Aerial Lift Rental Market

Aerial Lift Rental Market Size and Share Forecast Outlook 2025 to 2035

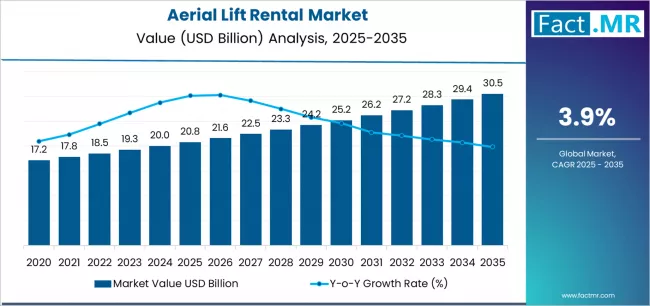

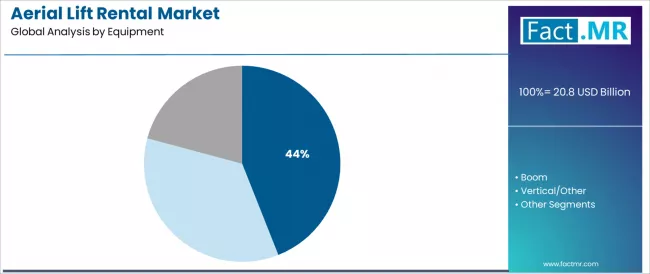

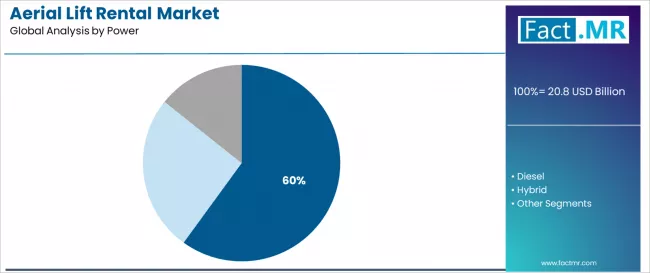

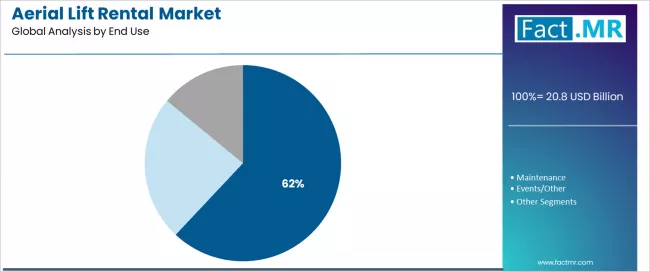

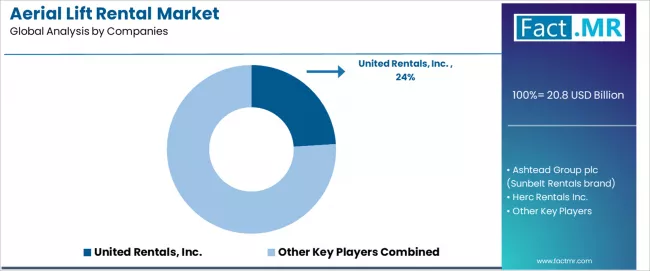

Aerial lift rental market is projected to grow from USD 20.8 billion in 2025 to USD 30.5 billion by 2035, at a CAGR of 3.9%. Scissor will dominate with a 44.0% market share, while electric will lead the power segment with a 60.0% share.

Aerial Lift Rental Market Forecast and Outlook 2025 to 2035

The global aerial lift rental market is projected to grow from USD 20,800.0 million in 2025 to approximately USD 30,500.0 million by 2035, recording an absolute increase of USD 9,700.0 million over the forecast period. This translates into a total growth of 46.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.9% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.5X during the same period, supported by increasing construction activities driving equipment demand, growing adoption of rental services over equipment purchase, and rising infrastructure development projects requiring specialized access solutions across various construction and maintenance applications.

Quick Stats for Aerial Lift Rental Market

| Aerial Lift Rental Market Value (2025) | USD 20,800.0 million |

|---|---|

| Aerial Lift Rental Market Forecast Value (2035) | USD 30,500.0 million |

| Aerial Lift Rental Market CAGR | 3.9% |

| Leading Segment by Equipment (2025) | Scissor (44.0%) |

| Leading Segment by Power (2025) | Electric (60.0%) |

| Leading Segment by End Use (2025) | Construction (62.0%) |

| Key Growth Regions | Asia Pacific, North America, and Europe |

| Top Companies by Market Share | United Rentals, Ashtead/Sunbelt, Herc Rentals |

Aerial lift rental operations encompass comprehensive equipment management systems coordinating scissor lifts, boom lifts, vertical mast lifts, and personnel lifts across diverse construction, maintenance, and installation applications. Electric-powered configurations dominate rental fleets through zero-emission operation capabilities and reduced noise characteristics suitable for indoor environments and sensitive locations. Platform heights typically range from 12 to 185 feet with working capacities between 350 and 3,000 pounds accommodating various personnel and material requirements.

Construction applications drive primary rental demand through requirements for interior finishing work, exterior building maintenance, and structural installation operations requiring reliable aerial access solutions. Commercial building construction utilizes scissor lifts for drywall installation, ceiling work, and mechanical system installation where stable platforms and material storage capabilities enhance productivity. Infrastructure projects encompass bridge construction, highway maintenance, and utility installation requiring specialized boom configurations and extended reach capabilities.

Scissor lift configurations represent the largest equipment segment through versatility in indoor applications and cost-effective operation for moderate height requirements. Compact scissor models provide maneuverability in restricted spaces while maintaining sufficient platform area for multiple workers and tools. Rough terrain scissors enable outdoor applications with enhanced ground clearance and traction capabilities for uneven construction sites.

Electric power systems incorporate advanced battery technology providing extended runtime capabilities with rapid charging options for continuous operation. Lithium-ion battery configurations reduce weight while improving energy density and cycle life compared to traditional lead-acid systems. Regenerative lowering capabilities capture energy during descent operations extending battery life and reducing charging frequency requirements.

Fleet management technologies incorporate GPS tracking systems, telematics monitoring, and predictive maintenance algorithms optimizing equipment utilization and reducing operational costs. Digital platforms provide real-time equipment availability information enabling customers to locate and reserve specific models across multiple rental locations. Automated scheduling systems coordinate delivery logistics while optimizing route planning and equipment allocation.

The market outlook further benefits from expanding rental partnerships with construction contractors and facility management firms emphasizing flexibility, cost efficiency, and operational scalability. Moreover, technological integration across rental platforms including IoT-enabled performance tracking, digital inspection systems, and predictive analytics are enhancing service reliability, improving equipment uptime, and optimizing asset lifecycle management for aerial lift rental providers.

Aerial Lift Rental Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 20,800.0 million |

| Market Forecast Value (2035) | USD 30,500.0 million |

| Forecast CAGR (2025-2035) | 3.9% |

Why is the Aerial Lift Rental Market Growing?

| CONSTRUCTION & INFRASTRUCTURE TRENDS | EQUIPMENT REQUIREMENTS | ECONOMIC & OPERATIONAL FACTORS |

|---|---|---|

| Global Infrastructure Development Continuous expansion of construction and infrastructure projects across established and emerging markets driving demand for efficient aerial access solutions. Aging Infrastructure Maintenance Growing emphasis on maintenance and renovation projects creating demand for specialized access technologies throughout building lifecycle. Commercial Construction Growth Superior access capabilities and enhanced safety characteristics making aerial lifts essential for performance-focused construction applications. | Advanced Access Solutions Modern construction requires high-performance equipment delivering precise positioning control and enhanced safety features. Equipment Efficiency Demands Construction companies investing in rental services offering consistent performance while maintaining operational efficiency. Safety and Reliability Standards Certified rental providers with proven track records required for advanced construction applications. | Rental Model Adoption Economic requirements establishing performance benchmarks favoring rental models over equipment purchase strategies. Performance Property Standards Quality standards requiring superior safety properties and resistance to environmental stresses in construction environments. Industrial Compliance Requirements Diverse construction requirements and safety standards driving need for sophisticated equipment rental services. |

Aerial Lift Rental Market Segmentation

| Category | Segments Covered |

|---|---|

| By Equipment | Scissor, Boom, Vertical/Other |

| By Power | Electric, Diesel, Hybrid |

| By End Use | Construction, Maintenance, Events/Other |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Aerial Lift Rental Market Analysis by Equipment

| Segment | 2025 to 2035 Outlook |

|---|---|

| Scissor | Leader in 2025 with 44.0% market share; likely to maintain leadership through 2035. Broadest use across construction, maintenance, and industrial applications, mature supply chain, predictable functionality. Momentum: steady-to-strong. Watchouts: increasing competition from boom lifts. |

| Boom | Strong second position with established market presence in specialized construction applications, but operational complexity requires trained operators. Momentum: steady in construction segments; strong growth in infrastructure projects. |

| Vertical/Other | Benefiting from specialized access requirements due to compact design and enhanced maneuverability characteristics. Momentum: rising. Watchouts: limited application scope, technical qualification requirements. |

Aerial Lift Rental Market Analysis by Power

| Segment | 2025 to 2035 Outlook |

|---|---|

| Electric | At 60.0%, largest power segment in 2025 with established clean operation integration. Mature charging infrastructure, standardized maintenance specifications. Momentum: steady growth driven by environmental regulations and indoor application demand. Watchouts: battery technology advancement affecting equipment replacement. |

| Diesel | Strong performance segment driven by outdoor construction and heavy-duty applications. Established fuel infrastructure dominates high-capacity applications. Momentum: moderate growth through 2030, supported by construction expansion. Watchouts: environmental regulations affecting equipment selection. |

| Hybrid | Specialized segment with diverse power requirements. Growing demand for flexible power systems supporting various operational applications. Momentum: moderate growth via technology advancement and operational flexibility. Watchouts: higher equipment costs affecting rental pricing. |

Aerial Lift Rental Market Analysis by End Use

| End Use | Status & Outlook 2025-2035 |

|---|---|

| Construction | Dominant segment in 2025 with 62.0% share for building and infrastructure applications. Established rental systems, operational advantages, ease of project integration. Momentum: steady growth driven by construction efficiency and safety advantages. Watchouts: equipment availability during peak construction periods. |

| Maintenance | Important for specialized applications requiring reliable access control. Value-add through superior positioning capabilities, custom height requirements, specialized operational needs. Momentum: moderate growth as maintenance applications demand enhanced properties. Operational complexity may limit broader growth. |

| Events/Other | Growing segment with diverse access requirements across entertainment, filming, and specialty applications. Momentum: selective growth in specialized applications requiring specific operational profiles. |

DRIVERS

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Construction Activity Growth Continuing expansion of construction and infrastructure activities across established and emerging markets driving demand for efficient aerial access solutions. Infrastructure Development Increasing adoption of specialized access systems for infrastructure maintenance and construction project optimization. Rental Model Preference Growing demand for rental services that support both operational benefits and cost efficiency in construction management. | Equipment Cost Pressures Cost fluctuations affecting rental rates and equipment availability for construction companies. Operational Complexity Complex technical requirements across applications affecting equipment deployment and standardization. Technical Qualification Requirements Complex technical requirements across applications affecting equipment selection and operator training. Competition from Alternatives Alternative access technologies affecting market selection and equipment development. | Advanced Equipment Technologies Integration of advanced aerial lift systems, operational innovations, and safety control solutions enabling superior operational efficiency. Performance Enhancement Enhanced positioning control, improved safety features, and advanced operational capabilities compared to traditional access systems. Specialized Equipment Development of specialized aerial lift categories and custom configurations providing enhanced performance benefits and application-specific optimization. Technical Innovation Integration of advanced aerial lift development and intelligent operational management for sophisticated construction solutions. |

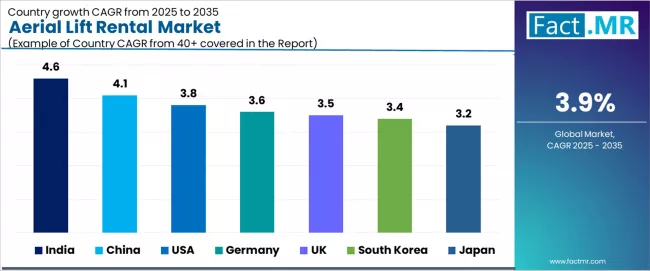

Analysis of Aerial Lift Rental Market by Key Countries

| Country | CAGR (2025-2035) |

|---|---|

| India | 4.6% |

| China | 4.1% |

| USA | 3.8% |

| UK | 3.5% |

| South Korea | 3.4% |

| Germany | 3.6% |

| Japan | 3.2% |

India Leads Global Market Growth with Construction Excellence

Revenue from aerial lift rentals in India is projected to exhibit strong growth driven by expanding construction infrastructure and comprehensive building development innovation creating opportunities for rental companies across construction operations, infrastructure applications, and specialty access sectors. The country's developing construction tradition and expanding urban development capabilities are creating demand for both conventional and high-performance aerial access equipment. Major construction companies are establishing comprehensive local equipment procurement strategies to support large-scale building operations and meet growing demand for efficient access solutions.

Construction industry modernization programs are supporting widespread adoption of advanced aerial lift rental services across building operations, driving demand for high-quality access equipment throughout major urban development projects. Infrastructure development excellence initiatives and specialized construction growth are creating opportunities for rental suppliers requiring reliable positioning and cost-effective aerial access solutions across diverse construction applications.

China Demonstrates Strong Market Potential with Infrastructure Processing Growth

Revenue from aerial lift rentals in China is expanding supported by extensive construction expansion and comprehensive infrastructure development creating demand for reliable aerial access equipment across diverse building categories and specialty construction segments. The country's dominant construction position and expanding building capabilities are driving demand for rental solutions that provide consistent performance while supporting cost-effective operational requirements. Construction processors and developers are investing in rental partnerships to support growing building operations and infrastructure demand.

Construction operations expansion and infrastructure capability development are creating opportunities for aerial lift rental services across diverse building segments requiring reliable positioning and competitive operational costs throughout major construction regions. Infrastructure modernization and construction technology advancement are driving investments in equipment rental supply chains supporting performance requirements across industrial development areas.

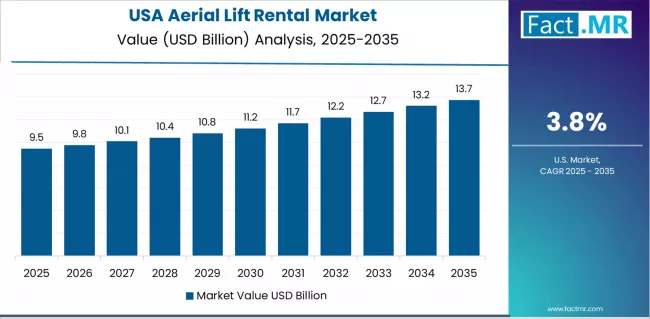

USA Maintains Strong Position with Construction Innovation

Demand for aerial lift rentals in USA is projected to grow supported by the country's expanding construction base and building technologies requiring advanced aerial access systems for construction and maintenance applications. American construction companies are implementing rental strategies that support advanced building techniques, operational efficiency, and comprehensive safety protocols. The market is characterized by focus on operational excellence, construction performance, and compliance with building safety standards.

Construction industry investments are prioritizing advanced rental services that demonstrate superior positioning and safety while meeting American building standards throughout operational excellence initiatives. Research and development programs for access enhancement are facilitating adoption of specialized rental techniques across major construction centers, supporting advanced building systems and performance optimization.

Australia Expands Market with Construction Innovation

Revenue from aerial lift rentals in Australia is growing driven by advanced construction development programs and increasing building technology innovation creating opportunities for rental suppliers serving both construction operations and maintenance contractors. The country's extensive infrastructure base and expanding development awareness are creating demand for rental equipment that support diverse performance requirements while maintaining operational performance standards. Construction companies and specialty service providers are developing procurement strategies to support operational efficiency and regulatory compliance.

Advanced construction development programs and aerial lift rental services are facilitating adoption of equipment capable of supporting diverse positioning requirements and competitive operational standards throughout construction innovation and performance-focused development programs. These programs are enhancing demand for rental equipment that support operational efficiency and positioning reliability across Australian construction facilities.

Germany Focuses on Construction Manufacturing Excellence

Demand for aerial lift rentals in Germany is projected to grow driven by construction excellence and specialty aerial access capabilities supporting advanced building development and comprehensive construction applications. The country's established construction tradition and growing performance building market segments are creating demand for high-quality rental equipment that support operational performance and construction standards. Construction companies and rental suppliers are maintaining comprehensive development capabilities to support diverse building requirements.

Construction manufacturing and specialty rental programs are supporting demand for aerial lift equipment that meet contemporary positioning and reliability standards throughout development and performance-focused manufacturing programs. These programs are creating opportunities for specialized rental equipment that provide comprehensive construction support across major building regions.

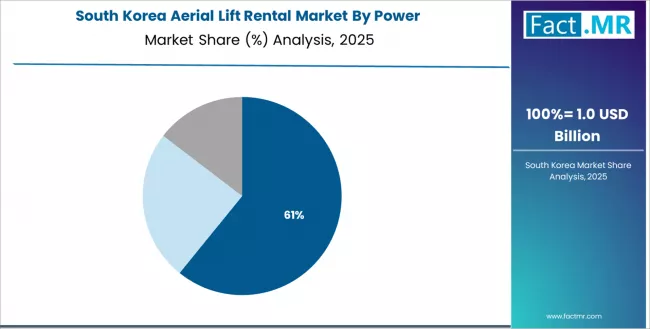

South Korea Focuses on Advanced Construction Manufacturing

Demand for aerial lift rentals in South Korea is projected to grow at 3.4% CAGR driven by advanced construction excellence and specialty aerial access capabilities supporting building development and comprehensive construction applications. The country's established construction tradition and growing performance building market segments are creating demand for high-quality rental equipment that support operational performance and construction standards.

Advanced construction manufacturing and specialty rental programs are supporting demand for aerial lift equipment that meet contemporary positioning and reliability standards throughout building development and performance-focused manufacturing programs. These programs are creating opportunities for specialized rental equipment that provide comprehensive construction support across major building regions.

Japan Focuses on Precision Construction Manufacturing

Demand for aerial lift rentals in Japan is projected to grow driven by precision construction excellence and specialty aerial access capabilities supporting advanced building development and comprehensive technical applications. The country's established construction tradition and growing performance building market segments are creating demand for high-quality rental equipment that support operational performance and construction standards.

Precision construction manufacturing and specialty rental programs are supporting demand for aerial lift equipment that meet contemporary positioning and reliability standards throughout building development and performance-focused manufacturing programs. These programs are creating opportunities for specialized rental equipment that provide comprehensive construction support across major construction regions.

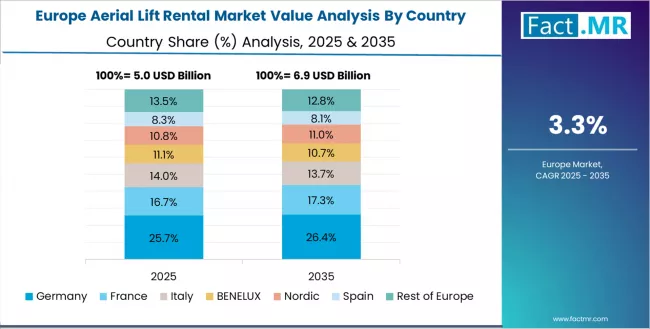

Europe Market Split by Application

European aerial lift rental operations are increasingly polarized between Western European precision construction and Eastern European cost-competitive manufacturing. German (USD 4,200.0 million) and UK facilities (USD 3,100.0 million) dominate construction and infrastructure rental processing, leveraging advanced building technologies and strict safety protocols that command price premiums in regional markets. German rental providers maintain leadership in high-performance aerial access applications, with major construction companies driving technical specifications that smaller suppliers must meet to access service contracts.

France (USD 2,500.0 million), Italy (USD 2,000.0 million), and Spain (USD 1,600.0 million) operations focus on specialized applications and regional market requirements. Rest of Europe (USD 4,400.0 million) including Eastern European operations in Poland, Hungary, and Czech Republic are capturing volume-oriented rental contracts through labor cost advantages and EU regulatory compliance, particularly in standard aerial access equipment for construction applications.

The regulatory environment presents both opportunities and constraints. EU construction regulations and safety directives create barriers for substandard rental equipment but establish quality standards that favor established European providers over imports. Brexit has fragmented UK sourcing from EU suppliers, creating opportunities for direct relationships between rental companies and British construction manufacturers.

Supply chain consolidation accelerates as rental providers seek economies of scale to absorb rising operational costs and compliance expenses. Vertical integration increases, with major construction companies acquiring rental facilities to secure equipment supplies and operational control. Smaller rental providers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream construction requirements.

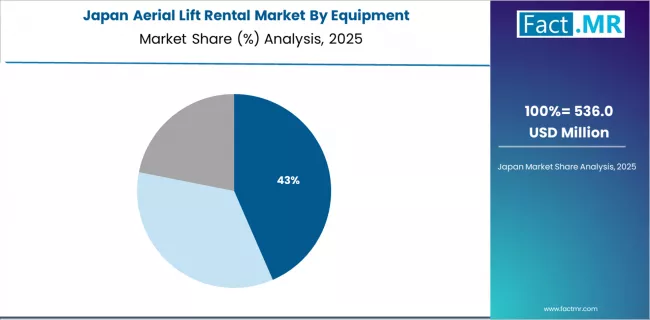

Construction Quality Standards Define Japanese Market Dynamics

Japanese aerial lift rental operations reflect the country's exacting quality standards and sophisticated construction expectations. Major construction companies maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, equipment testing, and facility audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports construction positioning.

The Japanese market demonstrates unique application preferences with Construction accounting for 55.0%, Maintenance 30.0%, Events/Other 15.0%. Companies require specific positioning ratios and safety specifications that differ from Western applications, driving demand for customized rental capabilities and specialized operational procedures.

Japanese market demonstrates unique equipment preferences with Scissor accounting for 50.0%, Boom 35.0%, Other 15.0%. Companies require specific operational capabilities and positioning specifications that differ from Western applications, driving demand for customized access capabilities and enhanced safety systems.

Regulatory oversight emphasizes comprehensive construction equipment management and traceability requirements that surpass most international standards. The construction registration system requires detailed equipment sourcing information, creating advantages for suppliers with transparent supply chains and comprehensive documentation systems.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese companies typically maintain long-term supplier relationships spanning decades, with annual contract negotiations emphasizing quality consistency over price competition. This stability supports investment in specialized rental equipment tailored to Japanese specifications.

Market Dynamics Drive Innovation in South Korea

South Korean aerial lift rental operations reflect the country's advanced construction sector and development-oriented business model. Major construction companies drive sophisticated equipment procurement strategies, establishing direct relationships with global suppliers to secure consistent quality and pricing for their building and infrastructure operations targeting both domestic and international markets.

The Korean market demonstrates opportunities in power distribution with Electric accounting for 65.0%, Diesel 25.0%, and Hybrid 10.0%. This technology-focused approach creates demand for specific operational specifications that differ from Western applications, requiring suppliers to adapt equipment and maintenance techniques.

Regulatory frameworks emphasize construction equipment safety and traceability, with Korean construction administration standards often exceeding international requirements. This creates barriers for smaller rental suppliers but benefits established providers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with comprehensive certification and documentation systems.

Supply chain efficiency remains critical given Korea's geographic limitations and import dependence. Companies increasingly pursue long-term contracts with suppliers in United States, Germany, and Japan to ensure reliable access to equipment while managing foreign exchange risks. Technical logistics investments support quality preservation during extended shipping periods.

The market faces pressure from rising labor costs and competition from lower-cost regional manufacturers, driving automation investments and consolidation among smaller providers. However, the premium positioning of Korean construction brands internationally continues to support demand for high-quality aerial lift rental services that meet stringent specifications.

Competitive Landscape of Aerial Lift Rental Market

Profit pools are consolidating upstream in scaled aerial equipment rental operations and downstream in value-added specialty services for construction, maintenance, and infrastructure applications where certification, reliability, and consistent availability command premiums. Value is migrating from basic equipment rental to specification-tight, application-ready aerial access solutions where technical expertise and operational control drive competitive advantage.

Several archetypes set the pace: global rental integrators defending share through equipment scale and operational reliability; multi-category providers that manage complexity and serve diverse applications; specialty aerial access developers with construction expertise and industry ties; and performance-driven suppliers pulling volume in construction and infrastructure applications.

Switching costs including re-qualification, safety testing, operational validation provide stability for incumbents, while supply shocks and regulatory changes reopen opportunities for diversified suppliers. Consolidation and verticalization continue; digital procurement emerge in commodity categories while premium specifications remain relationship led.

Focus areas include locking construction and infrastructure pipelines with application-specific equipment and service level agreements; establish multi-category rental capabilities and technical disclosure; develop specialized aerial access services with safety claims.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global rental integrators | Scale, operational integration, technical reliability | Long-term contracts, tight specs, co-development with construction/infrastructure |

| Multi-category providers | Equipment diversification, application expertise, supply flexibility | Multi-application serving, technical support, safety assurance across segments |

| Specialty aerial access developers | Construction expertise and industry relationships | Custom equipment, operational science, performance SLAs |

| Performance suppliers | Application-focused demand and specialized service | Technical safety claims, specialized equipment, application activation |

| Equipment distributors & platforms | Technical support for mid-tier manufacturers | Equipment selection, smaller volumes, technical service |

United Rentals, Inc.

- Ashtead Group plc (Sunbelt Rentals brand)

- Herc Rentals Inc.

- Loxam S.A.

- Kanamoto Co., Ltd.

- Nishio Rent All Co., Ltd.

- Aktio Corporation

- Kiloutou S.A.S.

- Riwal Holding Group B.V.

- Boels Rental B.V.

- H&E Equipment Services, Inc.

- Ahern Rentals, Inc.

- TVH Group NV

- Mateco Holding GmbH

- United Powered Access Ltd.

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 20,800.0 Million |

| Equipment | Scissor, Boom, Vertical/Other |

| Power | Electric, Diesel, Hybrid |

| End Use | Construction, Maintenance, Events/Other |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, India, South Korea, Australia, and other 40+ countries |

| Key Companies Profiled | United Rentals, Ashtead/Sunbelt, Herc Rentals, Loxam, Kanamoto, Nishio, Aktio, Kiloutou, Riwal, Boels, H&E, Ahern, TVH, Mateco, United Powered Access |

| Additional Attributes | Dollar rentals by equipment/power/end use, regional demand (NA, EU, APAC), competitive landscape, electric vs. diesel adoption, rental/operational integration, and advanced equipment innovations driving safety enhancement, technical advancement, and efficiency |

Aerial Lift Rental Market Segmentation

-

By Equipment :

- Scissor

- Boom

- Vertical/Other

-

By Power :

- Electric

- Diesel

- Hybrid

-

By End Use :

- Construction

- Maintenance

- Events/Other

-

By Region :

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Equipment

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Equipment , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Equipment , 2025 to 2035

- Scissor

- Boom

- Vertical/Other

- Y to o to Y Growth Trend Analysis By Equipment , 2020 to 2024

- Absolute $ Opportunity Analysis By Equipment , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Power

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Power, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Power, 2025 to 2035

- Electric

- Diesel

- Hybrid

- Y to o to Y Growth Trend Analysis By Power, 2020 to 2024

- Absolute $ Opportunity Analysis By Power, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End Use, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End Use, 2025 to 2035

- Construction

- Maintenance

- Events/Other

- Y to o to Y Growth Trend Analysis By End Use, 2020 to 2024

- Absolute $ Opportunity Analysis By End Use, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Equipment

- By Power

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment

- By Power

- By End Use

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment

- By Power

- By End Use

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Equipment

- By Power

- By End Use

- Competition Analysis

- Competition Deep Dive

- Value (USD Million)ed Rentals, Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Ashtead Group plc (Sunbelt Rentals brand)

- Herc Rentals Inc.

- Loxam S.A.

- Kanamoto Co., Ltd.

- Nishio Rent All Co., Ltd.

- Aktio Corporation

- Kiloutou S.A.S.

- Riwal Holding Group B.V.

- Boels Rental B.V.

- H&E Equipment Services, Inc.

- Ahern Rentals, Inc.

- TVH Group NV

- Mateco Holding GmbH

- Value (USD Million)ed Powered Access Ltd.

- Value (USD Million)ed Rentals, Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Equipment , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Power, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by End Use, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Equipment

- Figure 6: Global Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Power

- Figure 9: Global Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by End Use

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Equipment

- Figure 26: North America Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Power

- Figure 29: North America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by End Use

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Equipment

- Figure 36: Latin America Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Power

- Figure 39: Latin America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by End Use

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Equipment

- Figure 46: Western Europe Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Power

- Figure 49: Western Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by End Use

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Equipment

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Power

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End Use

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Equipment

- Figure 66: East Asia Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Power

- Figure 69: East Asia Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by End Use

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Equipment

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Power

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by End Use

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Equipment , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Equipment , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Equipment

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Power, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Power, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Power

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by End Use

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the aerial lift rental market in 2025?

The global aerial lift rental market is estimated to be valued at USD 20.8 billion in 2025.

What will be the size of aerial lift rental market in 2035?

The market size for the aerial lift rental market is projected to reach USD 30.5 billion by 2035.

How much will be the aerial lift rental market growth between 2025 and 2035?

The aerial lift rental market is expected to grow at a 3.9% CAGR between 2025 and 2035.

What are the key product types in the aerial lift rental market?

The key product types in aerial lift rental market are scissor, boom and vertical/other.

Which power segment to contribute significant share in the aerial lift rental market in 2025?

In terms of power, electric segment to command 60.0% share in the aerial lift rental market in 2025.