobility and long-range commercial applications. Certification and conformity processes support a high bar for reliability that appeals to large European fleet customers.

Market incentive frameworks favor sustainability criteria in procurement. Public tenders increasingly incorporate lifecycle emissions and circularity metrics. Suppliers that can demonstrate lower embedded carbon and end-of-life plans gain procurement advantage with public and private fleets.

Market Intelligence Brief:

- Engineering R&D focus on materials and thermal systems for heavy-duty use cases

- Public procurement emphasizing lifecycle emissions and circularity

- Industry–institute collaborations shortening commercialization cycles

When Will France’s Mobility Innovation Translate into Broader Fuel Cell Adoption?

France’s market dynamics hinge on integrated mobility programs and strategic hydrogen infrastructure investments. Municipal and regional transport authorities run pilots for buses and intercity coaches that validate operational economics and refueling logistics. Commercial fleets evaluate range performance, refuel cadence, and depot integration as primary adoption criteria. Suppliers that provide turnkey refueling plus maintenance packages gain early contracts.

Industrial policy supports R&D in PEM durability and stack integration for multi-modal vehicles. French research consortia focus on lowering catalyst loadings and improving membrane life. Collaboration among energy utilities, OEMs, and local governments drives infrastructure pilots that demonstrate fleet viability under urban duty cycles.

Procurement frameworks emphasize operational metrics rather than single-point capital price. Buyers require service level agreements, uptime guarantees, and local technical coverage. Manufacturers with established EU certification and partner service networks are preferred for scaling from pilot to fleet deployment.

Strategic Market Considerations:

- Municipal pilot programs driving initial fleet conversion models

- R&D emphasis on cost reduction for core stack components

- Procurement focus on service guarantees and uptime metrics

Why Does the United Kingdom Prioritize Clean Transport in Fuel Cell Development?

The UK combines national net-zero mandates with targeted funding for hydrogen production and refueling infrastructure. Government programs enable pilot fleets, heavy-goods vehicle demonstrations, and port logistics trials that stress test supply models. Industry consortia integrate stack suppliers, vehicle integrators, and energy providers to build commercially viable refueling ecosystems.

Operational emphasis favors solutions that fit existing fleet workflows. Buyers evaluate depot refueling integration, safety compliance, and interoperability with telematics. Suppliers that can deliver proven maintenance regimes and remote diagnostics capture interest from early commercial adopters. Infrastructure investments in green hydrogen production determine clustering of initial demand.

Export opportunities arise from UK system validation in challenging urban and logistics conditions. Demonstrated performance in commercial pilots positions UK suppliers to offer validated packages to adjacent European markets and commonwealth partners seeking rapid decarbonization pathways.

Market Intelligence Brief:

- National net-zero targets acting as procurement levers for public fleets

- Focus on depot integration and operational compatibility for commercial buyers

- Pilot validation increasing supplier export prospects

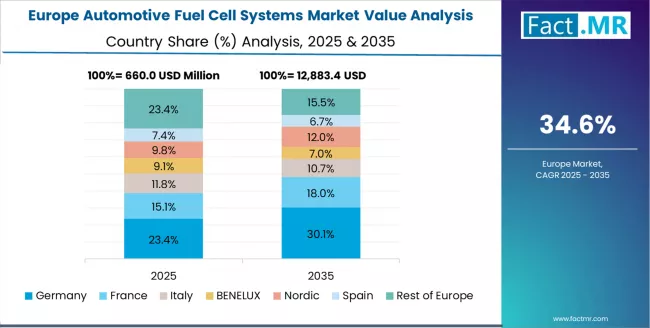

How Is Europe’s Fuel Cell Market Projected to Evolve Between 2025 and 2035?

Europe’s aggregated market will scale rapidly as policies, infrastructure, and fleet procurement converge to support heavy-duty, public transport, and specialized commercial segments. Member-state hydrogen strategies and EU funding programs create coordinated investment signals that reduce early adopter risk for fleet operators and system suppliers. Markets with established green hydrogen projects and corridor planning will capture disproportionate early volumes for buses and regional freight.

Supplier dynamics will shift toward regional manufacturing clusters capable of providing full system packages and certified aftersales support. Cost competitiveness will improve as production scales for membranes, catalysts, and bipolar plates. Standardization initiatives at EU level will reduce integration complexity and shorten OEM qualification timelines for suppliers.

Buyer criteria will crystallize around total cost of ownership and operational reliability. Fleet operators will prefer suppliers offering integrated refueling contracts and predictable maintenance models. Procurement frameworks that value lifecycle emissions and circularity will reward suppliers that can document lower embedded carbon and established end-of-life plans.

Regional Competitiveness Highlights:

- EU funding and hydrogen corridors accelerating fleet demand in targeted regions

- Scale economies reducing unit cost for core stack components

- Procurement moving toward lifecycle and circularity metrics that favor certified suppliers

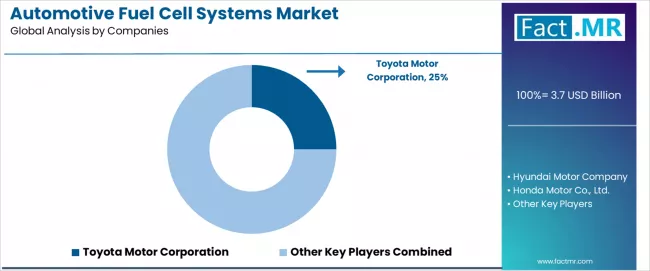

Competitive Landscape of the Automotive Fuel Cell Systems Market

Structure: Approximately 15-20 credible players; top 4-6 hold 60-65% by revenue.

Leadership is maintained through: automotive partnerships, technology innovation, and product development (fuel cell efficiency + system reliability + vehicle integration).

What is commoditizing: basic stack designs and standard fuel cell technologies.

Margin Opportunities: custom automotive services, vehicle integration, and incorporation into mobility workflows (fleet optimization, predictive maintenance).

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global automotive brands | OEM relationships, broad vehicle portfolios, brand recognition | Wide market access, proven reliability, multi-region support | Technology refresh cycles; dependency on automotive validation |

| Technology innovators | Fuel cell R&D; advanced stack technologies; enhanced efficiency properties | Latest technologies first; attractive ROI on performance effectiveness | Service density outside core regions; scaling complexity |

| Regional specialists | Local compliance, fast delivery, nearby customer support | "Close to customer" support; pragmatic pricing; local automotive regulations | Technology gaps; talent retention in customer service |

| Full-service providers | Complete automotive programs, vehicle integration, performance monitoring | Lowest operational risk; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized applications, custom systems, automotive services | Win premium applications; flexible configurations | Scalability limitations; narrow market focus |

The competitive landscape features established automotive suppliers leveraging extensive industry relationships and comprehensive technical capabilities. Global automotive brands maintain leadership through wide OEM access, proven system reliability, and multi-region automotive support capabilities that create customer relationships and operational advantages. Technology innovators focus on advanced fuel cell technologies and enhanced stack systems, offering latest innovations with attractive ROI on automotive effectiveness.

Regional specialists provide local automotive expertise, fast delivery, and nearby customer support with pragmatic pricing and local automotive regulations knowledge. Full-service providers offer complete automotive programs including vehicle integration and performance monitoring, delivering lowest operational risk through comprehensive support systems. Niche specialists focus on specialized automotive applications and custom systems, winning premium applications through flexible configurations and targeted solutions.

Market dynamics reflect increasing consolidation among smaller players while larger companies expand through strategic automotive partnerships and technology acquisitions. Competition intensifies around advanced fuel cell technologies, vehicle integration capabilities, and comprehensive automotive solutions that provide complete mobility management systems.

Key Players in the Automotive Fuel Cell Systems Market

- Toyota Motor Corporation

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Ballard Power Systems Inc.

- Plug Power Inc.

- Cummins Inc.

- Daimler Truck Holding AG

- BMW Group

- Nikola Corporation

- Robert Bosch GmbH

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 billion |

| Type | PEMFC, SOFC, MCFC |

| Application | Passenger Vehicles, Commercial Vehicles, Other Applications |

| Region | Asia-Pacific, Europe, North America |

| Countries Covered | Japan, South Korea, USA, Germany, France, UK, Mexico, China, India, Canada, and 15+ additional countries |

| Key Companies Profiled | Toyota, Hyundai, Honda, Ballard Power, Plug Power, Cummins, Daimler, BMW, Nikola |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across Asia-Pacific, Europe, and North America, competitive landscape with automotive manufacturers and system integrators, vehicle operator preferences for efficiency and operational effectiveness, integration with vehicle management platforms and monitoring systems, innovations in fuel cell technology and stack enhancement, and development of advanced automotive solutions with enhanced performance and mobility optimization capabilities. |

Automotive Fuel Cell Systems Market by Segments

-

Type :

- PEMFC

- SOFC

- MCFC

-

Application :

- Passenger Vehicles

- Commercial Vehicles

- Other Applications

-

Region :

- Asia-Pacific

- Japan

- South Korea

- China

- India

- Australia & New Zealand

- Rest of Asia-Pacific

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Nordic

- Rest of Europe

- North America

- United States

- Canada

- Mexico

- Rest of World

- Brazil

- Middle East & Africa

- Other Countries

- Asia-Pacific

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Type , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Type , 2025 to 2035

- PEMFC

- SOFC

- MCFC

- Y to o to Y Growth Trend Analysis By Type , 2020 to 2024

- Absolute $ Opportunity Analysis By Type , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Application, 2025 to 2035

- Passenger Vehicles

- Commercial Vehicles

- Other Applications

- Y to o to Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Application

- Competition Analysis

- Competition Deep Dive

- Toyota Motor Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Ballard Power Systems Inc.

- Plug Power Inc.

- Cummins Inc.

- Daimler Truck Holding AG

- BMW Group

- Nikola Corporation

- Robert Bosch GmbH

- Toyota Motor Corporation

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 4: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 7: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 8: Latin America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 10: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 11: Western Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 12: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 13: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Eastern Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 15: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 16: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 17: East Asia Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 18: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 19: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 20: South Asia and Pacific Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 21: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 22: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 23: Middle East & Africa Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 24: Middle East & Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Type

- Figure 6: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Application

- Figure 9: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Region

- Figure 12: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 13: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 14: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 15: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 20: North America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 21: North America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 22: North America Market Attractiveness Analysis by Type

- Figure 23: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Application

- Figure 26: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: Latin America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 28: Latin America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 29: Latin America Market Attractiveness Analysis by Type

- Figure 30: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 31: Latin America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 32: Latin America Market Attractiveness Analysis by Application

- Figure 33: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Western Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 35: Western Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 36: Western Europe Market Attractiveness Analysis by Type

- Figure 37: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 38: Western Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 39: Western Europe Market Attractiveness Analysis by Application

- Figure 40: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 42: Eastern Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 43: Eastern Europe Market Attractiveness Analysis by Type

- Figure 44: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 45: Eastern Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 46: Eastern Europe Market Attractiveness Analysis by Application

- Figure 47: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 48: East Asia Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 49: East Asia Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 50: East Asia Market Attractiveness Analysis by Type

- Figure 51: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 52: East Asia Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 53: East Asia Market Attractiveness Analysis by Application

- Figure 54: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 55: South Asia and Pacific Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 56: South Asia and Pacific Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 57: South Asia and Pacific Market Attractiveness Analysis by Type

- Figure 58: South Asia and Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 59: South Asia and Pacific Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 60: South Asia and Pacific Market Attractiveness Analysis by Application

- Figure 61: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 63: Middle East & Africa Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 64: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 65: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 66: Middle East & Africa Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 67: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 68: Global Market - Tier Structure Analysis

- Figure 69: Global Market - Company Share Analysis

- FAQs -

How big is the automotive fuel cell systems market in 2025?

The global automotive fuel cell systems market is estimated to be valued at USD 3.7 billion in 2025.

What will be the size of automotive fuel cell systems market in 2035?

The market size for the automotive fuel cell systems market is projected to reach USD 119.9 billion by 2035.

How much will be the automotive fuel cell systems market growth between 2025 and 2035?

The automotive fuel cell systems market is expected to grow at a 41.6% CAGR between 2025 and 2035.

What are the key product types in the automotive fuel cell systems market?

The key product types in automotive fuel cell systems market are pemfc, sofc and mcfc.

Which application segment to contribute significant share in the automotive fuel cell systems market in 2025?

In terms of application, passenger vehicles segment to command 50.0% share in the automotive fuel cell systems market in 2025.