Sericin Market

Sericin Market By Form (Solid, liquid), By Application (Personal Care & Cosmetics, Pharmaceuticals, Others), By Region (North America, Latin America, Europe) - Global Market Insights 2022 to 2032

Analysis of Sericin market covering 30 + countries including analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Inclination Towards Anti-Ageing Products to Strengthen the Sericin Market Over 2022 to 2032

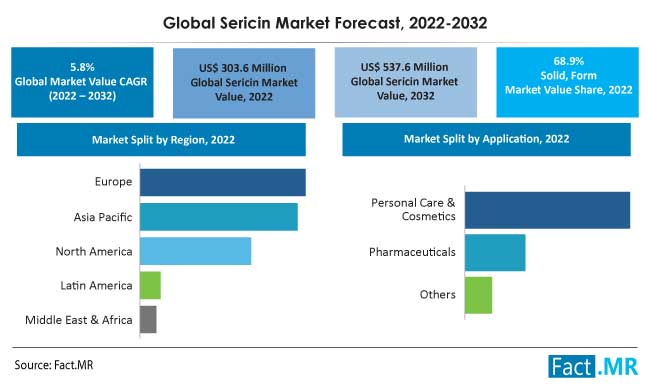

The global sericin market is anticipated to value at US$ 303.6 million in 2022 and further expand at a CAGR of 5.8% to reach US$ 537.6 million by the end of 2032.

Sericin has a wide range of applications from cosmetics and personal care to the textile industry to the food industry. It also holds antioxidant power, and it prevents water loss by strengthening the skin barriers showing its moisturizing properties. Sericin-made products are effective in protecting the skin from environmental stresses, providing some dense level for anti-bacterial and natural protection from UV rays damage.

| Report Attributes | Details |

|---|---|

| Sericin Market Size (2021A) | US$ 289.3 Million |

| Estimated Market Value (2022E) | US$ 303.6 Million |

| Forecasted Market Value (2032F) | US$ 537.6 Million |

| Global Market Growth Rate (2022 to 2032) | 5.8% CAGR |

| North America Market Share (2021) | ~30.5% |

| Asia Pacific Market Growth Rate (2022 to 2032) | ~6.5% CAGR |

| United States Market Growth Rate (2022 to 2032) | ~5.5% CAGR |

| Key Companies Profiled | Eaton Corporation; Siemens AG; ABB Ltd.; General Electric; Toshiba Corporation; Schneider Electric; Mitsubishi Electric Corporation; Littlefuse Inc.; Hitachi Ltd.; Rockwell Automation, Inc.; Zettler Electronics Inc.; Omron Corporation; Omega Engineering, Inc.; Celduc Realis |

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Comprehensive Sales Analysis: Historic to Futuristic

Depending on the form, sericin is available in solid as well as liquid forms. Sericin which is regarded as a silkworm waste has its demand arising from extensive utilization in the food, pharmaceuticals, molecular biology, cosmetics, and textile industries. Sericin is also found to be useful in reducing serum cholesterol levels and triglyceride levels by limiting tyrosinase enzyme, in addition to exhibiting anti-oxidant content.

Owing to numerous applications, and research being done to improve the efficiency of sericin extraction, the sericin market is expected to offer tremendous growth opportunities.

- Short Term (2022 to 2025): Rapid growing personal care & cosmetics market and its various properties will positively impact sericin market growth.

- Medium Term (2025 to 2028): Europe and Asia are anticipated to witness high sericin demand on the back of increasing expenditure on cosmetic products that are leading to a growing cosmetic industry.

- Long Term (2028 to 2032): Increasing use of sericin in pharmaceutical, food, and textile industries will drive the demand in the long run.

Over the 2017 to 2021 historical period, the global sericin market registered a CAGR of 3.1%, and according to the Fact.MR, a market research and competitive intelligence provider, the market is projected to exhibit growth at 5.8% CAGR between 2022 and 2032.

Market share analysis of sericin based on application and region is provided in a nutshell in the above image. Under the application segment, the personal care and cosmetics sub-segment dominates with a 64.9% market share in 2022.

“Personal Care & Cosmetics Industry: Providing Stage for Sericin Market”

Personal care & cosmetic products are becoming a trend and their use across the globe is spreading like wildfire. Sericin has been the trend as an essential ingredient in the manufacturing of cosmetics.

The key benefits of sericin in cosmetics are protective effects against UV radiation-induced skin damage and premature aging of the skin in the skin-care segment. Along with that, products of hair care and color cosmetics have also gained popularity which has a key ingredient as sericin.

The sericin extracts from silk are effectively and easily absorbed into the deep skin layer, maintaining the required hydration levels, while allowing antioxidants and amino acids to promote cell repairing, cell generating, and improving skin resilience and giving an outstanding appearance.

Cosmetics and personal care products are mostly in the form of liquids and powder while sericin provides the added benefit of being available in both of the mentioned reducing loss in properties through conversion. The demand across the globe has been rising and the cosmetics market is set to become the prominent market in consumer goods eventually elevating the demand for the sericin market.

“Numerous End-use Benefits Is Promoting the Sericin as Eye-catching Market”

Sericin is a biomolecule of explicit value as it has moisturizing, oxidative-resistant, antibacterial, and UV-resistant properties. Also, demand for pharmaceuticals has rampantly increased across the globe reciprocating to which there has been a rise in the production of sericin since the previous decade.

The majority demand for sericin is governed by pharmaceuticals and personal care & cosmetics contributing up to 65% of total Sericin demand. However, the textile and food industry is rising to contribute toward sericin demand and match resonance in the Sericin market. A wide-spread end-use spectrum of sericin across various domains including skin-care, hair-care, and color cosmetics in personal care & cosmetics to anti-oxygenation additives in the food industry has improved its supply throughout.

The significance of sericin in pharmaceuticals has been dominating with a range of targeted drug delivery, wound healing applications, and as a suitable carrier to proven potential to use for cancer drugs and also blood thinners which qualifies sericin to become an advanced solution for health benefits enhancing the market valuation.

The textile industry has been embracing the use of high molecular weight sericin peptides (greater than 20 kDa) which are used in medical biomaterials, degradable biomaterials, functional biomembranes, hydrogels, compound polymers, and functional fibers. Multiple industry application has been promoting the sericin market.

“Separation and Recovery Issues: Hindering the Sustainable Growth of Sericin Market”

The methods of separation and recovery of sericin as solid content from waste liquid silk sourcing have shown particular issues and also in the physical properties of recovered sericin.

Various conventional methods have been tried and tested comprising of partially hydrolyzing and eluted sericin contained in the silk through enzyme sourcing method or chemical sourcing method and recovering the sericin by adjusting the isoelectric point to a pH level of 4.5 to 5.0 with the addition of organic or inorganic acid and an organic or inorganic coagulant to precipitate sericin which is further separated and dried to get outcome as a powder.

Also, sericin can be precipitated by mixing solvents such as ethanol, methanol, or a similar aqueous solvent and then drying up the sericin separately to obtain a powder. Above mentioned methods have proved to be useful yet lack industrial competency, and from the viewpoint of economic recovery there has been a burden on the treatment of wastewater, and separation of sericin is difficult as it is produced as a precipitate.

The issues arising through this method have been hindering the long-term growth of the sericin market, while research institutes are coming up with various newer methodologies, the non-available robust separation and recovery of sericin still serve as a threat to its market growth.

Country-wise Insights

What is the Growth Scenario of the Sericin Market in the US?

Sericin consumption has increased considerably with the rise in demand for personal care & cosmetic products. Consumers are getting inclined toward cosmetic properties with anti-aging properties.

The US holds a prominent position in the cosmetics and pharmaceutical industry. Thus, the US is set to have a higher potential over the forecast period owing to the presence of a larger number of cosmetic product manufacturers and major pharmaceutical industries situated in the country.

Increased spending on personal care and beauty products is rising per individual as trends have noticed youngsters have been experiencing premature aging, wrinkles, dark circles, and fine lines, and products offering solutions to the mentioned are gaining huge market share and relative growth.

Apart from the cosmetic spending by individuals, there has been higher investment growth in the region, in the past half-decade and this is the prime reason which contributes to the escalating demand for sericin, utilized in cosmetic products.

Why is the China Highly Lucrative for Sericin Manufacturers?

China is the largest producer of silk. China accounts for around 80% of total global production with an annual production of 102,560 MT of raw silk. The extraction of sericin requires silk.

China has been pulling the demand for the personal care and cosmetics market because of the rising response from youth populations and trends of new fashion from the western culture. China is the prominent manufacturer of sericin due to the available abundance of silk and pre-existing market for silk fabrication. Exporting to countries of Europe and North America from Asia has been the flow of sericin across the globe.

Numerous sericin manufacturers have shifted their bases in or around China due to labor costs and ease of access to silk. Growing end-use industries such as pharmaceutical, textile, and personal care industries will further act as contributing factors to the growth of the sericin market.

The China market for sericin is projected to reach a valuation of US$ 27.6 million in 2022.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

Category-wise Insights

Why is the Solid Form of Sericin Most Widely Used?

Silk is composed of two proteins fibroin and sericin. Sericin is generally thrown as waste after the degumming process of silk. Sericin can be made available in two forms solid and liquid depending on the extraction method employed.

Sericin available in solid form is preferred by the majority of industries owing to the flexibility of applications and easier availability.

The solid form of sericin is predicted to expand at a CAGR of about 5.8% owing to the demand from a bundle of end-user industries by the end of 2032.

How will Pharmaceutical Industry Drive the Demand for Sericin?

Sericin being a biocompatible material finds its usage as a component of pharmaceutical formulations for various biomedical applications such as anti-tumor, antimicrobials, and antioxidants among others owing to its inherent biological properties.

Sericin exhibits the ability to form gels, microparticles, and nanoparticles, offering stability by strong affinity to the drug molecules. The property of solubility enhancements, formulation stabilizers, and drug carriers is providing an exclusive application in pharmaceuticals.

When sericin is consumed as a dietary supplement, it reduces the level of triglyceride and serum cholesterols, adding to that it shows antioxidant properties as well.

Potential growth in pharmaceuticals will be the guiding light for the rise in the strength of the sericin global market.

Competitive Landscape

Prominent sericin manufacturers are DSM, Huzhou Aotesi Biochemical Co., Ltd, Hyundai Bioland, Huzhou Aotesi Biochemical Co., Ltd., Huzhou Xintiansi Bio-tech Co. Ltd, Lanxess, Rita Corporation, Seiren Co., and Specialty Natural Products Co. Ltd.

Players operating in the sericin market are trying and improve their availability and distribution network, to reach newer customers. Furthermore, companies are channeling an adequate amount of funds into research and development, so that sericin could be made available at comparatively competitive prices, improve their overall profit margin in the long run, and cater to a larger set audience base.

- In May 2022, Karnataka State Sericulture Research and Development Institute (KSSRDI) announced that they are planning to launch 12 sericin-based cosmetic products.

- In Sep 2020, DSM decided to sell its Resin & Functional Material Business to generate equity of about US$ 1.8 billion to remain focused in the fields of nutrition, health, and sustainable living. The Resin & Functional Material Business was acquired by Covestro.

Fact.MR has provided detailed information about the price points of key manufacturers of sericin positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Segmentation of the Sericin Industry Research

-

By Form:

- Solid

- Liquid

-

By Application:

- Personal Care & Cosmetics

- Hair Care

- Skin Care

- Others

- Pharmaceuticals

- Others

- Personal Care & Cosmetics

-

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- MEA

Table of Content

- 1. Market - Executive Summary

- 2. Market Overview

- 3. Market Background and Foundation Data

- 4. Global Demand (Tons) Analysis and Forecast

- 5. Global Market - Pricing Analysis

- 6. Global Market Value (US$ million) Analysis and Forecast

- 7. Global Market Analysis and Forecast, By Form

- 7.1. Solid

- 7.2. Liquid

- 8. Global Market Analysis and Forecast, By Application

- 8.1. Personal Care & Cosmetics

- 8.1.1. Hair Care

- 8.1.2. Skin Care

- 8.1.3. Others

- 8.2. Pharmaceuticals

- 8.3. Others

- 8.1. Personal Care & Cosmetics

- 9. Global Market Analysis and Forecast, By Region

- 9.1. North America

- 9.2. Latin America

- 9.3. Europe

- 9.4. East Asia

- 9.5. South Asia & Oceania

- 9.6. Middle East & Africa

- 10. North America Market Analysis and Forecast

- 11. Latin America Market Analysis and Forecast

- 12. Europe Market Analysis and Forecast

- 13. East Asia Market Analysis and Forecast

- 14. South Asia & Oceania Market Analysis and Forecast

- 15. Middle East & Africa Market Analysis and Forecast

- 16. Country-level Market Analysis and Forecast

- 17. Market Structure Analysis

- 18. Competition Analysis

- 18.1. DSM

- 18.2. Huzhou Aotesi Biochemical Co., Ltd

- 18.3. Hyundai Bioland

- 18.4. Huzhou Xintiansi Bio-tech Co. Ltd

- 18.5. Lanxess

- 18.6. Rita Corporation

- 18.7. Seiren Co.

- 18.8. Specialty Natural Products Co. Ltd

- 19. Assumptions & Acronyms Used

- 20. Research Methodology

Don't Need a Global Report?

save 40%! on Country & Region specific reports

List Of Table

Table 01: Global Market Value (US$ million) and Forecast by Region, 2017 to 2021

Table 02: Global Market Value (US$ million) and Forecast by Region, 2022 to 2032

Table 03: Global Market Volume (Tons) and Forecast by Region, 2017 to 2021

Table 04: Global Market Volume (Tons) and Forecast by Region, 2022 to 2032

Table 05: Global Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 06: Global Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 07: Global Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 08: Global Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 09: Global Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 10: Global Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 11: Global Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 12: Global Market Volume (Tons) and Forecast By Application, 2022 to 2032

Table 13: North America Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 14: North America Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 15: North America Market Volume (Tons) and Forecast by Country, 2017 to 2021

Table 16: North America Market Volume (Tons) and Forecast by Country, 2022 to 2032

Table 17: North America Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 18: North America Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 19: North America Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 20: North America Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 21: North America Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 22: North America Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 23: North America Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 24: North America Market Volume (Tons) and Forecast By Application, 2022 to 2032

Table 25: Latin America Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 26: Latin America Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 27: Latin America Market Volume (Tons) and Forecast by Country, 2017 to 2021

Table 28: Latin America Market Volume (Tons) and Forecast by Country, 2022 to 2032

Table 29: Latin America Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 30: Latin America Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 31: Latin America Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 32: Latin America Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 33: Latin America Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 34: Latin America Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 35: Latin America Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 36: Latin America Market Volume (Tons) and Forecast By Application, 2022 to 2032

Table 37: Europe Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 38: Europe Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 39: Europe Market Volume (Tons) and Forecast by Country, 2017 to 2021

Table 40: Europe Market Volume (Tons) and Forecast by Country, 2022 to 2032

Table 41: Europe Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 42: Europe Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 43: Europe Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 44: Europe Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 45: Europe Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 46: Europe Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 47: Europe Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 48: Europe Market Volume (Tons) and Forecast By Application, 2022 to 2032

Table 49: East Asia Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 50: East Asia Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 51: East Asia Market Volume (Tons) and Forecast by Country, 2017 to 2021

Table 52: East Asia Market Volume (Tons) and Forecast by Country, 2022 to 2032

Table 53: East Asia Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 54: East Asia Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 55: East Asia Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 56: East Asia Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 57: East Asia Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 58: East Asia Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 59: East Asia Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 60: East Asia Market Volume (Tons) and Forecast By Application, 2022 to 2032

Table 61: South Asia & Oceania Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 62: South Asia & Oceania Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 63: South Asia & Oceania Market Volume (Tons) and Forecast by Country, 2017 to 2021

Table 64: South Asia & Oceania Market Volume (Tons) and Forecast by Country, 2022 to 2032

Table 65: South Asia & Oceania Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 66: South Asia & Oceania Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 67: South Asia & Oceania Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 68: South Asia & Oceania Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 69: South Asia & Oceania Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 70: South Asia & Oceania Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 71: South Asia & Oceania Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 72: South Asia & Oceania Market Volume (Tons) and Forecast By Application, 2022 to 2032

Table 73: MEA Market Value (US$ million) and Forecast by Country, 2017 to 2021

Table 74: MEA Market Value (US$ million) and Forecast by Country, 2022 to 2032

Table 75: MEA Market Volume (Tons) and Forecast by Country, 2017 to 2021

Table 76: MEA Market Volume (Tons) and Forecast by Country, 2022 to 2032

Table 77: MEA Market Value (US$ million) and Forecast By Form, 2017 to 2021

Table 78: MEA Market Value (US$ million) and Forecast By Form, 2022 to 2032

Table 79: MEA Market Volume (Tons) and Forecast By Form, 2017 to 2021

Table 80: MEA Market Volume (Tons) and Forecast By Form, 2022 to 2032

Table 81: MEA Market Value (US$ million) and Forecast By Application, 2017 to 2021

Table 82: MEA Market Value (US$ million) and Forecast By Application, 2022 to 2032

Table 83: MEA Market Volume (Tons) and Forecast By Application, 2017 to 2021

Table 84: MEA Market Volume (Tons) and Forecast By Application, 2022 to 2032

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

List Of Figures

Figure 01: Global Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 02: Global Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 03: Global Market Value (US$ million) and Volume (Tons) by Region, 2022 & 2032

Figure 04: Global Market Y-o-Y Growth Rate by Region, 2022 to 2032

Figure 05: Global Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 06: Global Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 07: Global Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 08: Global Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 09: North America Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 10: North America Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 11: North America Market Value (US$ million) and Volume (Tons) by Country, 2022 & 2032

Figure 12: North America Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 13: North America Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 14: North America Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 15: North America Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 16: North America Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 17: North America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 18: North America Market Attractiveness Analysis By Form, 2022 to 2032

Figure 19: North America Market Attractiveness Analysis By Application, 2022 to 2032

Figure 20: Latin America Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 21: Latin America Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 22: Latin America Market Value (US$ million) and Volume (Tons) by Country, 2022 & 2032

Figure 23: Latin America Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 24: Latin America Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 25: Latin America Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 26: Latin America Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 27: Latin America Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 28: Latin America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 29: Latin America Market Attractiveness Analysis By Form, 2022 to 2032

Figure 30: Latin America Market Attractiveness Analysis By Application, 2022 to 2032

Figure 31: Europe Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 32: Europe Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 33: Europe Market Value (US$ million) and Volume (Tons) by Country, 2022 & 2032

Figure 34: Europe Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 35: Europe Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 36: Europe Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 37: Europe Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 38: Europe Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 39: Europe Market Attractiveness Analysis by Country, 2022 to 2032

Figure 40: Europe Market Attractiveness Analysis By Form, 2022 to 2032

Figure 41: Europe Market Attractiveness Analysis By Application, 2022 to 2032

Figure 42: East Asia Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 43: East Asia Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 44: East Asia Market Value (US$ million) and Volume (Tons) by Country, 2022 & 2032

Figure 45: East Asia Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 46: East Asia Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 47: East Asia Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 48: East Asia Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 49: East Asia Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 50: East Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 51: East Asia Market Attractiveness Analysis By Form, 2022 to 2032

Figure 52: East Asia Market Attractiveness Analysis By Application, 2022 to 2032

Figure 53: South Asia & Oceania Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 54: South Asia & Oceania Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 55: South Asia & Oceania Market Value (US$ million) and Volume (Tons) by Country, 2022 & 2032

Figure 56: South Asia & Oceania Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 57: South Asia & Oceania Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 58: South Asia & Oceania Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 59: South Asia & Oceania Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 60: South Asia & Oceania Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 61: South Asia & Oceania Market Attractiveness Analysis by Country, 2022 to 2032

Figure 62: South Asia & Oceania Market Attractiveness Analysis By Form, 2022 to 2032

Figure 63: South Asia & Oceania Market Attractiveness Analysis By Application, 2022 to 2032

Figure 64: MEA Market Value (US$ million) and Volume (Tons) Forecast, 2022 to 2032

Figure 65: MEA Market Absolute $ Opportunity (US$ million), 2022 to 2032

Figure 66: MEA Market Value (US$ million) and Volume (Tons) by Country, 2022 & 2032

Figure 67: MEA Market Y-o-Y Growth Rate by Country, 2022 to 2032

Figure 68: MEA Market Value (US$ million) and Volume (Tons) By Form, 2022 & 2032

Figure 69: MEA Market Y-o-Y Growth Rate By Form, 2022 to 2032

Figure 70: MEA Market Value (US$ million) and Volume (Tons) By Application, 2022 & 2032

Figure 71: MEA Market Y-o-Y Growth Rate By Application, 2022 to 2032

Figure 72: MEA Market Attractiveness Analysis by Country, 2022 to 2032

Figure 73: MEA Market Attractiveness Analysis By Form, 2022 to 2032

Figure 74: MEA Market Attractiveness Analysis By Application, 2022 to 2032

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

- FAQs -

What was the global market size of sericin in 2021?

The global sericin market was valued at US$ 289.3 Million in 2021.

What is the estimated market size at the end of 2022?

The global sericin market is expected to be valued at US$ 303.6 million in 2022.

What is the Share of Europe in the global sericin Market?

Europe holds around 35.2% share in the global sericin market and is expected to grow at a CAGR of 6.0% by 2032

Which country has the highest demand for sericin in East Asia?

China accounts for the maximum share in the Asia Pacific and is expected to reach an approximate valuation of US$ 27.6 million in 2022

Which Application of sericin has the highest adoption?

The personal care and cosmetics segment accounts for maximum consumption holding 64.9% of the global market

Which form of sericin holds the highest market share?

Solid sericin account for a 70.8% share of global sales.