Polyisobutylene (PIB) Market

Polyisobutylene (PIB) Market Analysis & Forecast by Molecular Weight, Product, End Use, and Region Through 2035

Analysis of Polyisobutylene (PIB) Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

An Outlook of Trends from 2025 to 2035

The polyisobutylene (PIB) market is valued at USD 2.59 million in 2025. As per Fact.MR's analysis, the market will grow at a CAGR of 5.6% and reach USD 4.47 million by 2035.

The exponential growth that the sector saw in 2024 was attributed to multiple applications across a variety of industries such as automotive, construction, and adhesives. The hydrophobic PIB continued to be in demand for tire-manufacturing purposes because of increased impermeability, flexibility at lower temperatures, and moisture resistance, thus becoming an essential material in tubeless tires, inner tubes, and fuel additives.

With the automotive industry gearing up production to satisfy increasing global demand for vehicles, especially commercial and passenger vehicles, PIB found much greater relevance.

Apart from automotive applications, the growing demand for fuel additives curbing engine deposits simultaneously enhanced PIB's role in lubricants.

PIB consumption in the construction sector also showed steady growth, notably in sealants and adhesives for construction, roofing, and photovoltaic system panel applications. The versatility of PIB in adhesive systems, particularly hot-melt and pressure-sensitive adhesives, would ensure the continued growth of applications in diverse industries.

The sector seems set for more growth in 2025 and beyond. By 2033 and at a 5.6% CAGR, the industry is anticipated to reach USD 4 billion. As sustainability and eco-friendly initiatives become more critical, PIB's resistance to environmental degradation positions it as a key material in developing more durable, long-lasting products across automotive, construction, and consumer goods sectors. Furthermore, the increasing focus on high-performance, fuel-efficient vehicles will continue to fuel PIB demand as a critical component in automotive applications.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Global Size in 2025 | USD 2.59 Million |

| Projected Global Size in 2035 | USD 4.47 Million |

| CAGR (2025 to 2035) | 5.6% |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Fact.MR Survey Results: Polyisobutylene (PIB) Market Dynamics Based on Stakeholder Perspectives

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, automotive suppliers, and end-users across the U.S., Western Europe, Japan, and South Korea)

Key Priorities of Stakeholders

- Durability and Performance in Automotive Applications: 79% of stakeholders globally identified durability and performance in tire production as a “critical” priority. This underscores the importance of PIB’s use in tire manufacturing, where its flexibility and gas impermeability are essential for enhancing tire longevity and fuel efficiency.

- Sustainability and Regulatory Compliance: 73% highlighted the need for eco-friendly and recyclable materials to meet rising sustainability standards in the automotive, construction, and adhesive industries. Regulatory pressures and consumer preferences for environmentally responsible products were cited as key drivers for this focus.

Regional Variance:

- U.S.: 62% emphasized the importance of low-cost, high-performance PIB formulations for automotive use, while 48% saw demand for sustainable formulations in construction applications.

- Western Europe: 85% cited sustainability as a primary concern, driven by strong EU environmental regulations.

- Japan/South Korea: 57% expressed interest in cost-efficient, hybrid PIB formulations combining performance and sustainability due to regional price sensitivity and land-use constraints.

Embracing Technological Advancements

High Variance in Technology Adoption:

- U.S.: 65% of automotive suppliers adopted advanced PIB formulations for fuel additives and lubricants, driven by demand for fuel-efficient vehicles.

- Western Europe: 50% of stakeholders invested in research for high-performance, environmentally friendly PIB solutions, particularly for construction sealants and adhesives.

- Japan: 31% focused on incremental improvements to existing PIB formulations rather than adopting high-tech alternatives, citing cost concerns and smaller-scale applications.

- South Korea: 41% of respondents were exploring automation and advanced material usage in automotive production to stay competitive with the rising demand for electric vehicles.

Convergent and Divergent Perspectives on ROI:

- 71% of U.S. stakeholders saw PIB's role in fuel additives and tire manufacturing as a long-term investment, whereas 43% in Japan remained hesitant about the long-term ROI of high-performance PIB in these applications.

Material Preferences

Consensus:

- High-Performance PIB for Automotive and Construction: 68% of stakeholders selected high-performance PIB formulations for automotive and construction applications, with a preference for materials offering superior durability, moisture resistance, and gas impermeability.

Variance:

- U.S.: 70% of automotive suppliers favored traditional PIB due to its well-established performance in tire manufacturing and fuel additives.

- Western Europe: 62% favored more sustainable, bio-based PIB options, citing rising pressure from environmental regulations and consumer demand for eco-friendly products.

- Japan/South Korea: 55% showed interest in hybrid PIB formulations, balancing performance and cost, due to the high price sensitivity in these regions.

Price Sensitivity

Shared Challenges:

- Rising Raw Material Costs: 84% of stakeholders cited the increasing price of raw materials, particularly isobutylene, as a significant challenge impacting PIB’s production costs and overall pricing structure.

Regional Differences:

- U.S./Western Europe: 60% would consider a 10-15% premium for eco-friendly PIB formulations, especially those meeting sustainability standards.

- Japan/South Korea: 74% were focused on cost-efficient PIB solutions and preferred low-cost options under USD 4,000, with a limited willingness to pay a premium for sustainability or high-performance formulations.

Pain Points in the Value Chain

Manufacturers:

- U.S.: 52% of manufacturers struggled with raw material supply chain issues, affecting PIB production for automotive and construction applications.

- Western Europe: 47% of manufacturers cited challenges with meeting stringent environmental regulations regarding material sourcing and production.

- Japan: 60% faced slow adoption of advanced PIB formulations due to limited demand in smaller-scale applications.

Distributors:

- U.S.: 67% cited delays in shipping raw materials from overseas suppliers, impacting product availability and production timelines.

- Western Europe: 55% faced competition from low-cost PIB suppliers in Eastern Europe, particularly in the construction and adhesive sectors.

- Japan/South Korea: 59% cited logistical challenges in delivering PIB-based products to remote regions with lower infrastructure capabilities.

End-Users (Automotive/Construction):

- U.S.: 48% of end-users highlighted the high cost of advanced PIB formulations for automotive applications as a barrier.

- Western Europe: 42% struggled with retrofitting older construction equipment with newer, eco-friendly PIB-based materials.

- Japan: 51% cited the lack of technical support for implementing advanced PIB formulations in smaller-scale automotive and construction projects.

Future Investment Priorities

Alignment:

- 72% of global stakeholders indicated plans to invest in developing sustainable and high-performance PIB formulations in the next 3–5 years to address both regulatory pressures and demand for greener alternatives.

Divergence:

- U.S.: 63% of automotive suppliers focused investments on enhancing PIB's role in fuel efficiency, while Western Europe (58%) focused on improving the sustainability of PIB formulations.

- Japan/South Korea: 45% prioritized cost-effective, hybrid PIB solutions for both automotive and construction applications, ensuring a balance between performance and price.

Regulatory Impact

- U.S.: 67% of stakeholders said new fuel efficiency and environmental regulations were increasing demand for PIB in automotive applications, particularly for fuel additives and tire manufacturing.

- Western Europe: 80% viewed EU regulations on sustainability and carbon emissions as a key driver for investing in eco-friendly PIB alternatives, especially in the construction and adhesive industries.

- Japan/South Korea: 38% felt regulatory changes had little impact on PIB purchasing decisions, citing weaker enforcement and less stringent environmental standards.

Conclusion: Variance vs. Consensus

High Consensus:

- Durability, performance, and sustainability are global priorities, with PIB’s role in automotive and construction growing across regions.

Key Variances:

- U.S.: Strong growth in automotive applications driven by demand for fuel efficiency vs. Japan/South Korea: Slower adoption due to cost concerns and smaller-scale demand.

- Western Europe: Leadership in adopting eco-friendly PIB formulations vs. Asia: Focus on cost-effective, hybrid formulations.

Strategic Insight:

A tailored, regional approach is necessary to capture opportunities. While the U.S. emphasizes high-performance PIB for automotive, Europe's focus is on sustainability, and Asia remains pragmatic, balancing cost and performance. To explore the evolving opportunities in PIB across automotive, construction, and other sectors, contact us for in-depth insights and actionable strategies tailored to your business needs.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Impact of Government Regulations

| Country | Impact of Policies, Government Regulations & Certifications |

|---|---|

| United States | Fuel Efficiency Regulations: Stringent regulations on fuel efficiency in the automotive sector are driving demand for PIB in fuel additives and tire manufacturing. EPA Regulations: The Environmental Protection Agency (EPA) mandates certain emission standards that PIB-based products need to comply with, particularly in automotive uses. Certification: Manufacturers need to comply with EPA Certification for products used in fuel systems, and FDA approval is required for PIB used in food-grade applications. |

| Western Europe | EU Green Deal & Carbon Footprint Regulations: The EU's strong sustainability agenda pushes demand for eco-friendly and recyclable PIB formulations, especially in construction and adhesives. REACH Regulation: The EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) mandates that manufacturers and importers register chemicals, including PIB, ensuring that they meet health and environmental safety standards. Certification: PIB products must be REACH-compliant, and products used in construction materials may need CE Certification (European Conformity). |

| Japan | Low Emission Standards: Japan’s commitment to reducing emissions has led to a growing demand for PIB in applications such as fuel additives in automotive manufacturing. Chemical Substances Control Law (CSCL): This law regulates the import, manufacture, and use of chemicals in Japan, impacting PIB-related products. Certification: PIB used in the automotive industry may need to comply with Japan’s JIS (Japanese Industrial Standard) certifications for quality assurance. |

| South Korea | Green Growth Strategy: South Korea’s green growth policies push for environmentally friendly and efficient materials, increasing demand for sustainable PIB options in automotive and construction. Environmental Regulations: Regulations governing air quality and fuel efficiency are pushing the adoption of PIB-based additives. Certification: PIB manufacturers targeting the automotive or construction industries must ensure compliance with KCS (Korean Certification Scheme) for product safety and environmental compliance. |

Market Analysis

The industry is ready for stable growth with a demand in automotive applications, particularly tire making and fuel additives. Key beneficiaries will be those manufacturers in automotive, construction, and adhesive applications, while generally based industries will face competition. PIB's very limited resistance to environmental degradation will serve to further strengthen its industry position as such trends towards sustainable alternatives grow.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

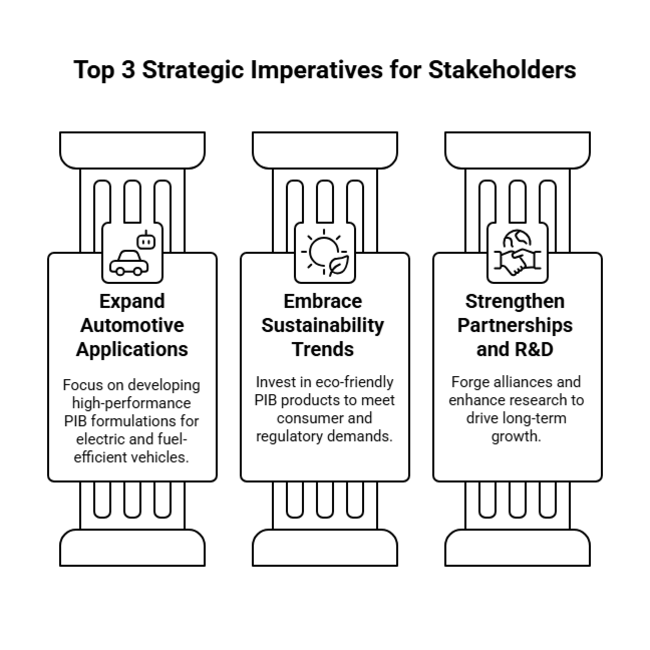

Top 3 Strategic Imperatives for Stakeholders

Expand Automotive Applications

Executives should invest in developing high-performance PIB formulations tailored for the growing electric vehicle and fuel-efficient vehicle segments. Expanding applications in tire manufacturing, fuel additives, and lubricants will capitalize on the increasing demand in the automotive industry.

Embrace Sustainability Trends

Focusing on eco-friendly, sustainable PIB formulations will align with rising consumer and regulatory demands for greener solutions. Investing in R&D to create bio-based or recyclable PIB products will help companies stay ahead of industry shifts toward environmental responsibility.

Strengthen Strategic Partnerships and R&D

Executives should forge partnerships with key players in the automotive, construction, and adhesives industries to improve product offerings and industry reach. Investing in R&D to enhance PIB’s properties and explore new applications will drive long-term growth.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Raw Material Price Fluctuations - Fluctuations in the price of raw materials, such as isobutylene, can significantly impact production costs. This risk is particularly high due to global supply chain disruptions and geopolitical factors. | Medium Probability, High Impact |

| Regulatory Changes - As global environmental standards tighten, regulatory shifts may impose restrictions on the production or use of certain materials, potentially affecting PIB’s growth prospects, particularly in industries like automotive and construction. | Medium Probability, Medium Impact |

| Sustainability & Eco-Friendly Substitutes - With increasing demand for eco-friendly solutions, alternative materials that offer similar or better properties may pose a significant challenge. This shift could result in a loss of share for PIB if sustainable substitutes gain traction. | High Probability, High Impact |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Monitor Raw Material Price Trends | Track and analyze raw material price fluctuations, especially isobutylene, and assess their impact on production costs. |

| Align with Sustainability Regulations | Initiate research and development efforts to create sustainable, eco-friendly PIB formulations that are in line with new regulatory standards. |

| Strengthen Automotive Industry Partnerships | Develop and implement a partnership strategy with key automotive OEMs to explore new PIB applications for fuel-efficient and electric vehicles. |

For the Boardroom

To stay ahead, companies must focus on strengthening strategic partnerships with key automotive and construction players while prioritizing R&D in sustainable PIB formulations to meet evolving regulatory demands.

This intelligence underscores the importance of adapting to eco-friendly trends and raw material price volatility, prompting an immediate reevaluation of sourcing strategies and product development.

The client must accelerate innovation in high-performance, fuel-efficient automotive applications while aligning with global sustainability shifts, positioning PIB as a long-term leader in critical industrial sectors. This roadmap not only supports immediate industry growth but ensures resilience in a rapidly evolving landscape.

Segment-wise Analysis

By Molecular Weight

High molecular weight constituted 65% of the global PIB share in 2022, and its domination is likely to continue at a steady pace, forecast to grow at a CAGR of 5.6% from 2025 to 2035. The segment is in demand on account of its high viscosity, extraordinary elasticity, and strength.

Applications for this product are found mainly in transportation, food, industrial applications, and adhesives. The continuous demand for high-performance lubricants, sealants, and stretch films has spurred further growth in this area.

In food packaging applications, high molecular weight is favored due to its excellent moisture barrier and food safety display properties, which makes it an attractive proposition for food applications as well. Slow growth is forecasted to continue as formulators increasingly rely on PIB's unique properties even in tough demanding applications in various other industries.

By Product

The conventional PIB segment is expected to grow at a 4.5% CAGR from 2025 to 2035. Although this segment is slowly being overshadowed by more specialized forms of PIB, such as highly reactive PIB, it remains important due to its cost-effectiveness and wide range of applications. Modern conventional PIB is primarily used in lubricants, sealants, and adhesives as well as in applications in rubber and plastics.

Its salient advantages include versatility and simplicity of processing, rendering it an attractive option for many industrial and automotive applications.

Although moving slowly, the conventional PIB application demand will continue to grow, mainly due to the industries continually looking for more cost-effective solutions without compromising performance.

By End Use

The automotive segment is expected to grow at a 5.7% CAGR from 2025 to 2035, driven by the increasing demand for high-performance materials in vehicle production. PIB is widely used in automotive applications for tire production, inner tubes, and seals due to its excellent flexibility and gas impermeability.

With the automotive industry’s growing focus on fuel efficiency, durability, and safety, PIB’s demand is expected to rise, particularly in the production of tubeless tires and other critical automotive components.

Additionally, its application in fuel additives and lubricants is expected to grow as the demand for advanced engine technologies rises. This segment's growth is also fueled by the expanding global automotive production, particularly in emerging industries, making it a key contributor to the overall development of PIB.

Country-wise Insights

U.S.

The U.S. is expected to experience a 5.8% CAGR, driven by strong demand for PIB in automotive applications, especially in fuel additives and tires. Regulations focused on fuel efficiency are encouraging increased PIB adoption in these sectors.

The country’s well-established manufacturing sector supports this growth. The automotive industry, one of the largest consumers, will continue to drive PIB demand, particularly as electric vehicles (EVs) and fuel-efficient technologies grow.

PIB is crucial for producing high-performance tires and fuel additives that align with U.S. environmental standards. The U.S. also benefits from significant investments in automation, which increases the demand for advanced materials. PIB’s role in adhesives, lubricants, and industrial applications will continue to expand as the focus on durability and sustainability persists across various industries.

UK

The UK is projected to grow at a 5.2% CAGR, driven by sustainability efforts. Increasing environmental policies and the push for greener materials are fostering PIB use in automotive, construction, and industrial applications. The demand for durable, eco-friendly materials is accelerating the adoption of PIB in these sectors. As the UK transitions towards more sustainable manufacturing, PIB’s role in reducing carbon footprints becomes critical.

The automotive sector, with a movement towards electric vehicles, will continuously use PIB in tires, lubricants, and fuel additives to meet tightening emission standards. Furthermore, PIB's supply of long-lasting and weather-resistant solutions in construction sealants and adhesives fits in with UK sustainability goals. The unfolding of advanced manufacturing technologies will support PIB's increased demand within the country.

France

France will see a 4.8% CAGR due to the increasing focus on sustainability. From the growing demand applications of PIB in automotive construction and industrial applications as the enforcement of stricter environmental performance regulations.

The transition of the automotive industry towards EVs will account for a greater demand for PIB vis-a-vis tires and fuel additives. The French government's green policies align with EU standards to drive PIB into manufacturing applications in France.

The demand for adhesives and sealants as sustainable construction materials continues to rise as France continues its march towards low-carbon infrastructure.

The performance characteristics of the French automotive and construction industries regarding product life encourage the use of PIB. As the trend towards sustainable building materials continues over the following years, PIB's involvement in these sectors will increase.

Germany

In Germany, the CAGR is expected to decline to 5.5% because of the automotive and industrial sectors. Germany's demand for PIB, used in fuel-efficient tires, lubricants, and automotive sealants, continues to remain strong because it leads the way in automotive manufacturing. The stricter environmental regulations will also fuel the rise in PIB adoption.

Much of the concern over sustainability in construction and manufacturing industry has seen an increase in the amount of PIB demand.

The automotive industry in Germany will typically be using PIB-based materials for the Electric Vehicles (EVs). In addition, the construction industry will adopt PIB for making sealants and adhesives that resist deterioration from weather conditions.

Furthermore, increased demand for PIB will arise from investments by Germany in automation and advanced manufacturing technology. This country's priority towards minimizing environmental impact also matches well with the sustainable aspect offered by PIB.

Italy

Italy is expected to expand at a 4.4% CAGR, led by PIB's application in the automotive and construction industries. Italy's automotive sector, especially in tire manufacturing, will lead demand for PIB due to the trend toward green and sustainable materials.

Fuel additives and lubricants are other areas of growth. Italy's emphasis on long-lasting, durable materials in the construction industry is driving PIB usage in sealants and adhesives.

The country's dedication to decreasing the environmental footprint of building materials further confirms the use of PIB in construction work, including green buildings.

With Italy moving towards sustainability objectives, PIB's application for diminishing carbon footprints across industries, particularly the automotive and construction sectors, will increase. These are the forces propelling Italy as a reliable region for PIB in the next decade.

South Korea

South Korea is likely to register a CAGR of 5.3% during the forecast period owing to a vibrant automotive sector. The rising application of electric vehicles (EVs) is creating demand for PIB in high-efficiency tires, lubricants, and battery parts.

Automotive manufacturing PIB-based products are still vital in fulfilling stringent legislations. The application of PIB in dairy farms, as an automated setup, is acquiring popularity in the agricultural sector.

The necessity of modern technologies in agricultural equipment is the main force behind PIB consumption, particularly in areas where there is a high density of mechanized farms. The emphasis of South Korea on green solutions in industrial usage, such as construction sealants, also fuels growth in PIB. The country's emphasis on sustainability across industries is well-suited with the characteristics of PIB, promoting sustained growth.

Japan

For the automotive and industrial sectors, PIB applications remain to be the primary growth driving force behind a 4.6% CAGR for Japan. The stringent environmental regulations of Japan impose the demand for environmentally friendly manufacturing practices in automotive production, especially in tires and fuel additives.

PIB remains a very important contributor to meeting these requirements. In comparison to other industries, in Japan, the smaller-scale agricultural sector limits the use of PIB in agriculture.

However, advanced automotive technology along with the continued emphasis on reducing environmental damage in manufacture shall promote PIB even more for high-performance applications, especially those involved in tire-making and lubricants.

Sustainability concerns, with the backing of government regulations, will keep dictating PIB demand in the prone country. In addition, the construction application of PIB as a carbon footprint mitigant in sealants and adhesives shall add on to PIB demand.

China

China is projected to grow at a CAGR of 6.1%, the highest among major regions, and is a key driver of PIB demand. Important areas of application for PIB in the region include tire construction, lubricants, and other automotive components necessary for the manufacture of fuel-efficient tires. With new infrastructure projects and urbanization, demand for PIB is pushed in construction in China.

The material is durable and weather resistant, making it suitable for sealants and adhesives in construction projects. Sustainable construction focused occupies a pedestal in line with the eco-face of PIB.

The country has extensive investments in manufacturing automation and technological advancements driving PIB consumption in the industrial sectors. The performance improvement of materials assisted by PIB will only manifest in enhancing the current booming demand for PIB itself in China.

Market Share Analysis

BASF SE: ~22-25%

BASF is anticipated to continue dominating the industry in 2025. Its grip on Highly Reactive PIB (HR-PIB), applied in adhesives, sealants, and lubricant additives, is the primary driver. Its recent moves in Germany, in addition to strategic alliances in Asia, will consolidate its leadership. Additionally, BASF's growing emphasis on sustainable PIB solutions, including bio-based versions, sets it up for ongoing growth and strengthened position in the future years.

ExxonMobil Chemical: 18-20%

ExxonMobil Chemical continues to be a major force, particularly in traditional PIB for fuel additives and lubricants. The company's 2024 expansion of its Baytown, Texas, plant is set to increase production capacity, providing a consistent supply to Europe and North America. ExxonMobil's wide distribution network, combined with long-term automotive and industrial customers' contracts, allows it to hold a firm share of around 20%. This dominance is set to carry over to 2025.

INEOS Group: 12-15%

INEOS is likely to experience steady growth in the PIB segment, led by increasing demand for butyl rubber-grade PIB, especially in tire production. Its 2024 supply contracts with leading tire manufacturers are likely to drive volume sales considerably.

Besides, INEOS is also investing in specialty PIB grades for automotive as well as construction segments. This strategic change is likely to drive its share to 15% by 2025, making it a dominant player.

TPC Group: 10-12%

TPC Group is a dominant regional player, particularly in North America, with emphasis on Reactive PIB for adhesives and sealants. The sustainability efforts of the company in 2024, including recyclable PIB-based products, are likely to fuel growth in the packaging as well as construction industries.

By focusing on high-margin niche uses, TPC Group is poised to command an estimated 12% share of the worldwide PIB industry by 2025. It will thus be able to remain competitive and robust in an expanding industry.

Daelim Industrial Co., Ltd.: 8-10%

Daelim is picking up speed in the PIB business, riding on the growing demand for PIB in fuel and lubricant additives. The expansions of the company in Southeast Asia and collaborations with Japanese and Chinese automakers are driving its growth.

Daelim may capture as much as 10% of the PIB industry by 2025. Its emphasis on high-performance grades of PIB and expansion into emerging industries puts it in a position to grow at a fast pace and establish a strong presence in the business.

Chevron Oronite: 7-9%

Chevron Oronite is still one of the dominant players in the PIB industry, dealing with fuel and lubricant additives in Europe and North America. The introduction by the company of a new engine additive based on PIB in 2024 strengthen its position in the automobile industry.

Nevertheless, due to intense competition from BASF and ExxonMobil, Chevron Oronite is likely to retain a share of approximately 9%. Its strategic direction towards high-valuePIB products will enable it to continue competing against industry odds.

Lanxess AG: 5-7%

Lanxess AG is a high-value specialty PIB grades player for industrial and automotive segments. Although it is not a volume leader, its niche focus on products like PIB for coatings and insulation provides a steady 5-7% share.

Lanxess AG's R&D activity in EV-compatible PIB materials can be a growth driver after 2025. With the growth of the electric vehicle industry, Lanxess can witness higher demand for its niche PIB materials, enhancing its standing.

Reliance IndustriesLtd.: 4-6%

Reliance Industries is increasing its presence in the PIB business, riding on India's emerging automotive and construction sectors. Integration of the company's Jamnagar refinery provides cost benefits, making it well-placed to raise its share of PIB to about 6% by 2025.

With emphasis on regional development, Reliance is well-positioned to cater to both local and global customers. Its aim to raise its production capacity will help it further strengthen its presence in major PIB applications over the next few years.

Braskem: 3-5%

Braskem, Latin America's dominant PIB supplier, is concentrating on increasing exports to North America. Its bio-based polymer activities are aimed at capturing the increased demand for eco-friendly PIB products.

Still, even with these initiatives, Braskem's share will likely be less than 5% by 2025. Although its bio-based orientation may set it apart, competition from the bigger global players might restrict its growth beyond Latin America at a high rate.

Sinopec: 3-5%

Sinopec is taking the position of a major stakeholder in China's domestic PIB industry, which is seeing increasing demand. With its expanded production facilities, Sinopec has the potential to reach a share greater than 5% by 2025, particularly in the Asian lubricant and adhesive industries.

The firm's capability to penetrate world regions, however, will be determined by its ability to expand production and comply with international demand. Its strategic focus on domestic growth is expected to drive its share up in the near future.

Key Companies

- BASF SE

- Kothari Petrochemicals

- Chevron Oronite Company LLC

- Zhejiang Shunda New Material Co., Ltd

- Daelim Industrial Co., Ltd

- Shandong Hongrui New Material Technology Co., Ltd

- INEOS Group

- ENEOS Corporation

- TPC Group Inc

- Lubrizol Corporation

- ExxonMobil Chemical

- Lanxess AG

- Reliance Industries Ltd.

- Braskem

- Sinopec

Polyisobutylene (PIB) Market Segmentation

By Molecular Weight :

By molecular weight, the industry is segmented into high, medium, and low.

By Product :

In terms of product, the industry is segmented into conventional and highly reactive.

By End Use :

Based on end use, the industry is segmented into automotive, industrial, food, and others.

By Region :

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Table of Content

- 1. Global Market - Executive Summary

- 2. Global Market Overview

- 3. Market Risks and Trends Assessment

- 4. Market Background and Foundation Data Points

- 5. Global Market Demand (US$ Mn) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- 6. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Molecular Weight

- 6.1. High

- 6.2. Medium

- 6.3. Low

- 7. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Product

- 7.1. Conventional

- 7.2. Highly Reactive

- 8. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by End Use

- 8.1. Automotive

- 8.2. Industrial

- 8.3. Food

- 8.4. Other End Uses

- 9. Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Region

- 9.1. North America

- 9.2. Latin America

- 9.3. Europe

- 9.4. East Asia

- 9.5. South Asia & Oceania

- 9.6. Middle East and Africa (MEA)

- 10. North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 11. Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 12. Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 13. East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 14. South Asia & Oceania Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 15. Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- 16. Market Structure Analysis

- 17. Competition Analysis

- 17.1. BASF SE

- 17.2. Kothari Petrochemicals

- 17.3. Chevron Oronite Company LLC

- 17.4. Zhejiang Shunda New Material Co., Ltd

- 17.5. Daelim Industrial Co., Ltd

- 17.6. Shandong Hongrui New Material Technology Co., Ltd

- 17.7. INEOS Group

- 17.8. ENEOS Corporation

- 17.9. TPC Group Inc

- 17.10. Lubrizol Corporation

- 17.11. ExxonMobil Chemical (USA)

- 17.12. Lanxess AG (Germany)

- 17.13. Reliance Industries Ltd. (India)

- 17.14. Braskem (Brazil)

- 17.15. Sinopec (China)

- 18. Assumptions and Acronyms Used

- 19. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

What factors are driving growth in this industry?

Demand in automotive, industrial, and food packaging, alongside the adoption of advanced technologies and sustainability trends, is driving growth.

Which regions are seeing the most significant demand for polyisobutylene?

North America, Europe, and the Asia-Pacific region, especially South Korea and Japan, are experiencing significant demand.

How is sustainability impacting the polyisobutylene sector?

Sustainability is influencing the development of bio-based and recyclable polyisobutylene, particularly in Europe, where eco-friendly solutions are prioritized.

What role do regulations play in the growth of polyisobutylene consumption?

Regulations around environmental impact and safety standards are driving the adoption of advanced PIB technologies in various industries.

What are the challenges faced by companies in the polyisobutylene supply chain?

Companies face challenges such as rising raw material costs, logistical delays, and competition from low-cost manufacturers in certain regions.