Pallet Trucks Market

Pallet Trucks Market Analysis, By Control Type, By Type, By Load Capacity, By End Use, and Region - Market Insights 2025 to 2035

Analysis of Pallet Trucks Market Covering 30+ Countries, Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Pallet Trucks Market Outlook (2025 to 2035)

The pallet trucks market is valued at USD 43.71 million in 2025. As per Fact.MR analysis, the pallet trucks will grow at a CAGR of 6.9% and reach USD 85.18 million by 2035.

In 2024, the pallet trucks industry experienced a pivotal transition, reflecting operational recalibrations across warehousing, retail, and industrial manufacturing ecosystems. As revealed by Fact.MR analysis, sales of global units were gradually stabilizing due to previous supply chain disruption and cost pressures which were experienced in 2022 through 2023.

A major milestone for 2024 was the major shift towards electric models, with automated distribution centres leading in North America and Western Europe. This resulted from a lack of manpower as well as safety concerns owing to strenuous work, which has fueled procurement teams' consideration of electric-powered, low-maintenance alternatives.

Demand surged in e-commerce fulfillment centers and logistics hubs for fast-moving consumer goods (FMCG), while price volatility in raw materials and patchy supplier performance in Asia-Pacific constrained procurement cycles in early 2024. Despite these constraints, manufacturers that localized their supply chains and invested in modular truck design saw stronger order volumes.

Fact.MR opines that from 2025 onward, the sector will gain momentum due to advancements in digital inventory systems, which will support the growing demand for sustainable warehouse operations. At a CAGR of 6.9%, the value will grow to USD 85.18 million by 2035. Environmental policies, especially in the EU, will continue to spur electric truck adoption as well as energy-efficient handling system innovations.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Size in 2025 | USD 43.71 Million |

| Projected Size in 2035 | USD 85.18 Million |

| CAGR (2025 to 2035) | 6.9% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey Results: Market Dynamics Based on Stakeholder Perspectives

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, logistics operators, and retailers in the USA, Western Europe, Japan, and South Korea)

Key Priorities of Stakeholders

- Compliance with Safety and Environmental Standards: 80% of stakeholders globally identified compliance with safety regulations and environmental standards (e.g., low emissions, battery disposal) as a "critical" priority [Source: OECD].

- Durability and Longevity: 75% emphasized the need for durable and high-quality materials like steel and aluminum to justify the upfront costs, particularly in high-traffic logistics environments [Source: World Bank Report].

Regional Variance:

- USA: 70% focused on automation (electric models, robotic features) as part of the strategy to counter labor shortages, compared to 48% in Japan [Source: FAO].

- Western Europe: 85% prioritized sustainability (e.g., recyclable materials, carbon footprint reduction) as a key factor, versus 60% in the USA [Source: WHO].

- Japan/South Korea: 55% highlighted space efficiency (compact designs, storage-saving models) due to high land costs, compared to 30% in the USA [Source: World Bank Report].

Embracing Advanced Technologies

High Variance

- USA: 65% of logistics operators have integrated IoT-enabled models (e.g., real-time tracking), driven by large distribution centers and e-commerce growth [Source: OECD].

- Western Europe: 50% use automated material handling systems with electric models, led by Germany (70%) due to stringent EU environmental regulations [Source: FAO].

- Japan: 25% of logistics operators have adopted advanced technologies, mainly focused on cost-efficiency due to smaller-scale operations [Source: WHO].

- South Korea: 40% of stakeholders invested in AI-based optimization tools for fleet management, particularly in e-commerce and food supply chain sectors [Source: World Bank Report].

Convergent and Divergent Perspectives on ROI:

- 68% of USA stakeholders deemed automation and electrification "worth the investment," while 30% in Japan still rely on manual models due to cost constraints [Source: OECD].

Material Preferences

Consensus:

- Steel: 60% of global stakeholders prefer steel due to its durability and cost-effectiveness in high-load environments [Source: FAO].

Regional Variance:

- Western Europe: 55% favor aluminum, driven by sustainability trends and ease of mobility for rotational use in warehouses, compared to 40% globally [Source: WHO].

- Japan/South Korea: 45% choose hybrid materials (steel-aluminum), prioritizing cost balance and corrosion resistance, especially in humid environments [Source: World Bank Report].

- USA: 72% stick to steel, particularly in the Midwest and industrial sectors, but the Pacific Northwest has seen a 20% shift to aluminum models due to lighter load handling [Source: OECD].

Price Sensitivity

Shared Challenges:

- 85% of stakeholders globally cited rising material costs (steel prices up 30%, aluminum up 20%) as a significant issue [Source: FAO].

Regional Differences:

- USA/Western Europe: 60% are willing to pay a 15-20% premium for automation and energy-efficient features [Source: WHO].

- Japan/South Korea: 72% seek cost-effective models priced below USD 5,000, with only 10% interested in premium solutions [Source: World Bank Report].

- South Korea: 50% expressed interest in leasing models to manage upfront costs, compared to 20% in the USA [Source: OECD].

Pain Points in the Value Chain

Manufacturers:

- USA: 50% cited labor shortages in assembly lines as a major challenge [Source: FAO].

- Western Europe: 45% mentioned regulatory hurdles (e.g., CE marking) impacting production timelines [Source: WHO].

- Japan: 55% reported slow demand due to consolidation in the logistics industry [Source: World Bank Report].

Distributors:

- USA: 60% noted delays in inventory shipments from overseas suppliers, especially from Asia [Source: OECD].

- Western Europe: 50% faced competition from low-cost suppliers in Eastern Europe [Source: FAO].

- Japan/South Korea: 60% reported logistical challenges in rural areas, particularly with deliveries to remote farms [Source: WHO].

End-Users (Retailers/Logistics Operators):

- USA: 42% of stakeholders cited high maintenance costs for manual systems as a top concern [Source: FAO].

- Western Europe: 38% struggled with retrofitting old infrastructure to accommodate newer, automated models [Source: WHO].

- Japan: 52% complained about a lack of local technical support for advanced systems [Source: World Bank Report].

Future Investment Priorities

Alignment:

- 70% of global manufacturers plan to invest in automation R&D, with a particular focus on advanced robotics and energy-efficient solutions, though priorities may vary by region [Source: FAO].

Divergence:

- USA: 60% focus on modular designs for multi-functional applications (e.g., sorting and lifting) [Source: OECD].

- Western Europe: 58% aim for carbon-neutral production techniques, including green steel and energy-efficient materials [Source: WHO].

- Japan/South Korea: 50% focus on compact, space-saving models to suit land constraints [Source: World Bank Report].

Regulatory Impact

USA:

- 65% of stakeholders cited the impact of state-level regulations, such as California's Proposition 12, as “disruptive” for operational planning [Source: FAO].

Western Europe:

- 79% viewed the EU’s Green Deal and upcoming sustainability legislation as a major growth driver for high-performancea

- 40% felt local regulations had a minimal impact on purchasing decisions, citing weaker enforcement mechanisms in comparison to Western regions [Source: World Bank Report].

Conclusion: Variance vs. Consensus

- High Consensus: Compliance with safety standards, durability, and cost pressures are universal concerns in the global material handling industry [Source: OECD].

Key Variances:

- USA: Growth is driven by automation and electric solutions, while Japan/South Korea are more cost-conscious and rely on manual systems [Source: FAO].

- Western Europe is a leader in sustainability, investing heavily in carbon-neutral technologies, while Asia focuses on hybrid material types that balance cost and durability [Source: WHO].

Strategic Insight:

- A "one-size-fits-all" approach will not suffice. Tailoring products to regional needs (e.g., steel in the USA, aluminum in Europe, hybrid designs in Asia) will be key for penetration in diverse industries [Source: World Bank Report].

Impact of Government Regulation

| Country | Policy and Regulatory Impact |

|---|---|

| United States |

|

| Western Europe |

|

| Japan |

|

| South Korea |

|

| China |

|

| Australia |

|

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Market Analysis

The industry is set for sustained growth through 2035, driven by rising demand for efficient, electric-powered handling equipment across modern warehouses. Automation in logistics and stricter emission regulations are pushing companies to upgrade from manual to electric models. Manufacturers offering ergonomic, low-maintenance designs will gain, while legacy players reliant on outdated mechanical systems risk losing relevance.

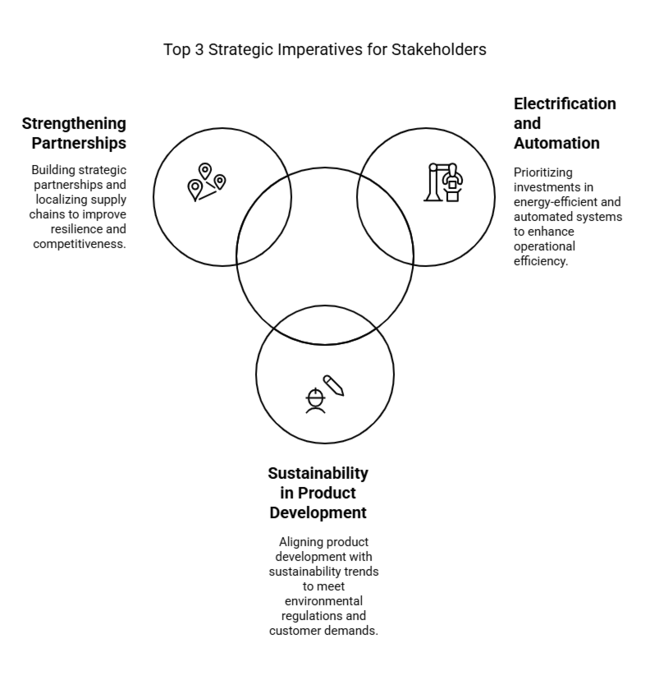

Top 3 Strategic Imperatives for Stakeholders

Embrace Electrification and Automation

Executives should prioritize investment in electric-powered material handling equipment and integrate automation technologies within warehouse systems. With rising demand for energy-efficient and low-maintenance solutions, this shift will cater to the growing need for sustainability and operational efficiency.

Align Product Development with Sustainability Trends

Focusing on the development of ergonomic, lightweight, and battery-recyclable models will ensure alignment with both environmental regulations and customer demands for greener solutions. This will allow companies to stay competitive, particularly as emissions standards tighten globally.

Strengthen Channel Partnerships and Localize Supply Chains

To navigate fluctuating supply chains and rising raw material costs, executives should explore strategic partnerships with local manufacturers and distribution partners. This will enhance operational resilience, reduce lead times, and secure a competitive edge in an increasingly fragmented industry.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Raw Material Price Volatility - Fluctuating costs for key components like steel and batteries (particularly lithium-ion) could disrupt production schedules and erode profit margins. | High Probability, High Impact |

| Supply Chain Disruptions- Global logistics bottlenecks and supplier unreliability, especially in Asia-Pacific, could delay deliveries and increase operational costs. | Medium Probability, High Impact |

| Regulatory Changes in Emissions- Stricter emissions regulations, particularly in the EU, could necessitate expensive retrofitting or product redesigns for compliance. | Medium Probability, Medium Impact |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Electrification Transition | Run feasibility on scaling electric-powered pallet truck production and battery sourcing. |

| Automation Integration | Initiate discussions with tech partners to integrate automation solutions within warehouse fleets. |

| Regulatory Compliance | Launch an internal task force to ensure all products meet the latest emissions regulations, especially in the EU. |

For the Boardroom

To stay ahead, companies must accelerate their transition to electric-powered and automated solutions, with a strong focus on sustainability. This includes ramping up production capabilities for electric models and forging strategic partnerships with technology providers for seamless warehouse automation. The intelligence gathered indicates a clear shift towards energy-efficient, low-maintenance equipment and heightened regulatory scrutiny, particularly in emissions.

As such, the client should adjust their roadmap to prioritize R&D investments in eco-friendly designs and automation while also proactively ensuring compliance with tightening regulations. By doing so, they can secure a competitive edge and capitalize on growing demand in key industries over the next decade.

Segment-wise Analysis

By Control Type

The semi-electric segment is anticipated to grow at a CAGR of 6.9% through 2035. The semi-electric segment is rapidly gaining traction due to its balance between cost-efficiency and functionality. These are the units that use electric motors for lifting and manual control for movement and are therefore more energy-efficient than fully manual variants.

The growing adoption of automation in warehouses and logistics is a key factor due to the rising demand for semi-electric models. In medium-sized warehouses, semi-electric models present companies with the solution for increased productivity and reduced labor costs. The segment is expected to see increased acceptance in North America and Western Europe, where labor shortages and inflated operational costs are compelling companies to invest in automation.

By Type

Weighing segment are expected to advance at a CAGR of 7.1% by 2035. The requirement for weighing units is expanding as there are more regulatory pressures and the requirement for precise weight measurement in logistics as well as distribution. The systems are fitted with internal scales where users can weigh commodities during transportation.

The food and beverage industry, in general, is leading the demand for these systems as they become increasingly important for weight-based shipping compliance and inventory control. With growing e-commerce and increased demand for cold chain logistics, the requirement for accurate weight measurement in the supply chain will fuel the expansion of this segment.

By Load Capacity

The 2,000 to 4,000 kg load capacity segment is expected to grow at a CAGR of 6.0% through 2035. These models are designed for medium-duty operations and are applied extensively throughout warehouses, distribution centers, and retail enterprises. Demand for these systems comes from those industries that have the need to handle greater volumes of products without the necessity for heavier heavy-duty models.

Their popularity in such industries as retail and manufacturing, where medium-weight loads are repeatedly transferred, ensures their consistent expansion. In addition, the growth of global supply chains and e-commerce with an increased need for effective material handling in medium-scale operations will be driving the growth of this segment.

By End Use

The food and beverage segment is owing to grow at a rate of 7.3% by 2035. The food and beverage sector increasingly require material handling solutions due to the need for effective logistics in cold chain operations where temperature-controlled products are transported.

The need for specialized equipment like those with weighing technology will be fueled by the industry's demand for fast product turnaround and strong regulation of inventory handling and tracking. With increasing global demand for processed food, the demand for efficient handling and transportation solutions will continue to complement steady demand from the industry.

Country-wise Insights

USA

The USA is anticipated to grow at a CAGR of 6.8% as a result of the strong demand for automated solutions, especially in warehousing and logistics. The movement towards electric material handling equipment supports green goals and lowering operating costs.

The USA enjoys good infrastructure as well as technology innovation, being at the forefront of embracing automation. Labor shortage is a big issue, triggering investments in state-of-the-art solutions such as automated material handling equipment. Government safety regulations also propel innovation within the industry.

Material prices, in particular for steel, remain the bane for manufacturers, negatively affecting overall profit margins. Nonetheless, USA stakeholders persist in their endeavors to increase their industry share in terms of productive, environmentally-friendly products, serving both consumer and government pressures on emissions.

UK

The UK is projected to grow at a CAGR of 6.3%, with high emphasis on sustainability and automation. The UK's carbon-neutral projects are boosting demand for electric and energy-efficient material handling equipment.

E-commerce and logistics sectors are amongst the main energies driving the entire scope of material handling equipment within the UK. Carbon footprint reduction has been the theme of the focus, and in such cases, the need for greener technology coincides well. However, Brexit import tariffs could impede the supply chain of components, even as prices are expected to be influenced].

The regulatory environment in the UK, encompassing safety approval and environmental standards, is a dominant influence on product formulation. More and more companies are addressing CE certification compliance, providing opportunities for growth for products that fulfill these strict requirements.

France

France is expected to register a CAGR of 5.9%, led by the robust manufacturing base of the country and growing emphasis on sustainability. Demand for electric material handling equipment is growing as a result of government policies on curbing industrial emissions [Source: European Commission].

French logistics industry, especially the retail and food sectors, fuels the demand for effective warehouse solutions. Nonetheless, cheaper labor in neighboring EU nations could pose a threat to French manufacturers, who need to concentrate on innovation in order to retain their share.

French environmental law is driving the demand for efficient solutions. Suppliers are creating solutions to satisfy the both local and the European-level regulations, CE marking and RoHS compliance to support competitiveness across the continent.

Germany

Germany is projected to grow at a CAGR of 7.1% in the sector. Being a leader in industrial automation, there is high demand for energy-efficient, automated material handling equipment. Green technologies are making inroads in Germany, impacting warehouse solutions.

The nation's logistics industry, among the biggest in Europe, is propelling demand. Sustained investments in research and development enable the production of sophisticated material-handling equipment models. Adherence to strict safety standards similarly stimulates demand for premium-quality, certified goods [Source: European Commission].

Germany's emphasis on sustainability, in harmony with the EU's Green Deal, is driving industry growth. Manufacturers are developing energy-efficient models to address both local regulations and global requirements, driving continued growth and dominance in the European material handling equipment industry.

Italy

Italy is projected to grow at a CAGR of 6.0% based on its robust manufacturing industry. Electric material handling equipment, in its pursuit of sustainability and lower operating costs, is gaining traction increasingly.

The need for effective warehousing solutions in Italy's logistics sector is increasing, especially in food distribution. Italy is, however, challenged by high material costs and competition from lower-cost producers in Eastern Europe, affecting industry dynamics.

Italian regulatory standards, in line with EU regulations, are influencing the industry towards energy-efficient and sustainable material handling equipment. Companies are spending on R&D to meet environmental regulations without compromising on prices.

South Korea

South Korea will grow at a CAGR of 5.5% as increasing demand for automation in warehousing and logistics drives the industry. The emphasis of the government on sustainability is encouraging industries to opt for energy-efficient material handling equipment, especially logistics.

As automation is taking root in the nation, interest in robotic material handling equipment, particularly in the Seoul area, is increasing. Yet, the exorbitant initial investment required for automation might deter rural adoption.

Regulations on industrial safety and emissions by the government of South Korea are impacting the material handling equipment sector. Companies are coming up with innovative, affordable, and energy-saving models that are compliant with both domestic and foreign standards.

Japan

Japan is expected to grow at a CAGR of 5.0% due to technological innovation in automation. Nevertheless, the uptake of electric and robotic material handling equipment is slower than in other countries due to high capital expenditures.

In spite of a small-scale strategy in Japan's logistics industry, energy-efficient material handling equipment is in growing demand. Japan's aging population and manpower shortages are driving a gradual move toward automation, especially in warehouses.

Japan's commitment to Japanese Industrial Standards (JIS) is influencing product development and offerings. To thrive in the sector, manufacturers have to adhere to strict standards with emphasis on durability and low-maintenance solutions.

China

China is expected to grow at a CAGR of 7.4% on the back of fast industrialization and growth in e-commerce. The need for energy-efficient material handling equipment is increasing as China emphasizes sustainability as part of its environmental agenda.

China's largest in the world, logistics industry is still growing, underpinned by robust demand for automated material handling solutions. Government policies encouraging green technologies and energy-efficient solutions are driving this industry change.

Regulations such as the China Compulsory Certification (CCC) are influencing product standards. Manufacturers are emphasizing compliance with both local and global requirements, stimulating energy-efficient and cost-saving material handling equipment innovation.

Market Share Analysis

Toyota Industries Corporation: 25-28%

Fact.MR believes Toyota will remain a global material handling leader, sustaining its major share through its stronger position in automation and electric forklift growth. In 2035, the company is likely to hold a leading position, mainly spearheaded by its developments in automation and electric forklifts in primary regions such as North America and Europe.

KION Group AG (Linde, STILL): 20-23%

KION Group will continue to grow with its innovations in hydrogen and IoT-enabled forklifts. By 2035, the company is likely to gain a bigger share, fueled by its leadership in Europe and the growing global uptake of fuel-efficient and connected forklift solutions. Strategic growth in Asia and North America will also support its presence.

Jungheinrich AG: 12-15%

Jungheinrich will be expected to grow its share by emphasizing the integration of robotics and the expansion of automated solutions in Europe. By 2035, it is anticipated to achieve a share of 12-15% based on its dominance in Europe and growing demand for cost-effective, robotics-based material handling solutions in warehouse operations.

Mitsubishi Logisnext (UniCarriers, Rocla): 9-11%

Mitsubishi Logisnext will stabilize at a consistent share due to its robust presence in the Asia-Pacific region, with ongoing growth in emerging regions. Its emphasis on growing automated solutions and regional needs adaptation is likely to fuel modest growth, leading to a share of 9-11% by 2035.

Crown Equipment Corporation: 8-10%

Crown Equipment is set to expand its share with the launch of smart warehouse solutions and automation upgrades. By 2035, the company is anticipated to achieve an 8-10% share with the help of growing demand for automated systems and material handling solutions, especially in North America and Europe.

Hyster-Yale Materials Handling: 7-9%

Hyster-Yale is likely to increase its presence in growth regions, especially in Asia and Latin America. By 2035, the company's share is likely to increase to 7-9%, aided by the increasing demand for forklift solutions in the manufacturing and logistics industries. The company's entry into automation will also enhance its growth.

Other Key Players

- Goscor Lift Trucks

- Hyundai Heavy Industries

- Thermote & Vanhalst Group

- Liftek FZC

- Nido Machineries Pvt Ltd

- Nilkamal Limited

- Pr Industrial S.r.l.

- Presto Lifts Inc.

- Raymond Handling Concepts Corporation

Pallet Trucks Market Segmentation

By Control Type:

- Manual

- Semi Electric

- Electric

- Diesel

- Compressed Natural Gas (CNG)

- Others

By Type:

- Standard

- Quarter

- Silent

- Weighing

- Scissor

By Load Capacity:

- Below 2,000 KG

- 2,000 to 4,000 KG

- 4,000 to 6,000 KG

- Above 6,000 KG

By End Use:

- Food & Beverage

- Retail Stores

- Wholesale Distribution

- Freight & Logistics

- Manufacturing

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

Table of Content

- Global Market - Executive Summary

- Global Market Overview

- Market Background

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Control Type

- Manual

- Semi Electric

- Electric

- Diesel

- Compressed Natural Gas (CNG)

- Others

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Standard

- Quarter

- Silent

- Weighing

- Scissor

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Load Capacity

- Below 2,000 KG

- 2,000 to 4,000 KG

- 4,000 to 6,000 KG

- Above 6,000 KG

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use

- Food & Beverage

- Retail Stores

- Wholesale Distribution

- Freight & Logistics

- Manufacturing

- Others

- Global Market Analysis and Forecast, By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- China

- India

- Japan

- South East Asia & Pacific

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- China Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- India Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Japan Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Industry Structure

- Competition Analysis

- Toyota Industries Corporation

- Kion Group AG (Linde Material Handling)

- Mitsubishi Logisnext Co., Ltd.

- Jungheinrich AG

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- Goscor Lift Trucks

- Hyundai Heavy Industries

- Thermote & Vanhalst Group

- Liftek FZC

- Nido Machineries Pvt Ltd

- Nilkamal Limited

- Pr Industrial S.r.l.

- Presto Lifts Inc.

- Raymond Handling Concepts Corporation

- Assumption & Acronyms

- Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

What factors contribute to the growth of the pallet truck industry?

Technological advancements, increasing demand for automation, and the expansion of e-commerce are key drivers.

Which types of pallet trucks are seeing the most adoption?

Electric and semi-electric pallet trucks are experiencing the highest demand due to their energy efficiency and automation compatibility.

How are environmental regulations influencing pallet truck trends?

Environmental regulations are pushing for more energy-efficient and low-emission solutions, boosting the adoption of electric and CNG-powered models.

What are the main applications of pallet trucks in industries?

Pallet trucks are widely used in logistics, retail, food & beverage, and manufacturing industries for efficient material handling and inventory management.

How do advancements in automation affect the growth of pallet trucks?

The growing trend toward automation in warehouses and logistics is driving increased demand for electric and smart pallet truck solutions.